In just one week, life as we know it in the developed world has drastically changed. Advancement of the coronavirus pandemic has led to unprecedented actions and calls for social distancing across the country.

- Six counties in the San Francisco Bay Area led with a shelter-in-place rule, which now extends across the entire State of California.

- Over the span of three days, New York Governor Andrew Cuomo mandated a reduction of “non-essential” workplace employees by 50%, then 75%, and now 100%. While not officially “shelter-in-place,” New York State’s restrictions that go into effect this weekend certainly encourage residents to hunker down at home.

- Schools, beaches, restaurants, and bars across Florida and Texas are now closed following orders from Governors Desantis and Abbott on Friday.

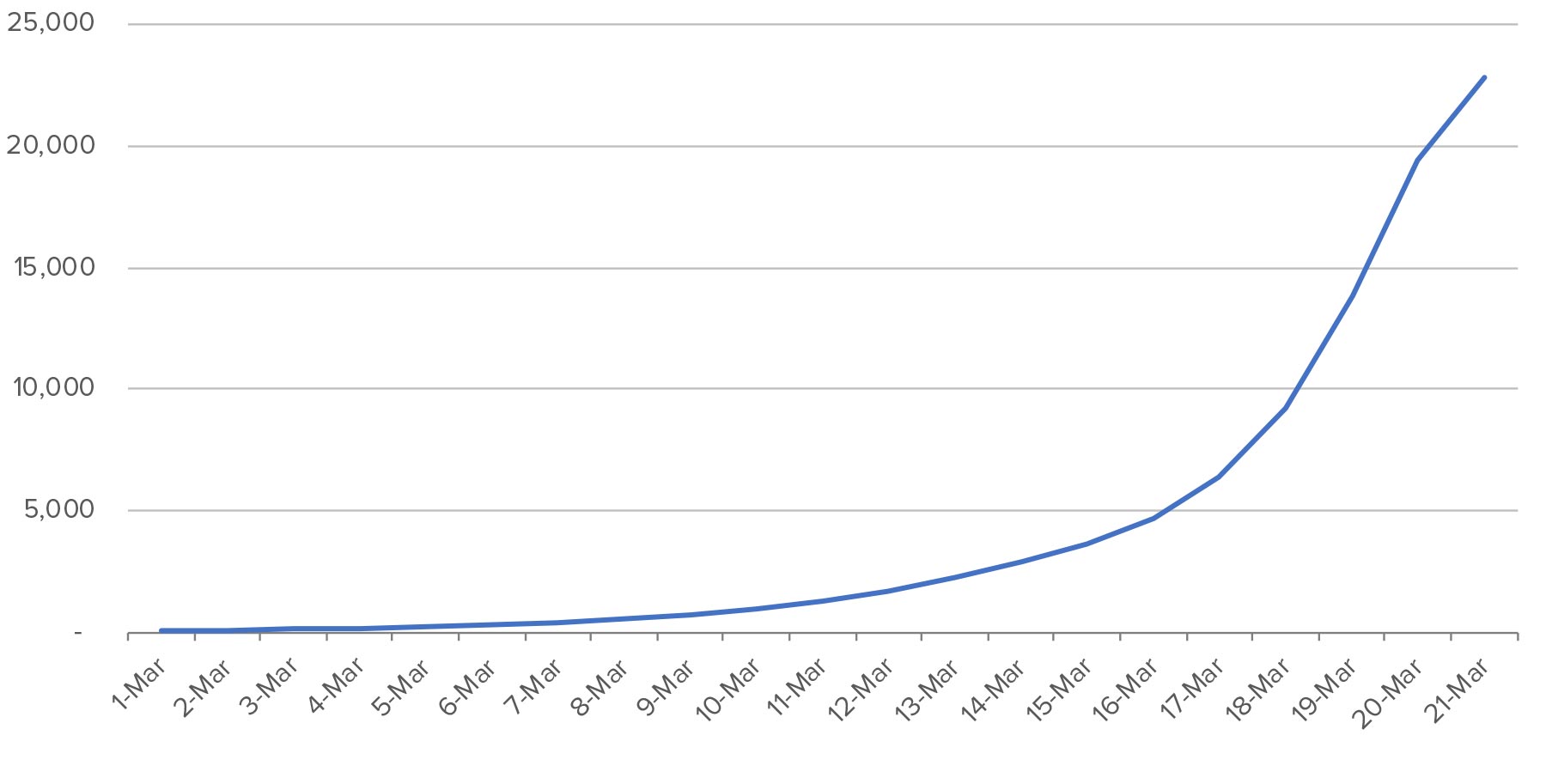

Since our last update on March 15, the number of COVID-19 cases in the US has grown exponentially as testing became more widely available and responsive. And yet, we may still only be at the beginning of the curve. Healthcare professionals expect a significant increase as the coronavirus continues to spread and more Americans are tested.

Number of cases of COVID-19 in the US.

Market update for the week of March 16.

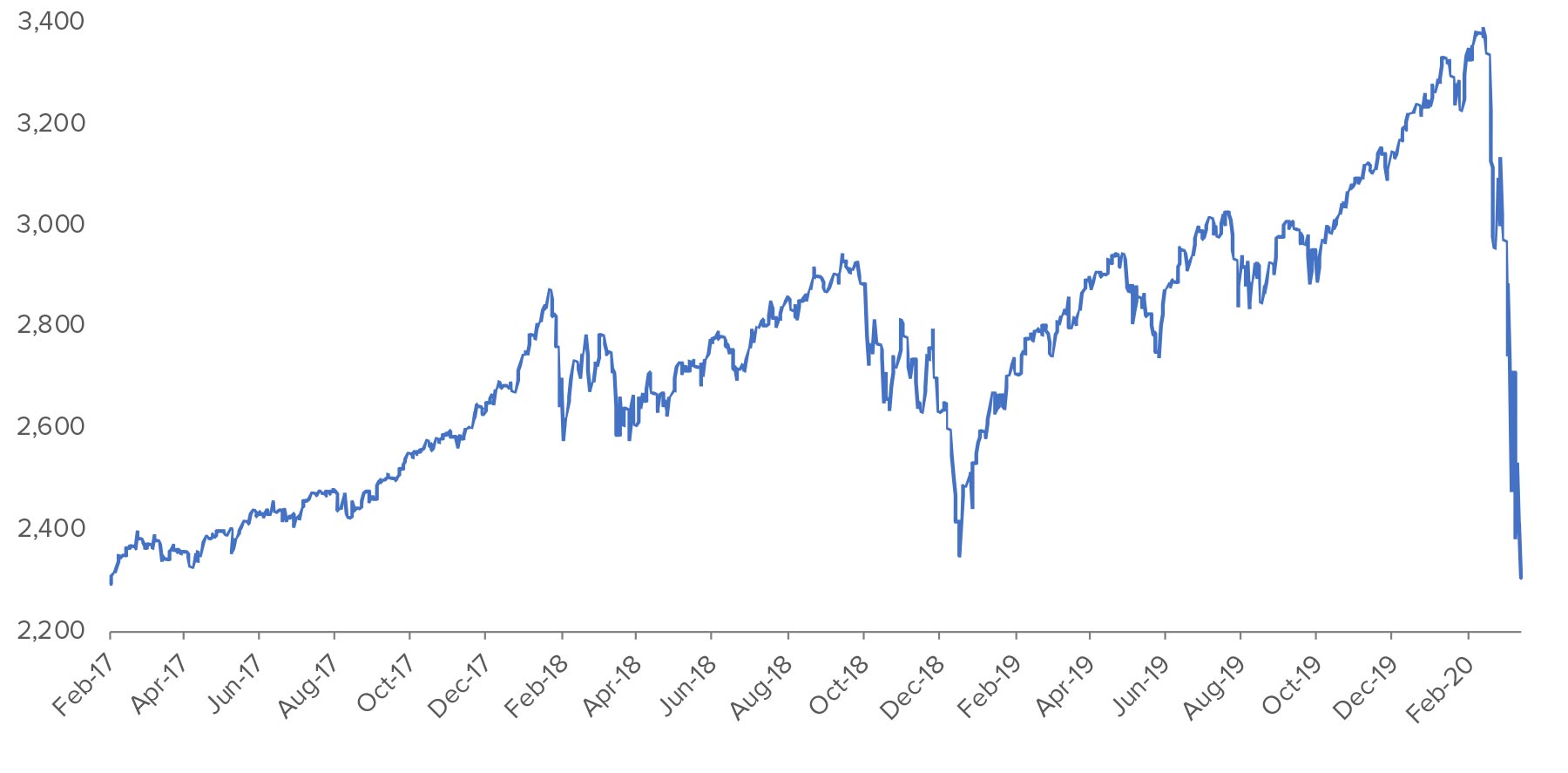

The stock market responded poorly to the news, uncertainty, and fear. Last week was the worst for US stocks since the depths of the Great Recession in 2008. The markets had two positive trading sessions and three down.

| Monday March 16 | Tuesday March 17 | Wednesday March 18 | Thursday March 19 | Friday March 20 | |

| S&P 500 Close | 2,386.13 | 2,529.19 | 2,398.10 | 2,409.39 | 2,304.92 |

| % Change | -11.98% | 6.00% | -5.18% | 0.47% | -4.34% |

| VIX High | 83.56 | 84.83 | 85.47 | 84.26 | 69.51 |

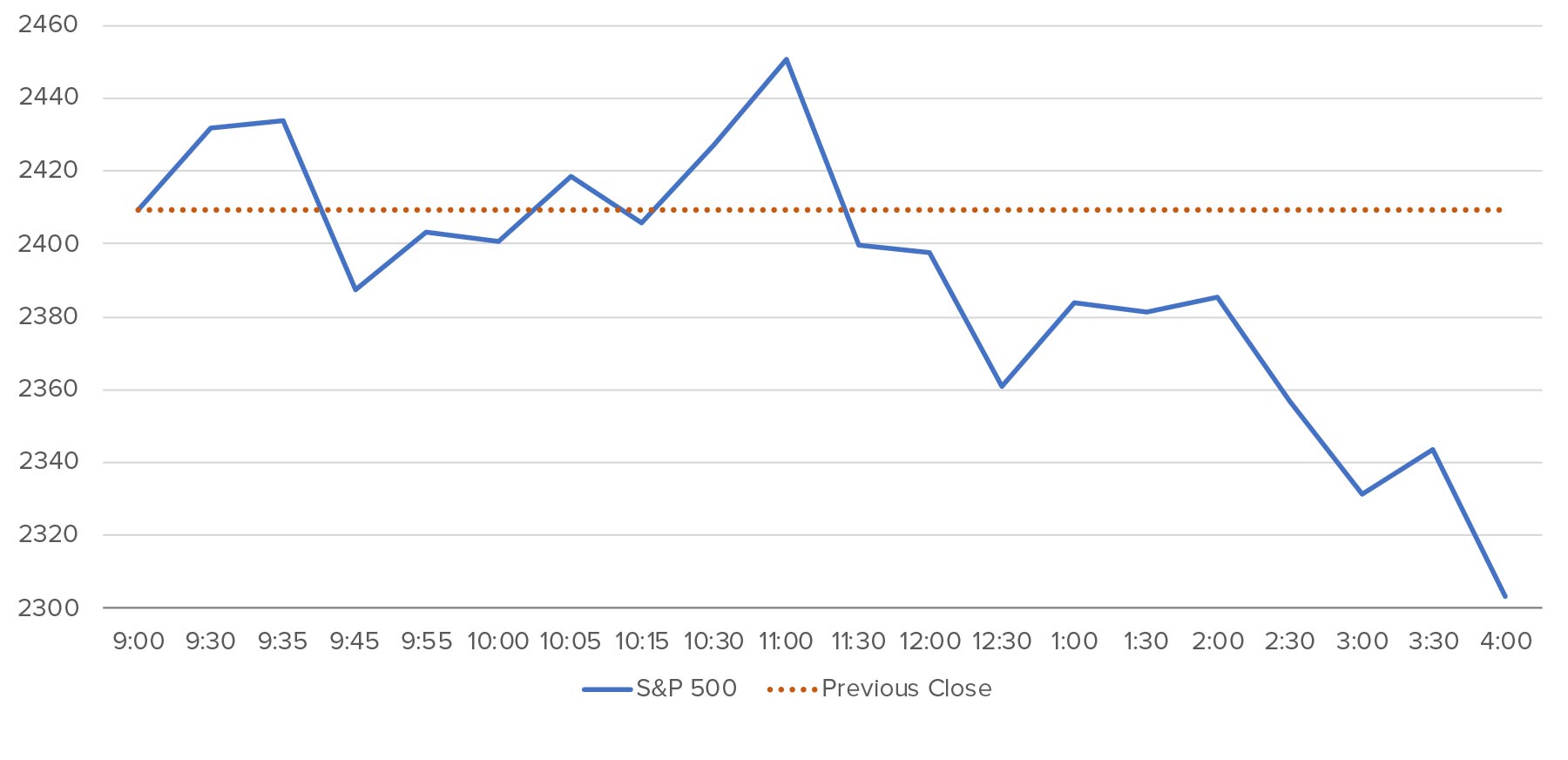

On Friday alone, the US markets began heavily up, went down, returned up again very positive, and finally dropped—finishing at their lowest levels in more than three years. In the US, we have not had back-to-back positive trading sessions since mid-February.

S&P 500 Intraday - March 20, 2020.

S&P 500 - Returning to 2300.

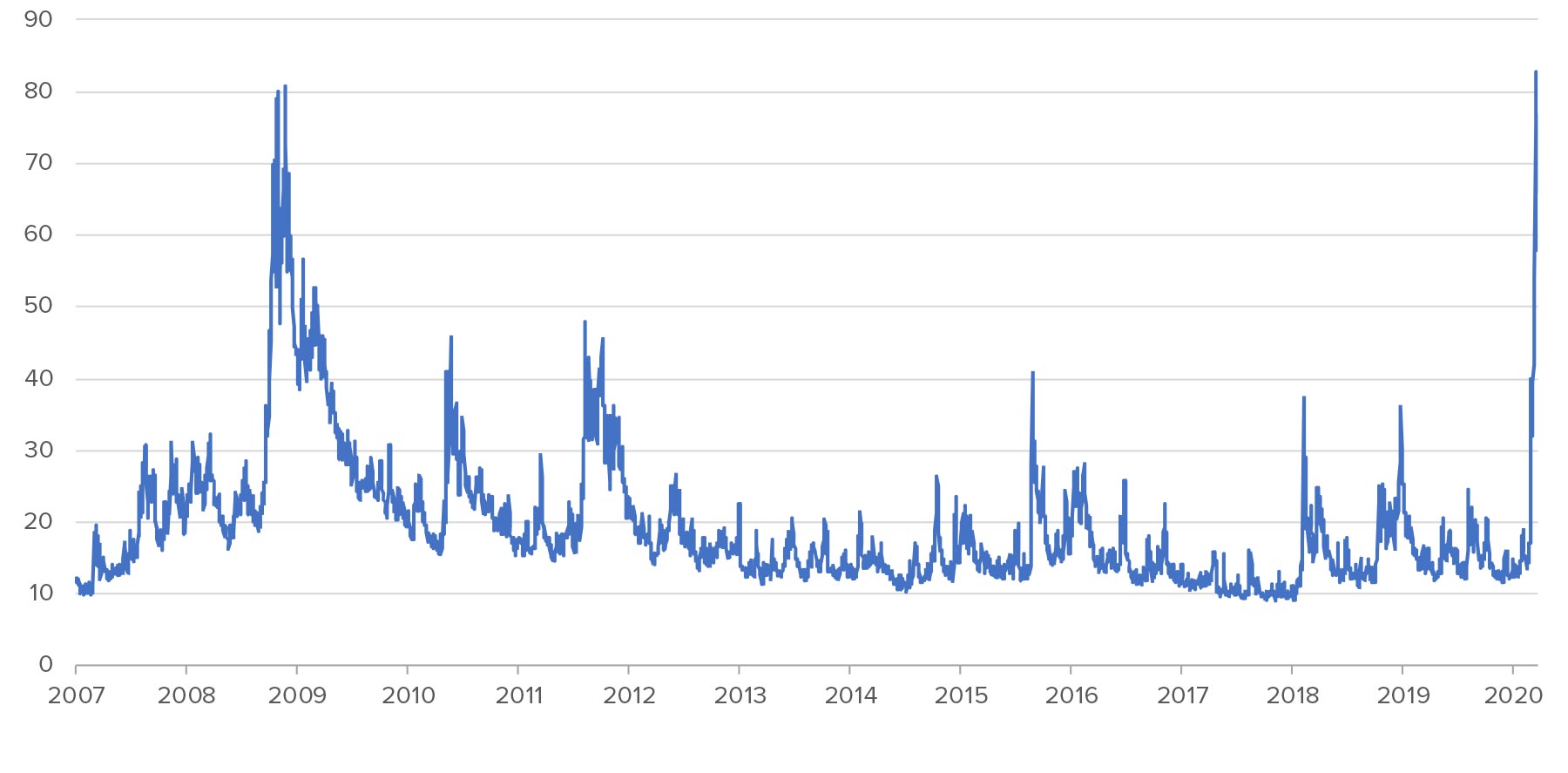

In addition to the lows in the broader market indices, further evidence of fear include the new all-time intraday and closing highs in the VIX (volatility index), which suggest that these extreme market movements could likely persist for some time. Investors are uncomfortable as the sudden market movements are unlike anything we have experienced in living memory.

This is different than 2008, which stemmed from the potential collapse of the global financial system. The source of fear and uncertainty now is a new virus that can potentially overwhelm our healthcare system, and threatens the health and wellbeing of all 7.8 billion people here on earth.

The Volatility Index (VIX).

That fear and uncertainty have essentially brought parts of the global economy to a sudden halt in a way that we have never experienced. As most of the countries in the west institute varying levels of isolation, the consumption which drives our developed economies stops—changing our daily lives unlike any other time in history.

A wartime mentality.

Perhaps the conditions closest to what we’re experiencing now can be traced back to September 11, 2001. Following the coordinated terror attacks, we had a similar level of uncertainty as we awaited what felt like the inevitable “next big one.” Thankfully that never occurred, and the country came together to pull out of recession within months.

The truth today is that no one knows what the true economic impact of this sudden halt will be. There are certainly large industries at risk, including hospitality, transportation, and brick-and-mortar retail. All small businesses are suffering from anxiety now, as lenders may tighten their credit requirements, and with more day-to-day concerns about consumer traffic and spending. The stock markets have already priced in a significant drop in the future cash flows for many of the largest companies in the world, suggesting that a recession is priced into current prices.

The good news.

On the positive side, this international crisis has forced dissenting geopolitical parties to work together and prioritize propping up the global economy before the grips of a deep, coordinated recession cause further damage.

Last Sunday, the Federal Reserve announced a reduction in the Fed Funds rate to the financial crisis levels of 0.0-0.25%, as well as another quantitative easing package, with the Fed planning to purchase $500 billion of Treasury bonds and $200 billion of agency-backed mortgage securities. In its statement, the Fed said that it is, “prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

Outside of the US, the European Central Bank announced on Wednesday a similar package and willingness to help prop up the economy by helping consumers and businesses with their suite of tools. Christine Lagarde, President of the European Central Bank, took to Twitter to explain:

Extraordinary times require extraordinary action. There are no limits to our commitment to the euro. We are determined to use the full potential of our tools, within our mandate. https://t.co/RhxuVYPeVR

— Christine Lagarde (@Lagarde) March 18, 2020

Monetary policy around the world is coming together, and we now await fiscal policy. Here in the US, the federal government is working on a $2 trillion relief package which it may finance with Treasury bond issuances out to 50 years. The package will likely put cash directly into the pockets of consumers, helping the many whose income has been affected by the crisis, as well as those who will use the funds for discretionary spending and boost the economy.

Our strategies and actions.

At Sanderson Wealth Management, our team has been and will continue to be working tirelessly for our clients. While every situation is unique, a few of our common strategies include:

- Tax-loss harvesting. This week, we began our tax swap process in response to the recent downturn. As prices have plummeted across all assets, we now have an opportunity to capture those losses, while still maintaining market exposure in order to not miss out on any portion of the recovery. For example, for our New York State resident clients, those tax swaps are worth about 30% in NYS (20% federal) long-term capital gains tax, 3.8% Medicare investment income surtax, and 7% NYS income tax). If the market continues to deteriorate, we will continue performing tax swaps to build up our clients’ capital loss carryforwards, as those losses never expire. After the 2008-2009 financial crisis, those losses kept many people from paying capital gains tax for several years in the future.

- Identifying long-term opportunities. We are continuing to invest cash for clients who have been looking for an opportunity to invest excess funds into the market. We are still maintaining a cautious approach by investing only a portion of these funds and keeping some available in case volatility remains high and the markets head lower.

- As volatility recedes in the coming weeks and months, we will begin to rebalance our clients’ portfolios. We have seen false recoveries in previous markets and will want to see more encouraging signs of the recovery before rebalancing our clients’ accounts. We will be watching for back-to-back positive days in the markets, a positive week, and more normal levels of volatility as we assess the art and science of timing rebalances out of core fixed income and into global stocks.

We are here for you.

Over the past few weeks, we have spoken with many clients, discussing what is important to them at this time, and explaining our strategy and approach. If you are feeling uneasy, have questions, or just want to hear our latest thoughts (generally or regarding particular matters), please reach out at any time. We are here for you during the good times and the bad—and hope to be the reassurance you seek as we watch these unpredictable events unfold.

Disclosure

© 2020 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®