Markets.

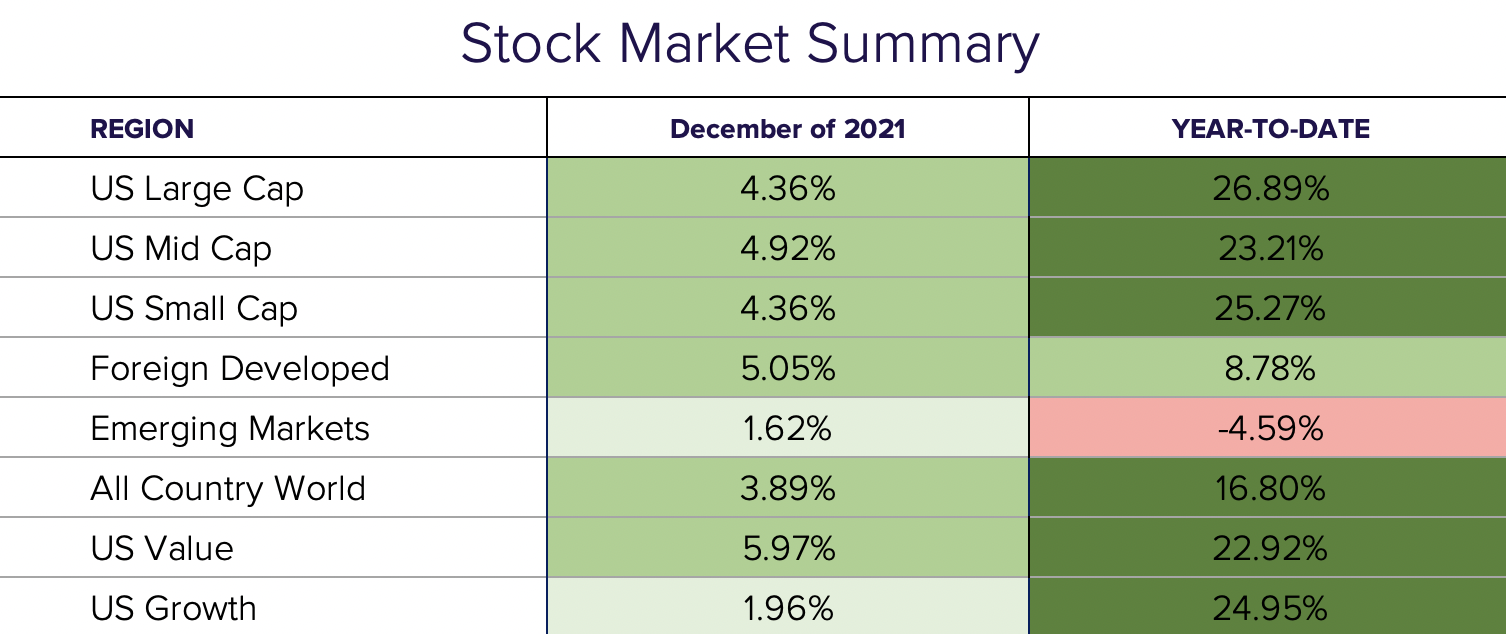

2021 was a wild year but the global equity markets certainly proved to be resilient. The combination of COVID disruptions, high inflation, supply chain bottlenecks, Fed rate hikes, and geopolitical concerns surely seemed like enough to derail markets, yet the global equity market reached a new high 63 times in 2021, finishing the year up 18.54%, including dividend reinvestment. The tailwinds of highly accommodative fiscal and monetary policies and strong corporate earnings prevailed in the equity markets.

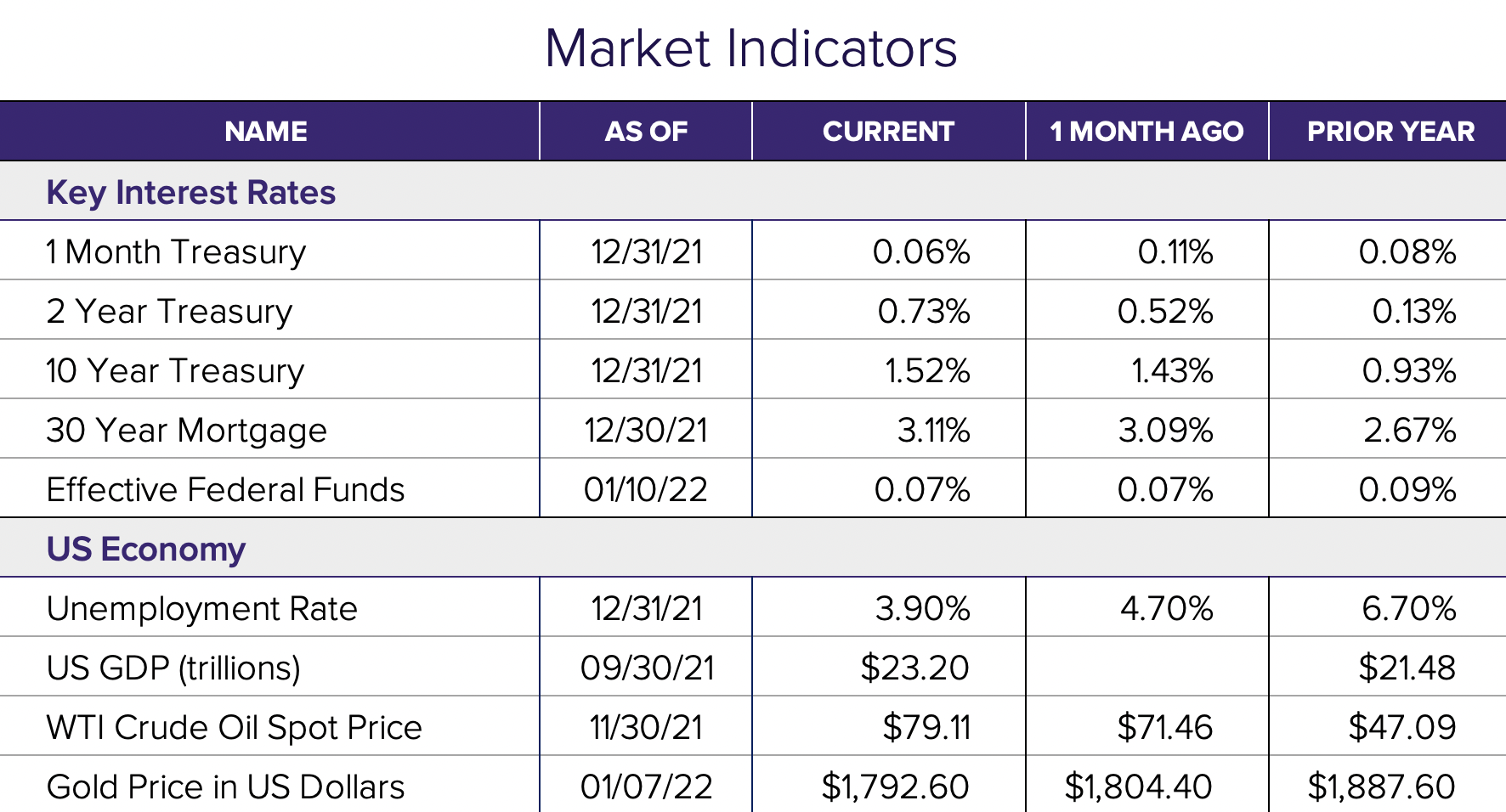

The bond market wasn’t as lucky. There, short and intermediate-term Treasury rates increased significantly while the longer-dated maturities only modestly rose. The rise in yields and flattening of the yield curve did not fare well for the price returns of fixed income. The U.S. bond market was down 1.54% by the end of December, with U.S. treasuries down 2.32%. The global bond markets fared even worse, ending the year down 4.7%.

Labor market strength and surging inflation.

The labor market has had quite a notable recovery from the lows of the COVID pandemic. The U.S has added almost 19 million jobs since April of 2020 and unemployment claims finished the year at a 52-year low! Despite the positive news in the labor markets, concerns came in the form of red-hot inflation. A 6.8% annualized rate of price increases is the highest inflation rate in the United States since the 1980s. The Federal Reserve certainly deserves an honorable mention in the 2021 stock market story as this last inflation print came on the heels of a hawkish pivot at year-end by Fed officials.

The Fed.

The Fed was under pressure all year to act against overheating prices and it wasn’t until the end of the year that they announced an accelerated end to the bond-buying program and new plans for raising rates next year by three-quarters of one percent. All throughout 2021, the Fed kept interest rates at zero and continued pushing billions of dollars into the market each month, encouraging investors’ risk appetites in search of high returns.

Flows.

The beneficiary of this risk-on behavior was equity exchange-traded funds, or ETFs, such as those that follow the S&P 500 index of US large-capitalization stocks. Of the record $900 billion that flowed into ETFs this year, over 50% of those flows went to US equity-based ETFs with the top funds being those that follow the S&P 500. This has pushed the valuations of those companies in these indices even further from the historic longer-term averages. Time will determine whether this is a permanent shift.

December: A strong finish for stocks.

In December, concern over the ultra-contagious Omicron variant injected additional volatility into the markets but the ever resilient buy-the-dip trend ensued, and the stock market ended the year on a high note. US stocks as a whole finished up 5.47%, international developed stocks were up 3.20% and Emerging Markets up .68%. One important trend we saw strengthen this month was the bias towards high-quality stocks and away from non-profitable and lower-quality stocks, particularly in the technology sector. Bonds finished roughly flat for the month with the 10-year treasury yield ending at 1.51%.

Final thoughts.

2021 was no doubt a continuation of the wild ride from 2020. It was full of scary headlines and unprecedented actions across the globe, yet risk assets continued to outperform. Hindsight is always 20/20 or in this case, 2021.

Nonetheless, staying the course and maintaining a diversified global portfolio of assets across class, market cap, style, and strategy has and will continue to be a successful strategy to weather whatever 2022 throws our way.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®