As the end of the year approaches, it becomes increasingly important to make financial decisions that will impact your tax return.

One common question we receive from our clients is whether or not they should use their Required Minimum Distribution (RMD) from their Individual Retirement Account (IRA) to make a charitable donation. The answer typically comes down to their financial circumstances and their overall philanthropic goals.

Making a charitable contribution in lieu of taking an RMD.

Clients who are 70½ years old are required to take an RMD. The RMD amount is calculated using a December 31 balance of the IRA in the prior year by the IRS life expectancy factor. The RMD can either be paid in cash directly to the owner or to a qualified charity.

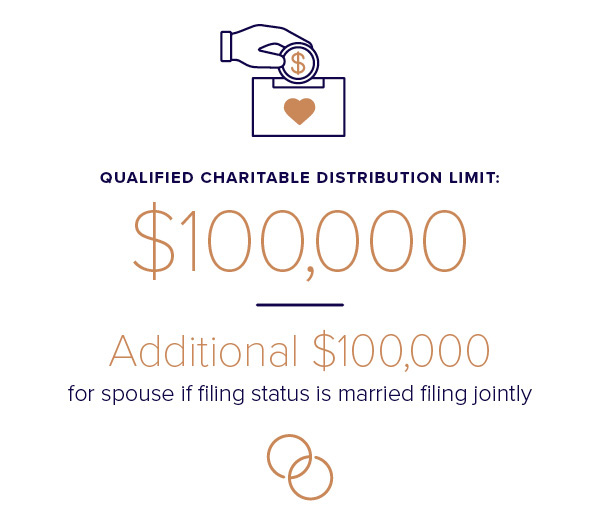

When an RMD is paid directly to a qualified charity it is considered a Qualified Charitable Distribution (QCD). The benefit of making a QCD is that it is not included in taxable income on their tax return. The maximum annual amount that can qualify for a QCD is $100,000. However, if your filing status is married filing jointly, your spouse can also make a QCD of $100,000.

In order to determine if a client should take their RMD in cash or if it would be more beneficial to make a QCD, we consider their income level, their charitable goals, and whether or not they itemize on their tax return.

Here are three client scenarios and how OCDs may come into play:

- Low taxable income – If a client is in the zero or a low tax bracket, they should take the RMD in cash and consider delaying charitable contributions for a year that they have a higher income.

- Taxable income, standard deductions – If the client is income taxable and claims the standard deduction on their tax return, they should make a QCD distribution. The QCD distribution will be excluded from their taxable income; thus lowering their taxes. A QCD is preferable rather than taking the RMD in cash and then subsequently making charitable contributions, as the RMD will be included in taxable income. In addition, there is no deduction for a charitable contribution when a taxpayer is taking the standard deduction on their tax return.For tax year 2019, the standard deduction is $12,200 for single taxpayers, and $24,400 for married filing joint taxpayers. In order to itemize on a tax return, a taxpayer must have more itemized deductions than the standard deduction. The most common itemized deductions are real estate taxes/state taxes limited to $10,000, mortgage interest, and charitable contributions.

- Taxable income, itemized deductions – If the client has significant taxable income and they are itemizing on their tax return, it is mainly neutral to either take the RMD in cash or to make a QCD as the tax impact is the same. Many of our clients who are itemizing on their tax return also have appreciated securities. In this case, we recommend that the individual take the RMD in cash and make the charitable distribution from appreciated securities, particularly if there is an account rebalance needed.

By donating appreciated securities, a taxpayer is able to receive an itemized deduction equal to the fair market value of the stock and eliminate the capital gain tax liability on the sale of the asset. For more information please refer to our post, “What Does the Tax Cuts & Jobs Act Mean to Your Philanthropic Planning?”

What should you do?

As you can see, there is no universal recommendation for using an OCD in place of the RMD. If you are unsure of your tax position, ask your tax professional to do a projection to see what is most advantageous in your particular case.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®