Whether retirement is a far-off concept or a reality quickly approaching for you, planning for this milestone can be intimidating and complex. Company-sponsored retirement plans, such as your 401(k), can simplify the process by automatically setting aside and investing a portion of your paycheck.

You may have noticed—whether starting a new job or as a recent addition to your benefits program—the option for a Roth 401(k). This type of retirement plan has increased in availability and popularity over the past decade or so, yet many employees are not fully aware of how it differs from a “regular” 401(k).

In this article, we’ll explain how a Roth 401(k) can maximize your retirement income, depending on your situation,

How Traditional and Roth 401(k)s work.

Before exploring the differences between a traditional and Roth 401(k), let’s cover their similarities.

- Both are employer-sponsored plans that make it convenient to save and invest for your retirement.

- Both come with the option of an employer contribution match (if offered by the company).

- Both are subject to contribution limits and withdrawal guidelines.

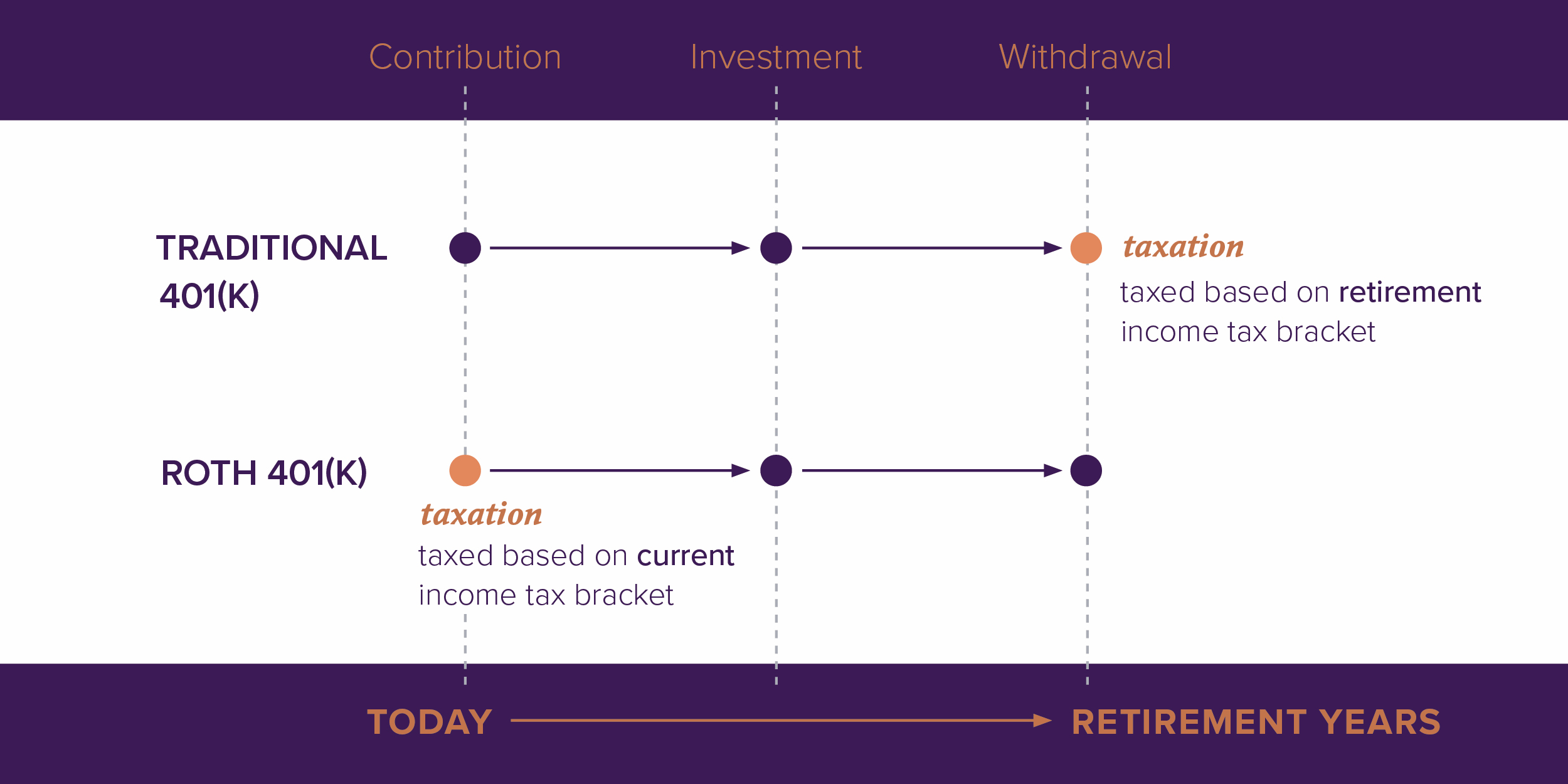

The primary difference between these two types of plans comes down to taxes. One way or another, your retirement savings will be subjected to income tax—there’s no way around that. However, your decision between a traditional or Roth account determines when the taxation takes place.

For a traditional 401(k), pre-tax money comes out of your paycheck and goes into your retirement savings account. You do not pay income taxes on this part of your salary, which can lower your overall adjusted taxable income (ATI). However, when you retire and withdraw funds from your traditional 401(k), that money will be taxed as income.

On the other hand, contributions into a Roth 401(k) are post-tax. The money that comes out of your paycheck is taxed before being deposited into your retirement account. Down the road, when you draw on your Roth 401(k) for retirement living expenses, the withdrawal will not be taxed since the income taxes you already paid it many years prior.

Important note: If your company offers a 401(k) match, those funds will typically be put into a traditional 401(k), even if you opt for a Roth account.

Benefits of a Roth 401(k).

At this point, you may be asking, “Why would I volunteer to pay taxes now?” Or, “Doesn’t that defeat the purpose of a 401(k)?” To answer those questions, you have to think long-term and weigh two factors: investment growth potential and tax brackets.

The first important factor in investing is time. Over the past century, the stock market averages a return of about 10% per year. The earlier you start to save in your career, the more you can take advantage of the power of compounding over time. Most people who set up a 401(k) understand this principle, but it is very important!

The second factor is income tax. No matter which plan you opt for, income taxes are going to detract from your retirement savings. In planning for these taxes, your income tax rate will likely change between now and when you withdraw from your retirement savings in 10, 20, 30, or even 40 years. There are two reasons for this:

- Your income changes: In many cases, an individual’s taxable income increases during their career through retirement, then will decrease when transitioning from their late-career salary to living off their retirement savings.

- Income tax brackets fluctuation: The IRS modifies tax brackets every year to adjust for inflation and cost of living. In addition, some investors are also concerned with future tax reform and regulations. While change is a certainty, there’s no way to accurately predict if income taxes will be relatively higher or lower in the future.

So, what does this all mean? Well, the goal of your retirement plan should be to accumulate as much savings as possible (through contributions and market returns) while minimizing your tax burden.

With a traditional 401(k), you may end up with a larger balance when you retire, but a portion of what you saved will go toward taxes each time you withdraw money.

With a Roth 401(k), you volunteer to pay taxes now so your contributions can grow and be withdrawn tax-free. Under the right circumstances, this approach can net you more retirement income than going with a traditional 401(1k).

Which type of account is right for you?

Unfortunately, there’s no perfect rule of thumb or calculator that will tell you, with great certainty, that a traditional or Roth 401(k) would be more advantageous. Anyone who provides a blanket recommendation is likely misinformed or attempting to sell you in one direction or another.

There are two general guidelines you can use as a starting point for your decision:

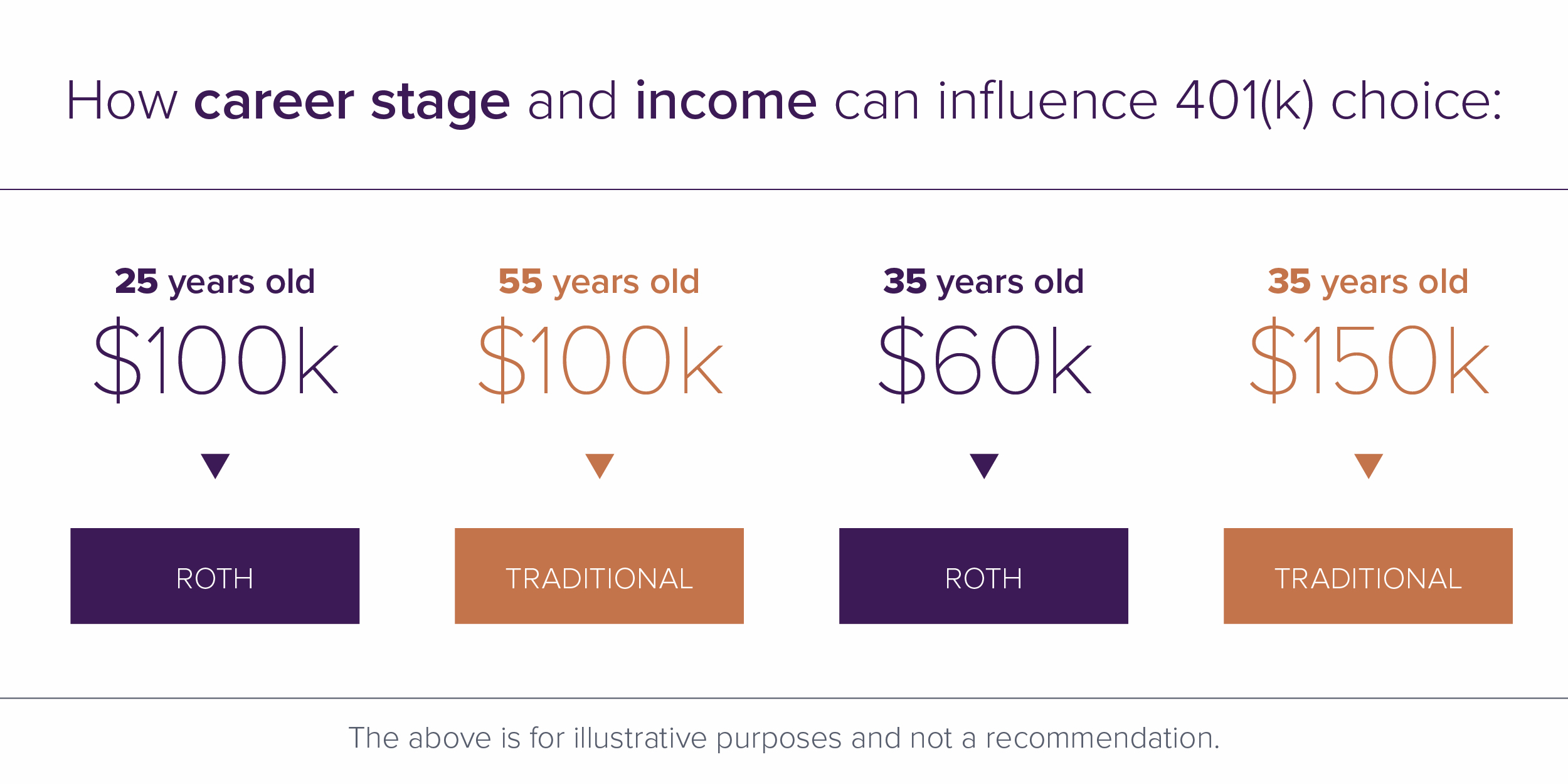

- If you’re early in your career and/or in a relatively low tax bracket, the benefits of a Roth 401(k) are more apparent.

- As your income increases (potentially pushing you into a higher tax bracket) and you get closer to retirement, it’s more likely that a traditional 401(k) is a better fit.

Final thoughts and takeaways.

There isn’t always a clear right or wrong choice for your 401(k). If you set up a retirement savings plan, make regular contributions through your paycheck, and maximize any employer match, you’re already on the right path. It never hurts to optimize your strategy—and deciding between a traditional or Roth 401(k) can help you make sure your savings is working as hard (and smart) as possible.

This choice is very individualized, and we suggest having an in-depth conversation with an experienced financial planner. We have covered the basics of each retirement vehicle in this article, but there are several other factors and nuances to consider for your personal situation.

In our opinion, part of the decision comes down to evaluating the knowns and unknowns. You may not know exactly where your career is heading or what the tax structure will look like in your retirement years, but some more predictable factors might make you lean toward a Roth 401(k) or stick with a traditional plan.

If you have any questions or are ready to have that conversation, reach out to your Thrive Financial Wellness adviser at Sanderson Wealth Management.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®