January 1, 2026 is a critical date for estate planning. This is when estate tax exemption amounts are scheduled to revert to significantly less generous pre-2018 amounts of roughly $6MM per person after indexing for inflation. That means the current amount of $12.06MM per person, or $24.12MM for married couples, will likely be more than halved.

Admittedly, 2026 may seem well into the future, and there is ample time for the political environment and tax legislation to change between now and then. However, many high-net-worth families are exploring ways to utilize the historically high estate tax exemption amounts we have today—particularly if it can be done in a way that doesn’t materially impact their daily lives and spending.

-jpg.jpeg)

A window of opportunity?

A Spousal Lifetime Access Trust, commonly referred to as a SLAT, is a wealth transfer planning vehicle designed to utilize a donor spouse’s remaining lifetime exemption amount today, before the scheduled decrease, through a gift to a trust for the benefit of their spouse or descendants.

Once the assets are transferred to the SLAT, they are outside of the taxable estate of both the donor spouse and beneficiary spouse. Furthermore, the donor spouse will have effectively utilized a portion of (or all) their lifetime exclusion amount. If the donor spouse allocates their generation-skipping trust (GST) exemption to the transfer, the trust assets will remain outside their descendant’s taxable estates for some time. This allows the initial transfer and the appreciation of the trust assets to avoid estate taxes at the spousal generation, as well as future generations, potentially saving millions of dollars in estate taxes.

With the relative lows in the financial markets currently, the removal of future appreciation from a couple’s estate is an attractive proposition. Remember, though—estate tax exemption utilization builds from the bottom up, so a gift in excess of the projected reversionary levels must be made to make the strategy impactful.

Potential clawback.

Within the estate planning community, there has been concern that the IRS may clawback gifts made during this era of historically high estate tax exemption amounts, if the amount reverts to pre-2018 levels. However, most of that concern has been alleviated by Treasury Regulations issued in 2019 stating that the IRS would not do such (Treas. Reg. § 20.2010-1(c).)

How a SLAT works.

SLATs are generally treated as grantor trusts with respect to the donor spouse. As such, the donor spouse will pay taxes on the income earned within the trust. This “tax burn,” as it is commonly referred to, is a powerful estate tax avoidance strategy in its own right. It dwindles the donor spouse's remaining taxable estate at the benefit of allowing the SLAT assets to grow free of an income tax burden for the surviving spouse and descendants.

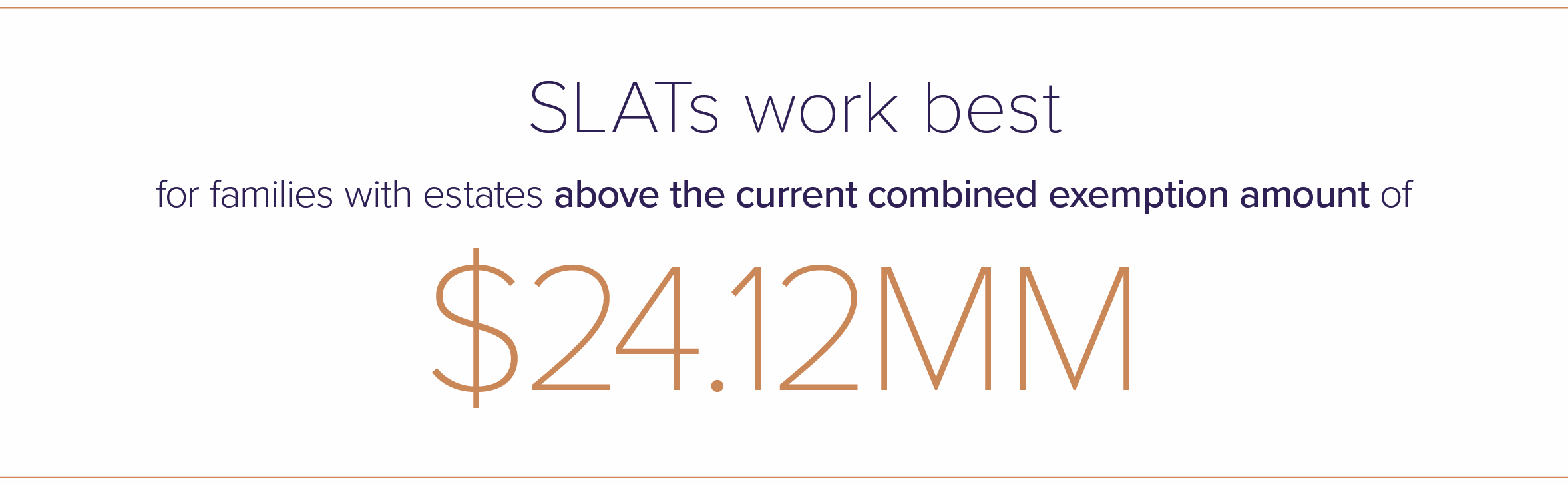

However, particular care should be taken to ensure that the donor spouse has enough remaining assets to continue their lifestyle and pay their taxes. As a result, the SLAT strategy operationally works best for taxpayers with estates well in excess of the current combined exemption amount of $24.12MM.

Once the SLAT is in place, the beneficiary spouse (and possibly the couple’s descendants) can benefit from distributions of principal and income from the trust—both on a standard basis (i.e., required income distributions) or flexible discretionary basis depending on the desired outcome of the wealth transfer planning strategy.

Since the distributions are going to the donor’s spouse and children, the family unit does not see a significant impact on their cashflow after implementing the SLAT. However, each dollar that comes out of the SLAT ultimately minimizes the estate tax avoidance impact of the strategy overall, so care should be taken to preserve SLAT assets. This is another reason why the strategy works best for families whose wealth level is well above the $24.12MM level.

Additionally, depending on the structure of the distribution plan, the creditor and general asset protection aspects of the trust may also be mitigated if distributions are being forced out of the trust on a regular basis.

Too good to be true?

While SLATs certainly represent a tremendous estate tax avoidance strategy if deployed properly and in the right set of family and financial circumstances, taxpayers choosing this strategy should be cautious for a variety of reasons.

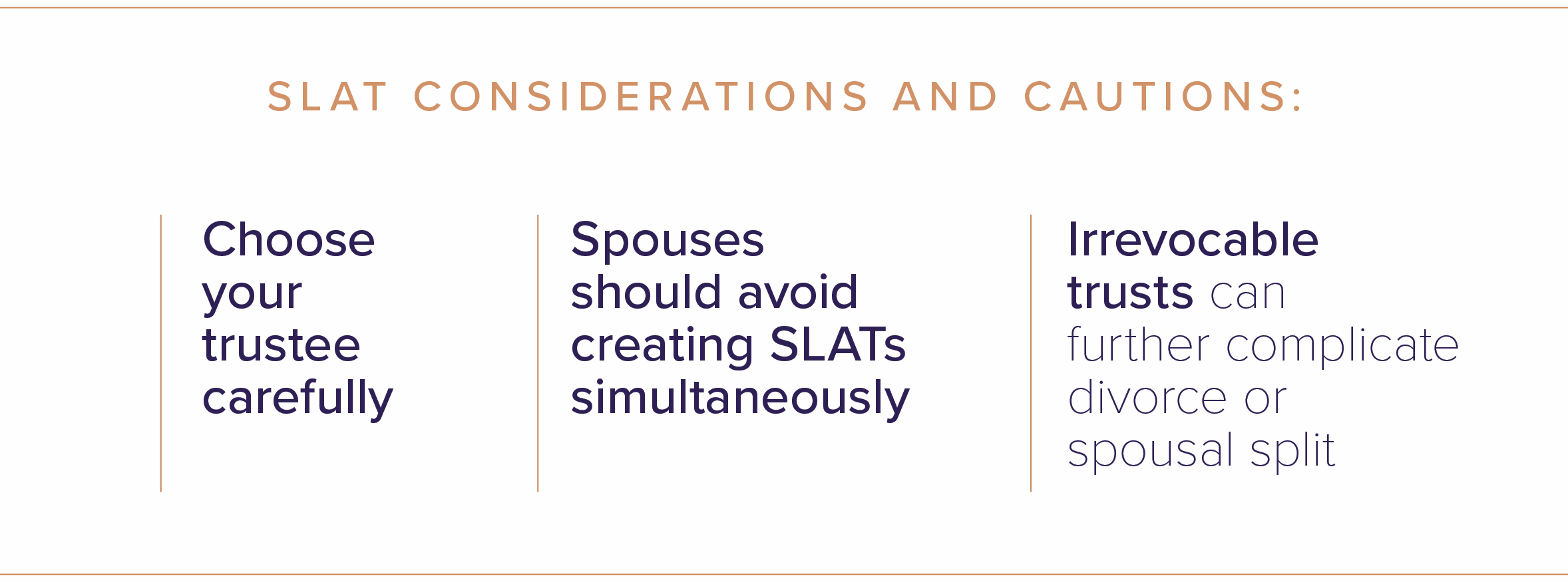

The choice of trustees is a decision wrought with complications. The donor spouse should not be a trustee to avoid the transfer being deemed an incomplete gift for estate tax purposes. If the beneficiary spouse is the trustee, distributions should be mandatory or subject to an ascertainable standard to avoid the trust assets from being pulled into their taxable estate. Choosing a truly independent trustee would be the most cautious approach to avoid estate inclusion and creditor challenges to the strategy.

There might also be a temptation for spouses to create SLATs for each other, in order to maintain control over and benefit from a portion of the family assets. While it is permissible for both spouses to benefit from a SLAT, the trusts should not be created at the same time to avoid the IRS’s “step-transaction doctrine.” Not allowing enough time between the creation and funding of the SLATs and not differing the terms of each trust significantly enough could cause the trusts to be included in each of the beneficiary spouse’s taxable estate, thus voiding the impact of the transaction.

Finally, it is worth emphasizing that SLATs are irrevocable trusts. While setting up the structure to benefit your spouse may seem like a harmonious estate planning strategy today, a divorce or other contentious spousal split could wreak havoc on the plan. The donor spouse could be left in a position where they have transferred a significant portion of their wealth to a now former spouse, while also paying the income tax burden on the trust assets into perpetuity. This seems like quite the unintended parting gift!

Careful consideration and drafting can pay off.

While SLATs are wrought with complications and pitfalls, their power as a tremendous estate tax avoidance strategy in the right situation is undeniable. A talented estate planning team should be able to navigate through the obstacles in the process of drafting, executing, and funding the trusts.

As we approach the sunset of the current estate tax laws at the end of 2025, SLATs will undoubtedly be at the forefront of many planning discussions for ultra-high-net-worth families due to the potential estate tax savings the strategy can create, coupled with minimal family financial disruption.

However, remember that “lifetime” can still mean a very long time for the donor spouse. Their personal finances and estate tax laws will inevitably change long after the irrevocable transfers to a SLAT are completed, and the spouse of today may not be the spouse of tomorrow, a particularly disastrous scenario for a SLAT.

If you have any questions about SLATs and their application, don’t hesitate to reach out to your Sanderson adviser or contact Sanderson to schedule a consultation.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®