Earlier this year we warned that we’re likely in for some surprises that are unknown consequences from the Federal Reserve's unprecedented rapid interest rate increases. On Friday we watched one of these unfold as Silicon Valley Bank, the 16th largest bank in the United States, was seized by the FDIC during the middle of the day.

Why it happened.

- The bank’s investment portfolio experienced massive losses on their longer duration bonds in 2022 as higher and faster than expected interest rate increases pummeled long-term bonds.

- A liquidity problem was disclosed as SVB made plans of raising $2.5bn in capital from investors to help insulate those losses.

- The bank’s deposits are 96% uninsured by the FDIC (that number is 38% at Bank of America).

- They did not have a diversified customer base. (It would be similar to only working with farmers during a drought and having those customers all need access to cash in a time of need.)

These factors lead to a run on the bank on Thursday, March 9, 2023, as 24% of uninsured deposits requested withdrawals and SVB was unable to meet all those requests with its reserves.

What’s next.

Now we’re watching the bank look for a suitor, likely one of the systemically important financial institutions (SIFIs), or perhaps a company that’s been looking to get into banking. This a very rare opportunity to dive headfirst into the venture capital space and become its go-to bank, which SVB has embraced for decades.

The FDIC seized the bank Friday afternoon and will open the Deposit Insurance National Bank of Santa Clara for insured deposits where withdrawals will be possible again. Uninsured will remain at SVB under receivership where depositors may have some access to their deposits, but likely only approximately $0.50 on the $1. They’ll be waiting many months - maybe more than a year -for the rest as the bank goes through its next stages. An external purchaser, like a large national bank, could change the dynamic very quickly, and both the Treasury Department and Federal Reserve are deploying resources to help.

Our perspective.

This is a very unfortunate outcome for a decades-old very large bank and its long-time customers. We will undoubtedly see ripple effects across the regional and smaller banks, especially as more regulation will likely be on its way. We’re likely to see a rotation of deposits into large national banks that are subject to more stringent regulation: SIFIs.

Additionally, we’re likely to see more rotation from bank deposits in general where insurance is capped at $250,000, to money market mutual funds where the funds are backed entirely by very short-duration bonds/loans.

Sanderson has always emphasized the use of money market funds over bank deposits, both likely to yield more income as interest rates change and to be much less exposed to rapid changes in value. We remain focused on encouraging deposits over insurance limits to be moved into money market accounts.

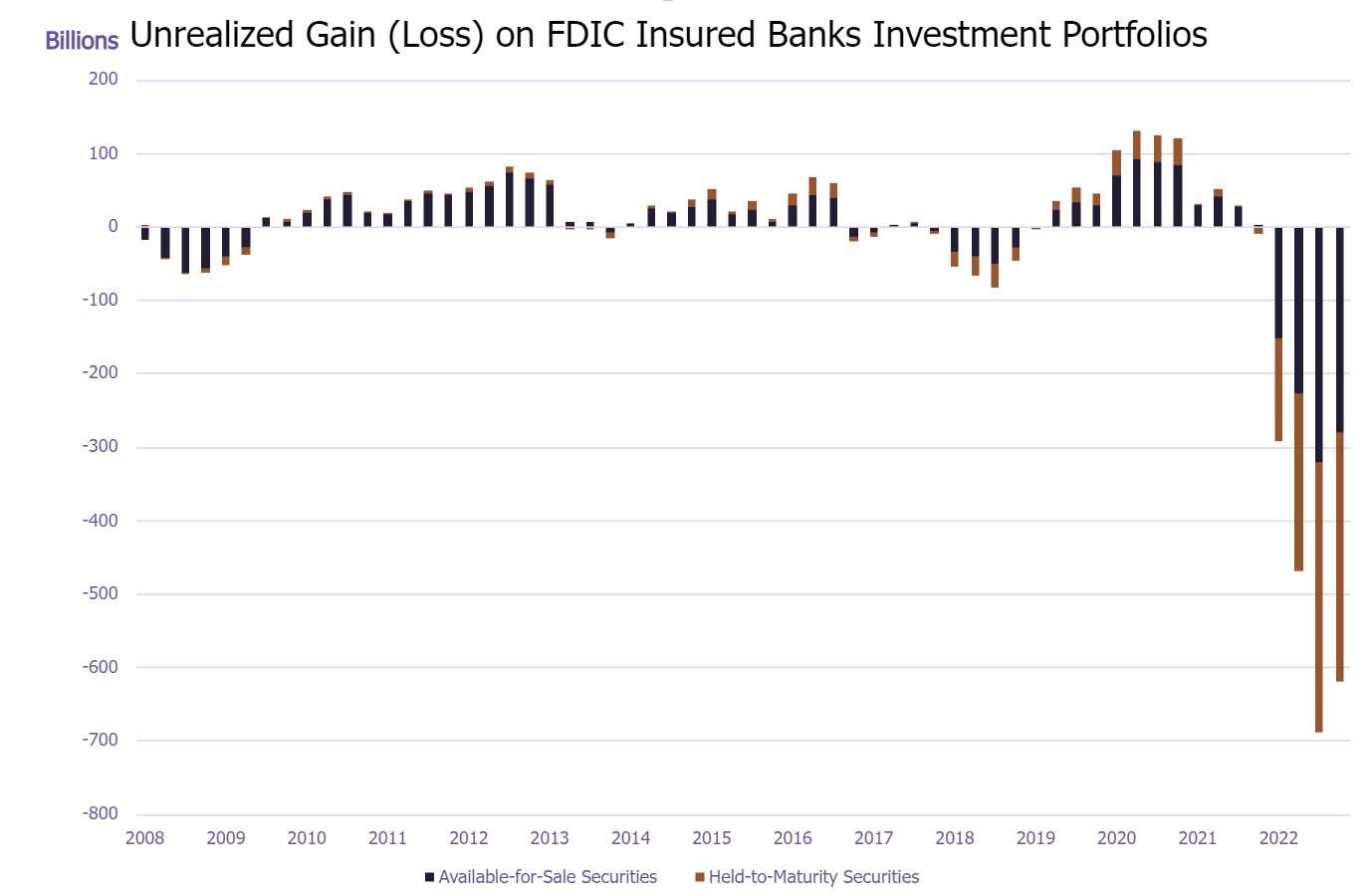

Lastly, we will be watching for the fallout across banking. SVB had a unique set of factors with its off-the-charts uninsured balances (96%) and such a tight niche focusing on venture capital. The interest rate increase exposure is not unique. Banks have massive unrealized losses on their investment portfolios following 2022's rapid interest rate increases. The losses are unrealized, and will roll off gradually as bonds mature; however, if a bank is forced to liquidate prior to maturity, large losses may occur.

Key takeaways.

The rapid demise of the 16th largest bank in the country can be alarming. A very unique fact pattern occurred here, and it’ll be many months before we know the extent of damage to its depositors. Rest assured, Sanderson clients' money market funds are not exposed to the risks that brought down SVB, and we remain confident that the new 2016 regulations in money markets continue to protect investors' access to their capital. Please feel free to reach out to me or your Sanderson adviser to discuss your personal facts and circumstances.

UPDATE.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®