We are now five months into 2023 and it appears to be a great year for U.S. stocks. At least it would appear that way when looking at returns for the S&P 500 index. From January 1 through May 31, this measure of large U.S. companies was up 9.6%. When we look a little deeper, however, things are not as rosy as at first glance.

When looking at the underlying companies in the S&P 500 index, the average return for an individual company is slightly negative thus far in 2023. When looking at other indices, such as the S&P Midcap index and the S&P SmallCap index (which represent medium and small size U.S. companies), returns are also negative.

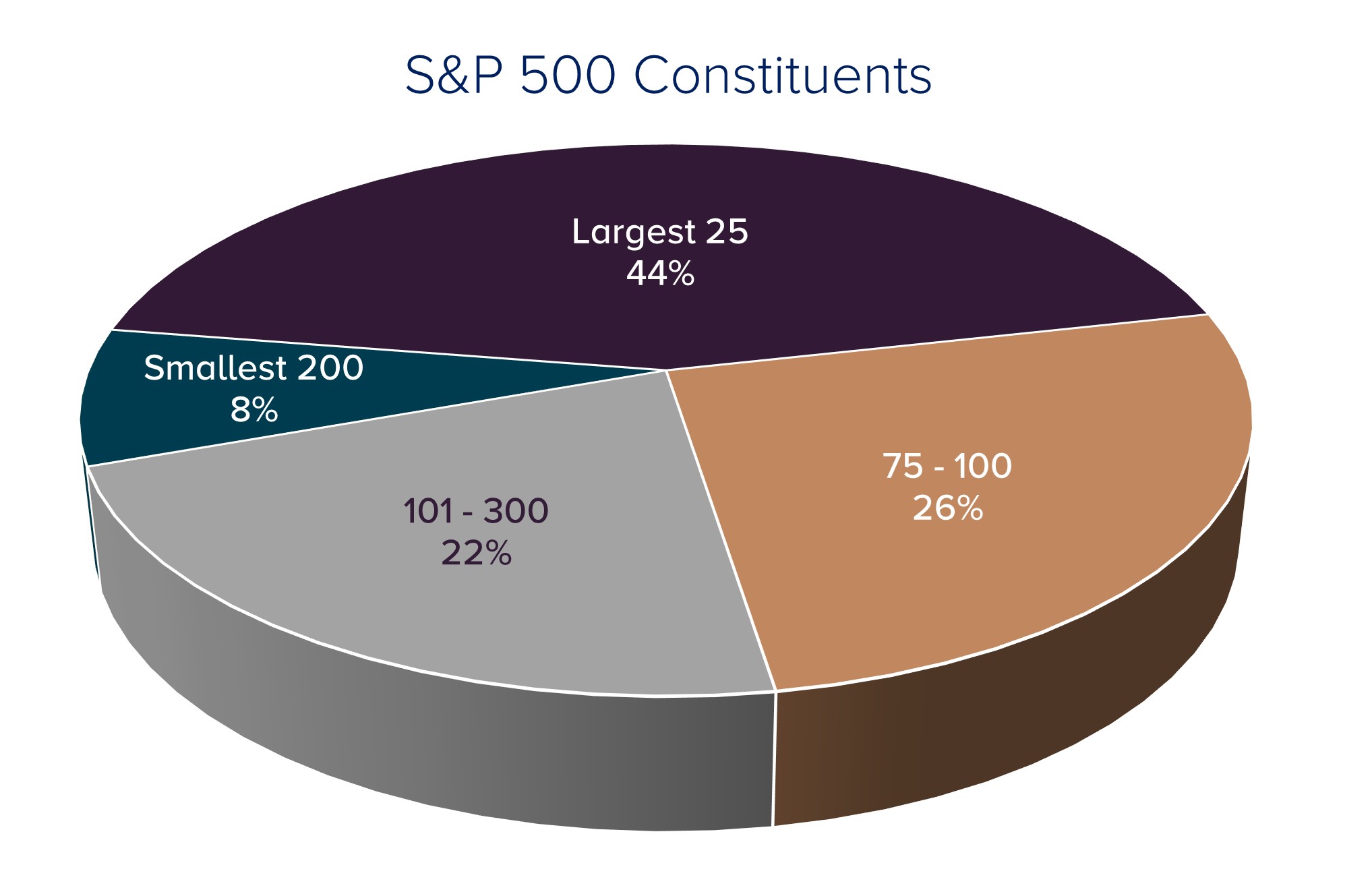

Perhaps one reason the S&P 500 index returns are much stronger than those experienced by many investors has to do with how the underlying companies are weighted in the index. The S&P 500 index is market capitalization weighted, which means that larger companies make up a larger percentage of the index. Even though there are 500 companies in the index, the largest 25 companies make up nearly 45% of the index, while the smallest 200 companies make up less than 10%.

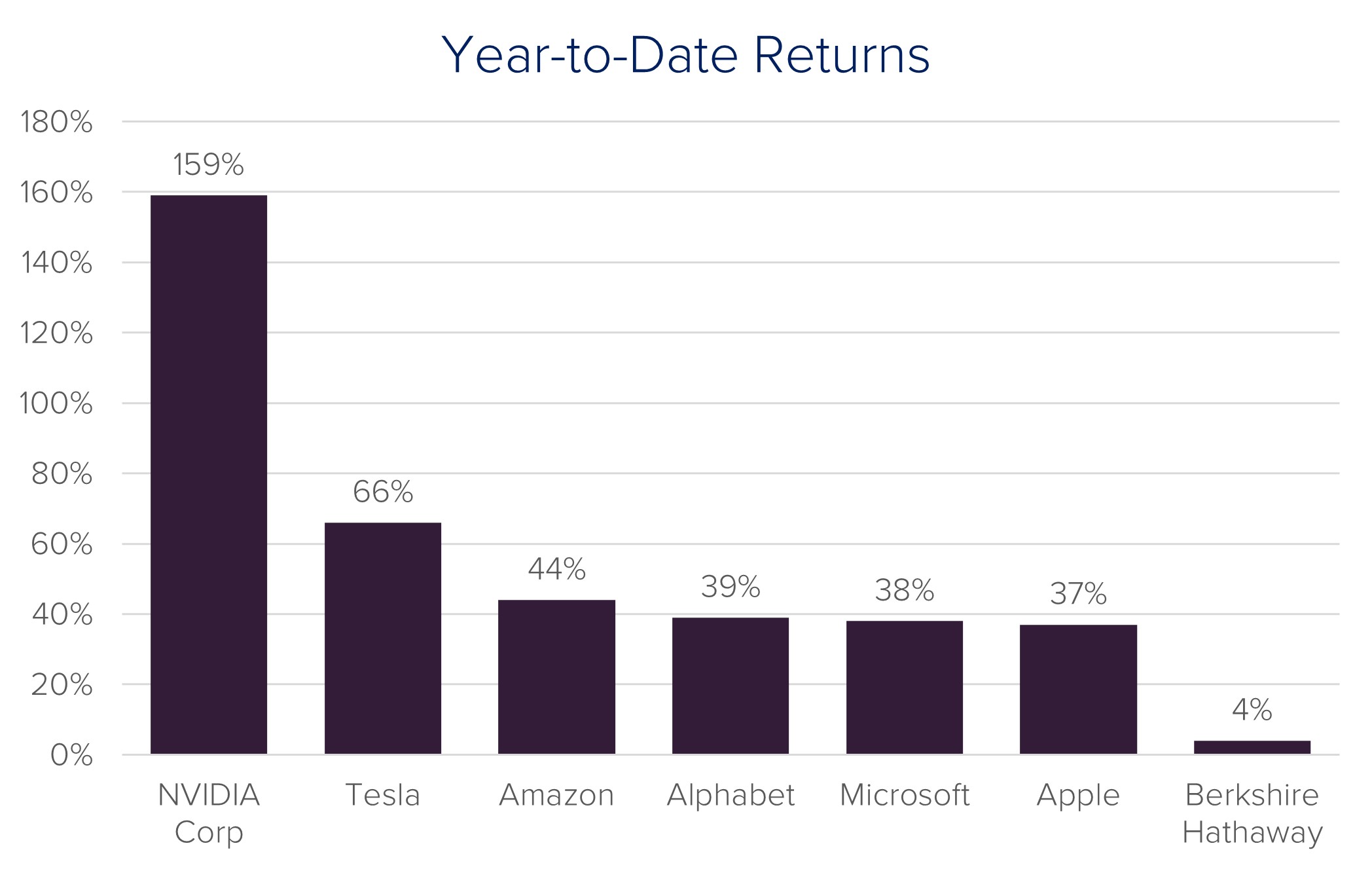

In fact, it is not even the top 25 companies that are driving performance, it is the top seven. In the first five months of 2023, Apple, Microsoft, Alphabet (a.k.a. Google), Amazon, NVIDIA, Berkshire Hathaway, and Tesla combined contributed 9.0% of the S&P 500’s return. The other 493 companies combined contributed 0.6% to the index’s return. With returns ranging from 37% to 159%, six of the largest holdings in the S&P 500 index had fantastic returns, while one returned a respectable 3.9%. As such, if an investor was to underweight these companies, they are likely disappointed in their returns when comparing them to the returns of the S&P 500 index thus far in 2023.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © June 2023 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®