For many people, September is typically a welcome time of year associated with the start of Fall and all things pumpkin spice. For the stock market, September has a reputation for being the worst performing month in the calendar year. This is certainly holding true for 2023 as the S&P 500 finished the month -4.77%, the worst monthly performance since December 2022. The sobering month also closed out a losing third quarter; the first negative quarter in 12 months.

Despite inflationary pressures beginning to ease, a sharp rise in treasury yields were a buzz kill to the 2023 stock market rally that has been fueled by large, overvalued technology stocks.

Higher for Longer

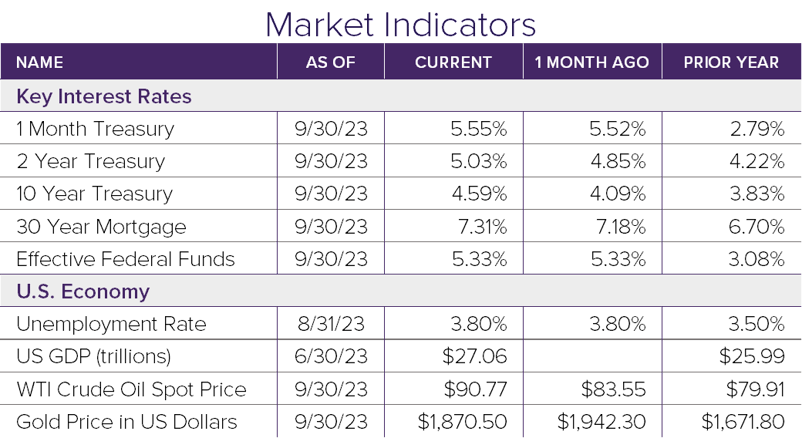

The Federal Reserve held a meeting in late September where they signaled rates may hold near current levels through 2024. When the stock market peaked in July, fed funds futures data indicated an 87% chance the Fed would trim rates by June 2024. The probability is now less than 50% according to the same data. The stock market was relatively flat heading into that meeting while the 10-year treasury yield was steadily moving higher. By month end, the 10-year treasury was at 4.59%, its highest level since 2007. These higher rates put pressure on tech stocks that have been primarily responsible for the entire gain in the S&P 500.

The potential for government bond rates to stay higher for longer would give investors the opportunity to earn a meaningful yield from treasury bonds. This is a welcome change for investors that have not seen attractive bond rates in over a decade thanks to prolonged central bank easing.

Markets

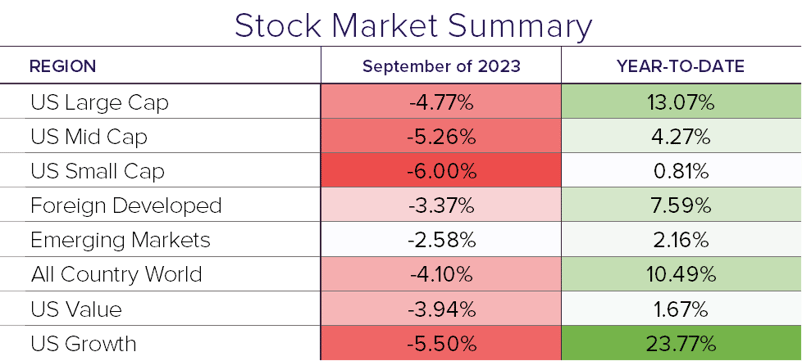

U.S. large cap stocks, which had been up over 20% two months ago, are now holding onto a 13% return for the year. Mid and small cap stocks are up 4.27% and .81% for the year after dropping -5.26% and -6% in September. International stocks provided some diversification for global investors as foreign developed stocks and emerging markets only dropped -3.37% and -2.58%, respectively.

Looking Forward

As we enter the fourth quarter of 2023, there are several questions remaining. Will the economy remain resilient? Will interest rates stay higher for longer? Time will tell. It is worth noting that historically, the fourth quarter is the strongest quarter of the year with an average gain of 2.8% going back to 1928.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®