Markets on edge.

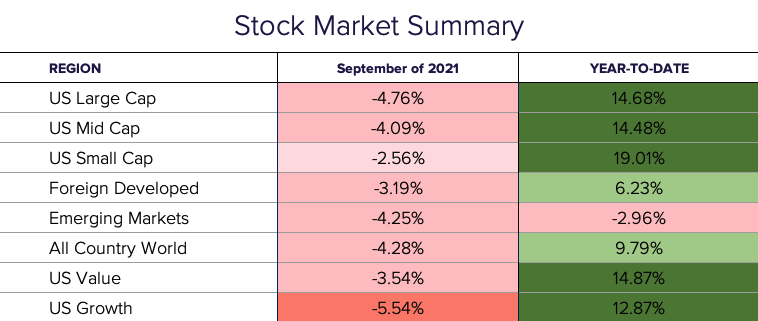

Traditionally, September is a choppy month for stocks and this September was no exception. Despite the S&P 500 squeaking out a positive third quarter (+.23%), the -4.76% tumble for the large-cap index left investors on edge this month. Rising bond yields weighed on highly valued growth and tech stocks. Adding to the list of investor worries are concerns about the government debt ceiling, hawkish signals from the Federal Reserve, and supply chain disruptions.

The growth trade came under pressure, detracting -5.54% this month, while Value and Small Cap stocks managed the volatility better giving up -3.54% and -2.56% respectively. It’s this rotation that’s become yet another headwind for the S&P 500 given the index’s heavy tilt toward growth stocks. Globally, Foreign Developed stocks fell -3.19% and Emerging Markets dropped -4.25%.

Fed talk.

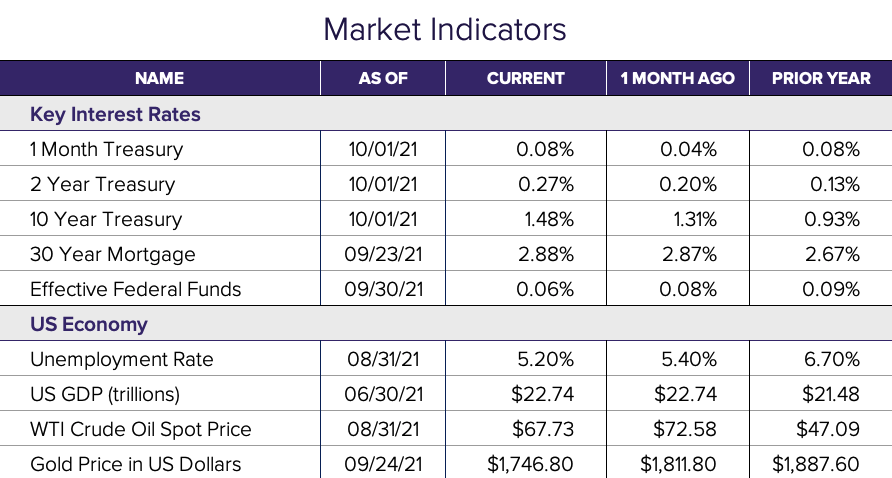

In this month’s meeting, the Fed indicated a willingness to respond to growing inflationary pressures by lifting rates as soon as next year, as well as tapering bond buying as soon as November. This was enough to send bond yields higher, with the 10-year Treasury climbing 20 basis points over the last week of September alone before settling in for the month at 1.52%.

The new fiscal cliff.

On the edge of a shutdown, Congress passed a short-term funding bill in the 11th hour to keep the lights on until Dec 3rd. It has been sent to President Biden to sign. Lawmakers in Washington will still need to act on the debt ceiling before October 18th in order to prevent a possible default on U.S. debt.

Supply chain bottleneck.

We have all felt the effects of the prolonged pandemic-era supply chain problem. Whether it’s the chip shortage, lumber/building material prices, or the 36% increase in natural gas this month, consumer demand is continuing to rise and production/manufacturing delays are only getting worse, magnifying the supply and demand imbalance. This certainly puts the economy on edge heading into the holiday season and 2022.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®