Russia-Ukraine War: An eye on the economics.

The third week of Russia’s unprovoked invasion of Ukraine is just beginning, and the economic fallout is being felt around the globe. Here are a few staggering metrics that have made recent headline news.

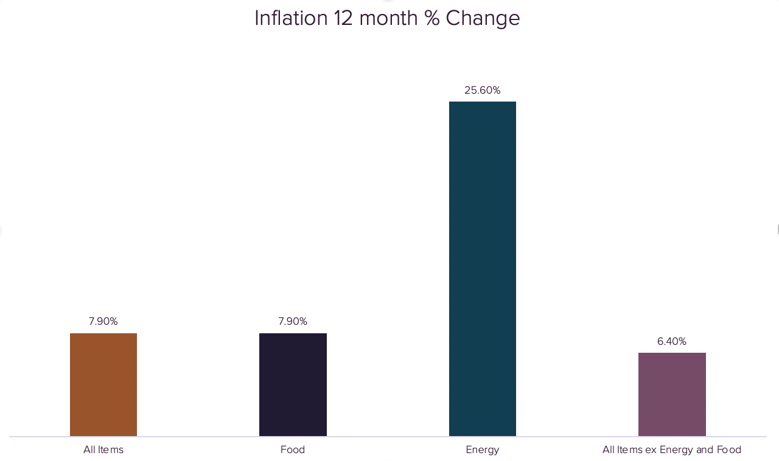

Inflation just reached 7.9%, a four-decade high.

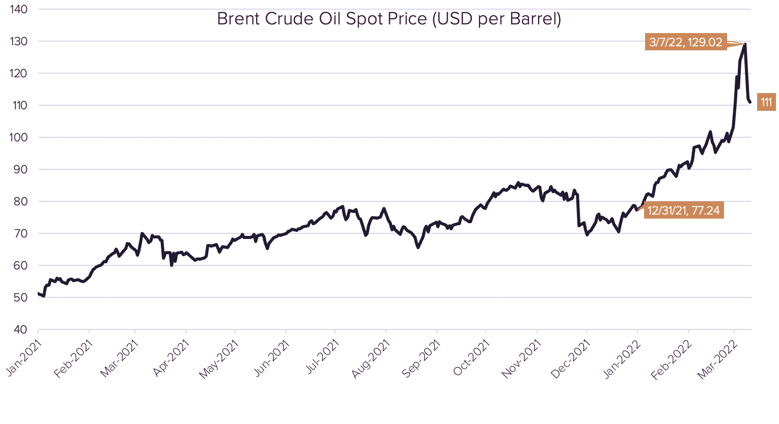

Oil prices have soared more than 60% this year.

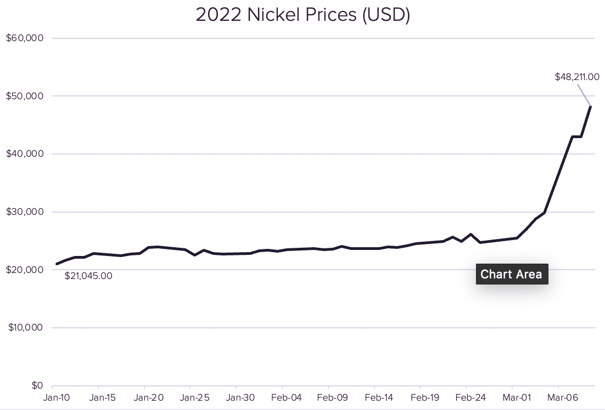

The overnight price for nickel (an important material for electrification) spiked 250%, forcing the London Metal Exchange (LME) to suspend trading for the first time since 1984.

Impact on the markets.

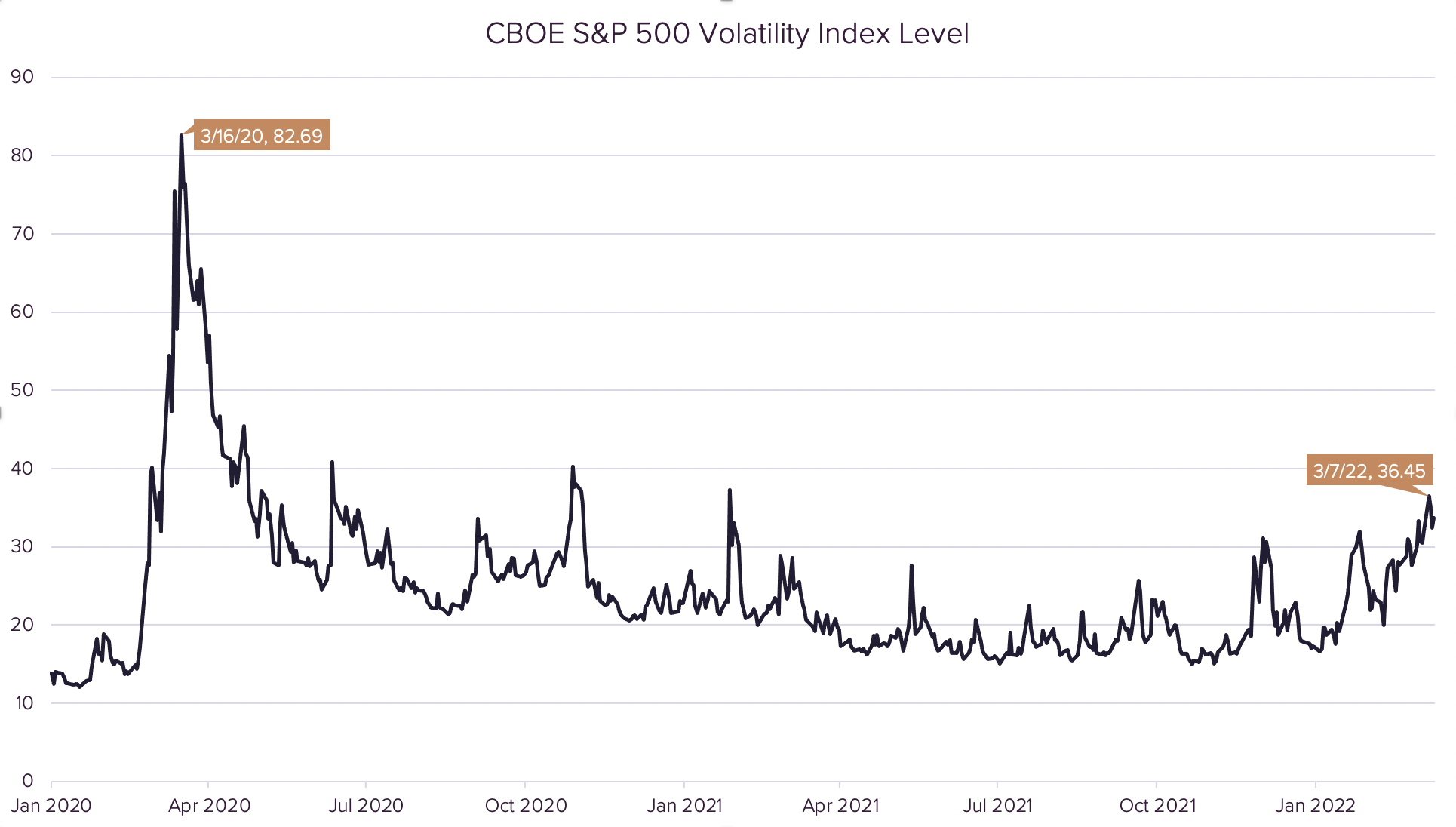

Shifting attention to the markets, we’re starting to see a rise in volatility. Earlier this week, the CBOE S&P 500 Volatility Index (VIX) peaked at 36—far above its 2021 average of 19.6, but nowhere near the Spring 2020 peaks that crested 100.

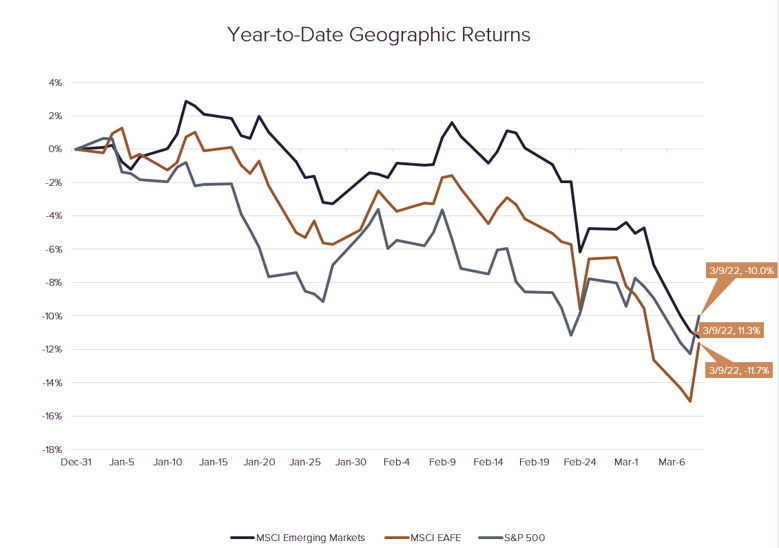

In January and early February, emerging market stocks were ahead of their developed and domestic peers. However, in times of global unrest, correlations move toward one, and all geographies are down approximately 10% for the year.

Looking back at the 52-week highs for domestic stocks, foreign developed, and emerging markets, we can see emerging markets entered a bear market this week (down > 20% from their high). The domestic stock market and foreign developed markets are both in correction territory (down > 10%).

What does this all tell us? The markets are generally a leading indicator for economic activity and hard asset prices. We’ll be watching closely to see if the market's downward sentiment is accurate in predicting a contraction in global GDP.

Opinion.

Unfortunately, the Russo-Ukrainian war continues to escalate. We are hopeful recent events mark the beginning of a turning point of what has been an eight-year conflict that began with Russia’s occupation of Crimea. The fallout continues to be horrific as Ukrainian cities are destroyed, infrastructure crumbles, citizens are displaced, and, worst of all, lives are lost. While truly a humanitarian crisis, the economic impact outside of the region is mainly related to inflationary pressures and energy supplies.

As American investors and consumers, we are certainly feeling the stock market volatility, as well as the price increases on all of our everyday goods and services. As we’ve seen repeatedly throughout history, the unrest will eventually pass, and democracy and capitalism will prevail. Before you know it, the innovation engine that is the free world will get back on track, and businesses will prosper. Who knows, we may even see all-time highs in the financial markets in the months to come.

In the meantime, we’ll be looking for rebalancing and buying opportunities, as well as tax-loss harvesting to create tax assets, saving our clients on future tax bills should the markets head even lower.

Like many of our clients, the Sanderson team is keeping a close eye on what is transpiring in Europe. We will continue to provide updates and financial perspectives as the tenuous situation unfolds.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®