Whether it’s money set aside for your retirement or an account that you want to pass down to your children and beneficiaries, Roth IRAs can be a powerful tool for building wealth. However, Roth IRAs are not the best choice for every investor. It’s crucial to weigh the variables and reap the benefits of the different options available to build your wealth strategy.

Traditional IRA vs. Roth IRA: What’s the difference?

IRAs are pertinent in your retirement portfolio, but which type you choose can make a big difference down the line, depending on your needs.

Traditional IRAs are primarily contributed to through pre-tax dollars, but funds are taxed when withdrawn from the account. Depositing into a traditional IRA may allow you to benefit from the tax deduction now, but if your wage increases over time, your distributions may be taxed at a higher rate when withdrawn.

Roth IRA, named after Delaware State Senator William Roth, became available in 1998 and altered the taxing procedure. With a Roth IRA, your deposits are from after-tax earnings, grow tax-free, and no tax is due on qualified withdrawals.

Both traditional and Roth IRAs allow for beneficiaries, but for Roth, your beneficiaries will not be taxed on qualified withdrawals.

.jpg?width=754&height=197&name=Tucker-post%20graphics-1%20(1).jpg)

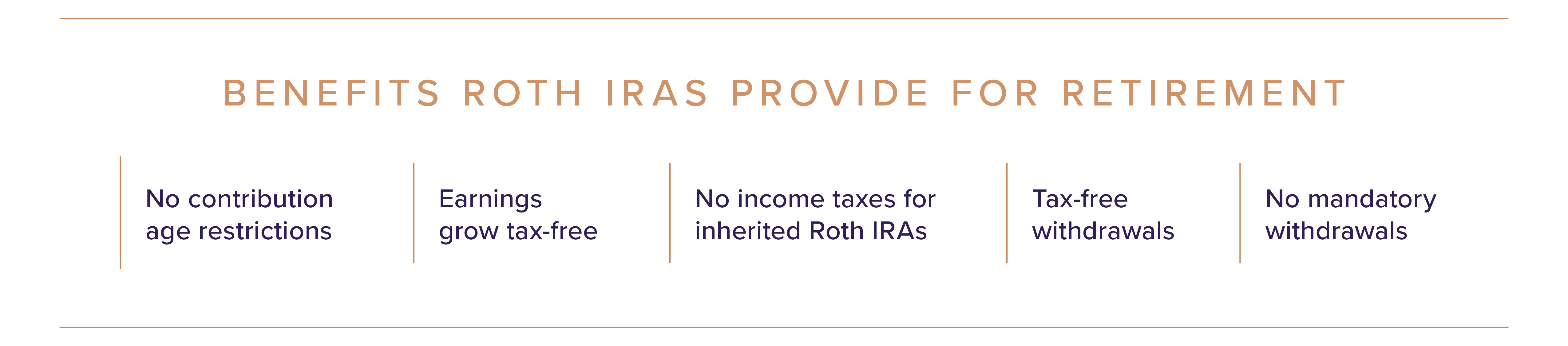

Benefits of a Roth IRA.

Advisers often recommend Roth IRAs to clients in lower tax brackets. When executed properly, the client will pay taxes at an earlier time, on a lesser amount of money, at a lower rate. Once invested, the assets have the potential to grow to a much larger value over time, and later be withdrawn when the client may be in a much higher tax bracket. Also, for those with both traditional and Roth IRA’s, they have the flexibility to potentially choose how much of their total distributions are taxed each year by varying how much of the distribution is Roth vs. traditional, as long as the required minimum distribution is met for the traditional IRA.

Qualifications for a Roth IRA.

In order to save and invest with a Roth IRA, you must contribute with earned income, as these are then after-tax dollars. A Roth IRA is the ideal type of account to open early in life due to no age restriction, a low tax bracket, and can continue to be contributed to throughout an individual’s working years.

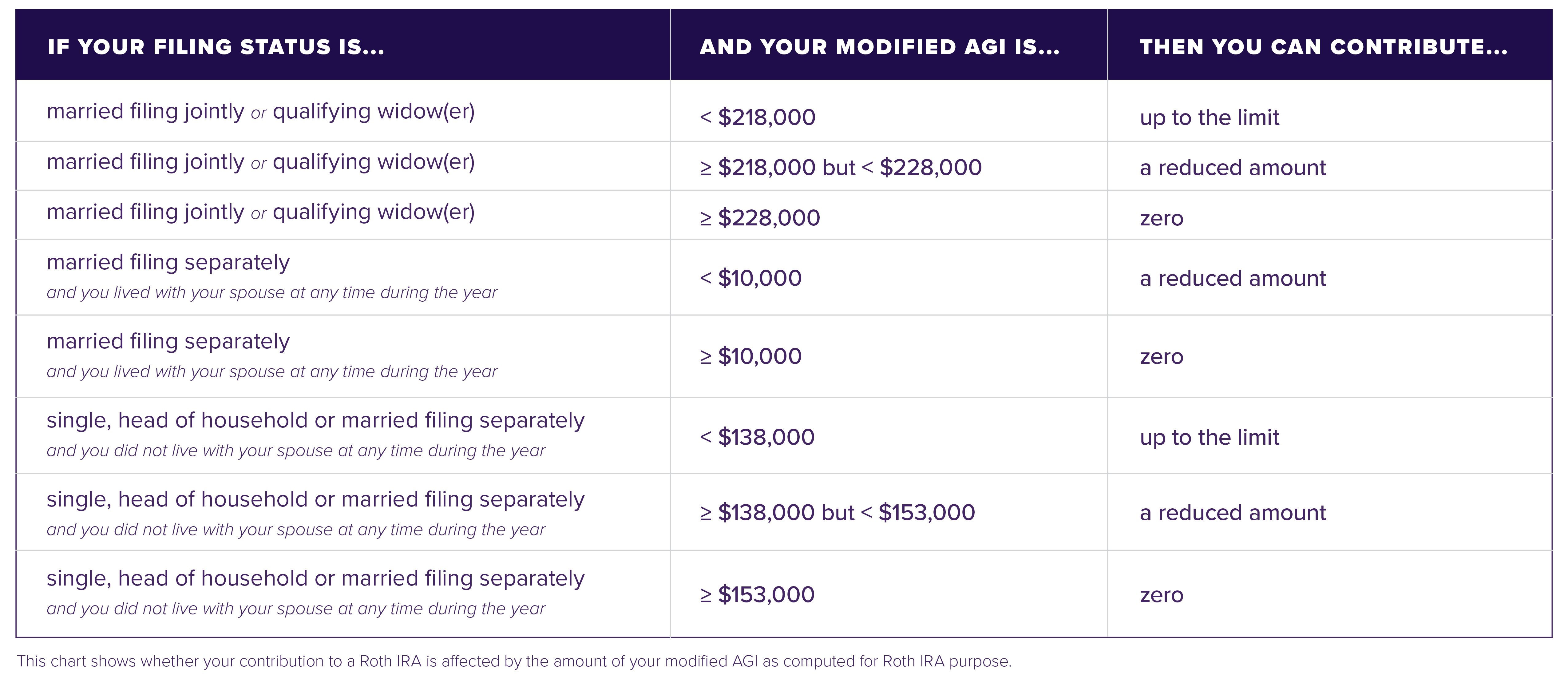

The income limit is based on your tax filing status and modified adjusted gross income (AGI). The IRS lists the different filing statuses paired with modified AGI to equate to the contribution limits.

In 2023, the contribution limit to a Roth IRA will be $6,500 (an increase of $500 from $6,000 in 2022) for ages 49 and younger. Ages 50 and older have an additional $1,000 catch-up contribution, for a total of $7,500.

Withdrawing from a Roth IRA.

How you withdraw funds is the biggest difference between a traditional IRA and Roth IRA. In addition to withdrawals not being taxed in Roth IRAs, there are also no mandated withdrawals for the original saver, whereas traditional IRAs have annual required minimum distributions (RMD) beginning at age 73.

Similar to any long-term savings fund, there are penalties should you withdraw funds early. A 10% penalty charge on the withdrawal amount is applied should you remove funds before the 5-year holding period or before age 59 ½. There are a few exceptions to this rule where the penalty charge will be waived.

Key exemptions from penalty charges include:

● If the amount is $10,000 or less to be used for a first-time home purchase

● If the amount is for qualified higher education expenses

● If the funds are being used for total and permanent disability coverage

Including a Roth IRA in your portfolio.

A Roth IRA can serve as a prudent savings tool for young individuals and others employed in a lower tax bracket. By opting for the addition of a Roth IRA to your portfolio, you’re providing your investment the potential to grow exponentially over time with no taxes due upon withdrawal.

Create a Roth IRA for your retirement or the younger beneficiaries in your life to gain the opportunity to build wealth on after-tax dollars for tax-free withdrawals. You can learn more about how a Roth IRA can benefit your financial plan by reaching out to your adviser or contact Sanderson for a consultation.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®