Retirement has long been viewed as the brass ring for employees to reach for. After a long, productive career and responsible savings, you can relax, travel, and live life on your terms—that’s the premise. And for most employers, fulfilling that vision heavily relies on their workplace retirement plan.

Unfortunately, for a large number of today’s workers, the financial picture isn’t that simple. Planning for retirement doesn’t automatically equate being ready for it. As workplace studies are starting to reveal, this disconnect is having significant ramifications on both personal lives and business success.

A short history of employee-sponsored retirement plans.

To understand today’s state of retirement readiness, it’s helpful to understand the evolution of employer-sponsored retirement programs, as well as the distinction between defined benefit plans and defined contribution plans.

In 1875, The American Express Co. established a pension plan for its employees—the first private-sector retirement benefits program in the U.S. Pension programs are considered defined benefits plans, since the employer has control over contributions and investments, while each employee is promised a certain payout based on a pre-determined formula. With this model, employees have little direct control over their retirement savings. To increase the lifetime benefit of the plan, one could stay at the company longer, earn a higher salary, or live longer—but the employer controlled the contribution formula and the investments, and generally make all the contributions to fund the plan. It’s important to note that these early pension plans were intended to provide supplemental income during retirement—not necessarily replace the employee’s full wages.

The pension plan model grew slowly in the early 1900s, then more quickly following World War II. As the economy boomed and companies needed ways to attract talent, pension plans began to provide a greater percentage of an employee’s average pay. Through the 1970-1990s, nearly half of private-sector employees were covered by pension plans.

The landscape shifted when Congress passed the Revenue Act of 1978. This legislation paved the way for a new approach—the defined contribution plan. Section 401(k) gave employees more control over how much and where their retirement savings were invested, and provided tax incentives to both the employee and employer for contributions. The tax advantages were critical at this time because the percentage of Americans who paid federal income tax had increased from 6% in 1939 to 75% in 1945. However, more control for the employee came with more responsibility, and they were no longer guaranteed a predetermined return when they entered retirement.

One final piece of context is life expectancy. In 1935, Social Security was enacted with a full retirement age of 65. At that time, life expectancy was 60. Today, Social Security benefits are available at age 66 or 67 (dependent on birth year) and life expectancy is 78 years. Therefore, most Americans must plan to pay for additional retirement years even though there is less certainty in their employee benefits program.

Even with the introduction of direct contribution plans, pensions held steady in the 1970s into the 1990s. However, by the turn of the century, 401(k) and similar plans gained popularity, and now constitute the vast majority of employee retirement plans.

Ramifications of the shift.

While the defined benefits model wasn’t perfect, it did facilitate a more harmonious relationship between employers and employees. With a secure retirement benefit tied to their employer, workers had a sense that that company was taking care of their financial future, which encouraged loyalty and reduced turnover. Only a few generations ago, it wasn’t uncommon for an individual to work for the same company for their entire career.

With the transition to defined contribution plans, an employee has less incentive to stay at their company long-term. All it takes is some paperwork to pick up their 401(k) and move it to their next job without financial consequences. Perhaps this could help explain why according to the latest data from the Bureau of Labor Statistics (BLS), the median employee tenure today is a mere 4.1 years.

There’s also the issue of active participation with defined contributions plans. Despite having the ability to steer their retirement plan and make investment choices, few employees give much attention to the process once the contribution level is set. On the other side of the table, employers need only to stay within compliance and perhaps match contributions (if offered). This passive approach would be acceptable if the outcome was positive. Unfortunately, that’s not the case.

Employees are feeling financial strain.

Given the proliferation of defined contribution plans, how are employees feeling about their financial security these days? In a word: stressed.

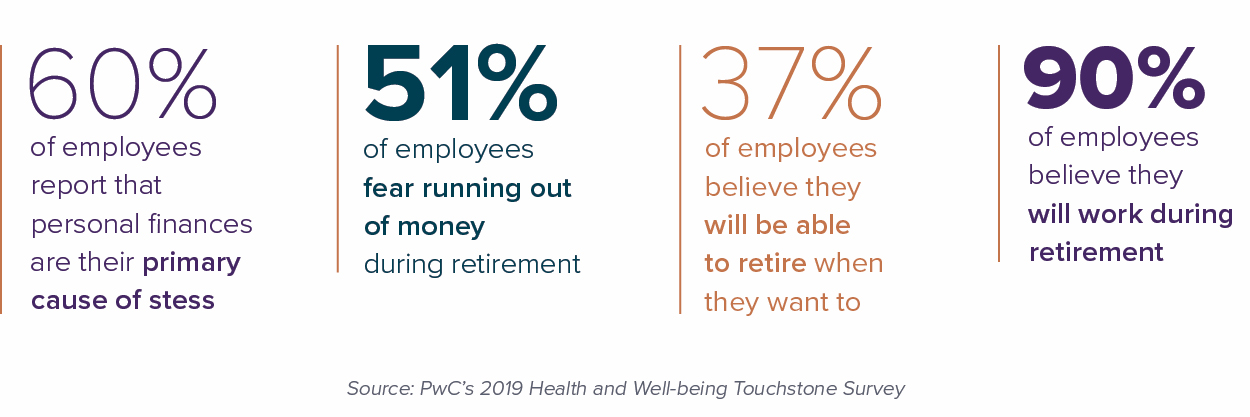

According to PwC’s 2019 Health and Well-being Touchstone Survey, personal finances are the top cause of stress for nearly 60% of employees. And it’s not just short-term money issues that are on their minds. Considering the following:

- Over half of employees are concerned about depleting their financial resources during retirement.

- Only about a third of employees believe they will be able to retire when they would like to

- A whopping 90% of employees believe they will have to work, in some capacity, during retirement.

All of this information was collected before COVID-19, so it’s reasonable to believe the stress level is even higher given today’s labor and economic climates.

The low confidence of retirement readiness isn’t necessarily due to a lack of effort by employees. By and large, employees are aware of the importance to save and invest for retirement. The PwC survey revealed that three-quarters of companies have at least 70% of employees participating in their retirement plans. And there’s evidence that employee contributions are increasing—from 7.1% of compensation in 2018 to 8.2% in 2018.

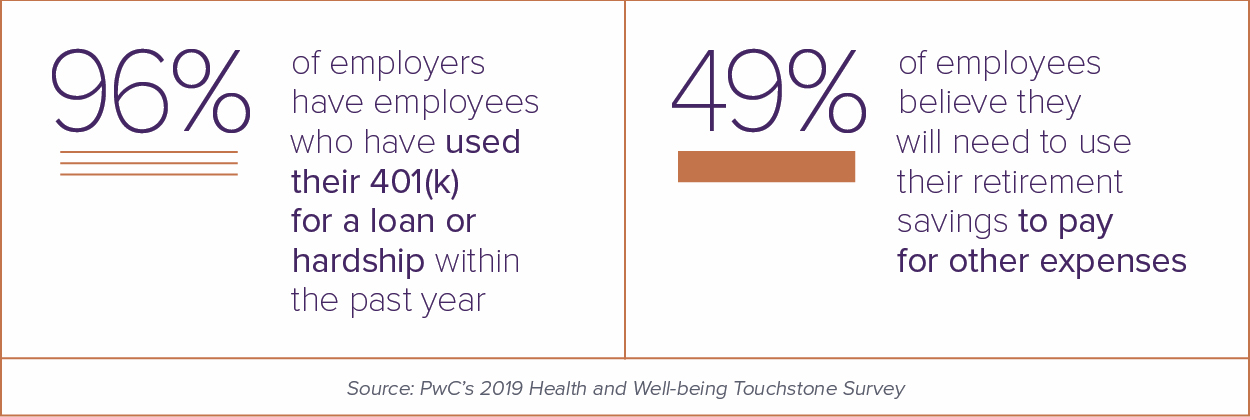

That leads us to the next question—if employees are active and contributing to their plans, why are expectations and morale so low? There are likely many factors, one of which may be the impact of short-term financial challenges on retirement planning. According to the PwC survey, nearly all (96%) of employers had employees who took a loan or hardship withdrawal from their 401(k) account within the previous year. Furthermore, nearly half (49%) of employees believe they will need to tap into their retirement savings early for expenses unrelated to retirement. Not only do these withdrawals set back the overall plan and reduce growth opportunities, but they can also come with hefty penalizes and taxes.

At Sanderson, we also believe that education and support—specifically the lack thereof—play roles in employees’ poor financial wellness. In this digital age, there’s no scarcity of financial “advice” across blogs, social media, and video platforms. Of course, without the ability to gauge the credibility of the source or quality of the data, this abundance of information amounts to noise for many individuals and families.

Employers are losing time and money.

The shift to defined contribution plans has helped employers reduce the financial liability of their benefits packages. However, as we’ve seen, the unintended consequences are putting additional financial and emotional burdens on employees. That said, what responsibility does (or should) an employer have in their retirement readiness of their employees?

The wellness of employees should be an area of focus for all businesses, and not just progressive or goodhearted employers who genuinely care about the welfare of their workforce. Simply put, unhealthy employees are bad for business. This person-centric philosophy has given rise to an array of workplace wellness programs. And as previously illustrated, personal finances are one of the biggest contributors to the overall mental health of employees.

It’s clear that simply providing a means in which to save for retirement does not assure retirement readiness. While 82% of employers believe that their current defined contribution plan provides an adequate framework for retirement planning, less than half believe that their employees will be ready to retire when they want (PwC survey). There is even more concern regarding younger generations, with 50% of employers with younger-than-average staff feeling that their employees do not understand how to manage their savings.

When employees are distracted by their personal finances, it can severely impact their work performance and the company’s bottom line. HR professionals indicate that managing stress and preventing burnout are the their people challenges. Poor mental health can lead to lower attendance, productivity, performance, morale, and motivation, as well as increased employee complaints, and increased ill-health, accidents, and incident reports.

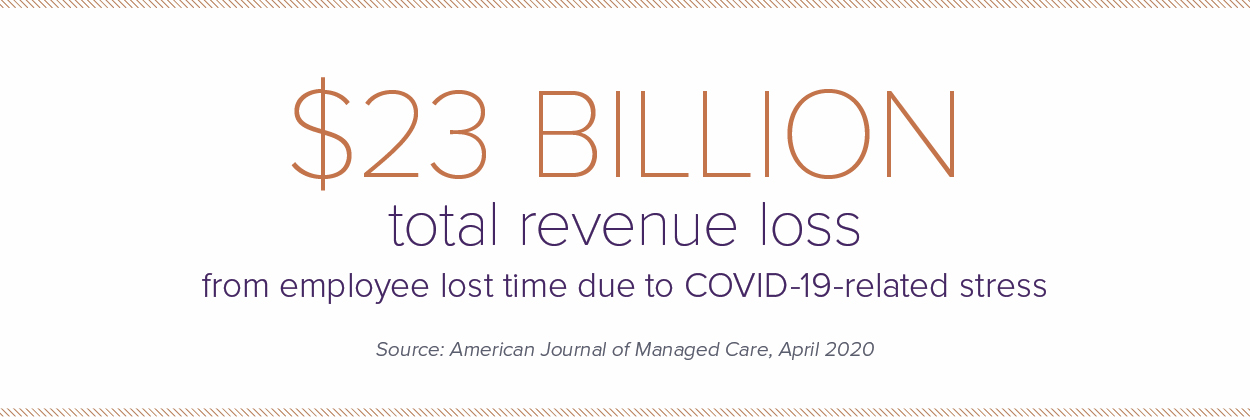

When you factor in the additional stress of COVID-19, the situation is even more pressing. According to a survey conducted by Ginger (a mental health provider) and published by Human Resources Executive, 69% of employees stated that the pandemic is the most stressful time of the careers. The survey also reported 62% of workers losing at least one hour a day in productivity due to COVID-19-related stress, with 32% losing more than two hours per day. The financial impact of this lost productivity is immense. In a study published by The American Journal of Managed Care in April 2020, lost employee time due to COVID-19 could cost employers over $23 billion.

How to turn the tide.

It’s not a bold stance to say that the current retirement plan model is not working. While we’re not advocating for the return pension plans, employers can provide their staff with a clearer path to retirement readiness while still taking advantage of the cost-savings of defined contributions plans.

By choosing an employer-sponsored program that provides individual guidance, financial tools, and educational support, companies can help alleviate the primary source of stress for employees, which in turn can improve productivity, loyalty, and recruitment efforts.

At Sanderson, we designed Prosper Financial Wellness to provide on-demand access to true fiduciary investment advice and representation, supporting confidence in their short- and long-term financial security. To find out if Prosper is a good fit for your company, contact us for a consultation.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®