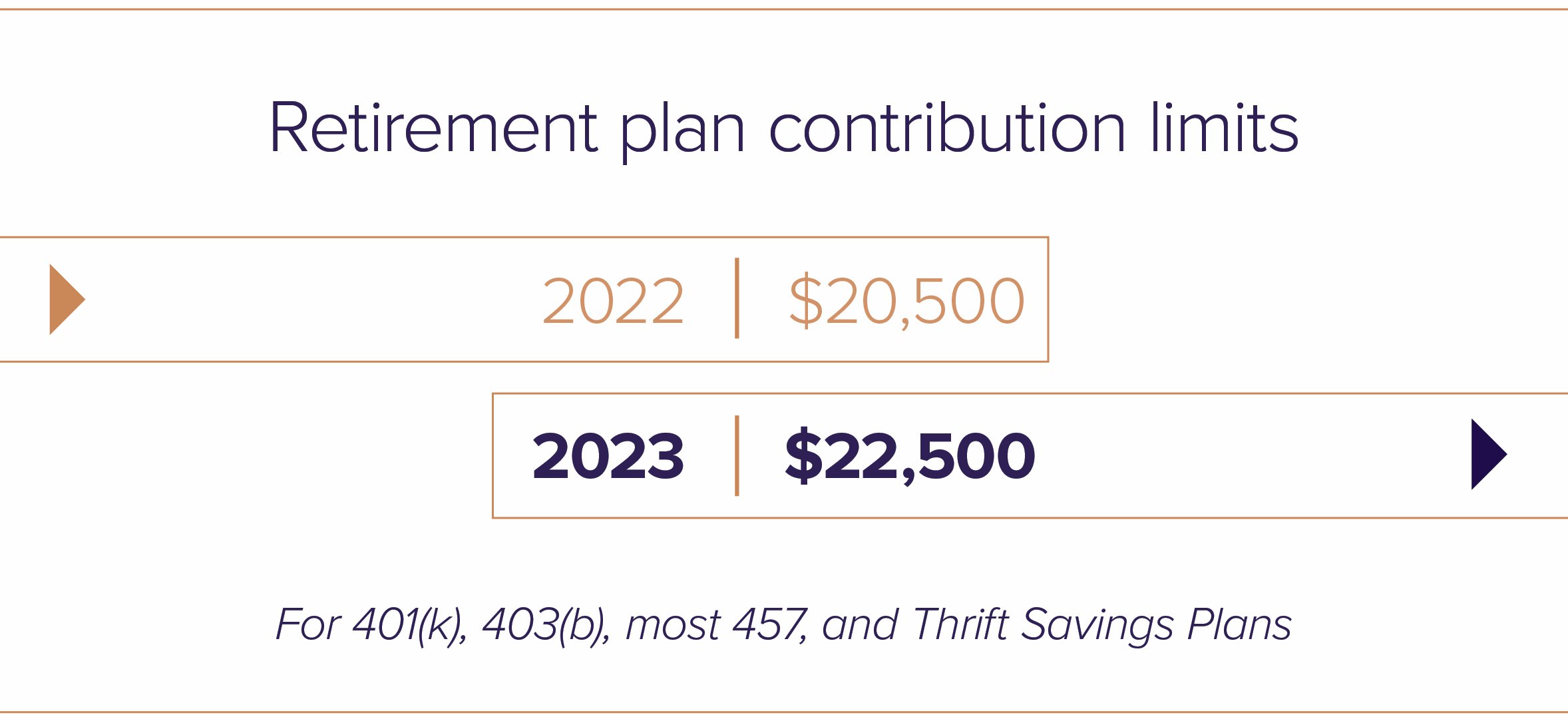

The Internal Revenue Service (IRS) announced it is raising the 2023 contribution limits for 401(k) plans from $20,500 to $22,500 due to the high pace of inflation. This unprecedented $2,000 increase allows workers to set aside more money for retirement next year.

The higher contribution limit also applies to other defined contribution plans including 403(b), most 457 plans, and the federal government’s Thrift Savings Plan in addition to after-tax deferrals as well as Roth 401(k) contributions.

While the increased contribution limits are the focal point of headlines, there are several other impactful changes clients should consider.

Catch-up contributions and total annual additions limits.

For people age 50 and older, catch-up contributions are raised from $6,500 in 2022 to $7,500 in 2023. Combined, this same demographic can contribute $30,000 in 2023, up from $27,000 in 2022.

The total annual additions limit (the maximum employee and employer contributions) has also increased by $5,000 to a total of $66,000 for 2023. In the age 50+ group, the 2023 annual additions limit is a whopping $73,500. Despite the increase, hitting this limit, after reaching the deferral limit plus employer matching, may still be possible using a “back-door Roth” strategy. Only possible under certain conditions, this high-level planning strategy rolls after-tax contributions into a personal Roth IRA to maximize individual retirement contributions.

IRAs get a bump too.

Additionally, the IRS is raising the Traditional IRA and Roth IRA limit by $500 to $6,500 for 2023. Keep in mind, for those aged 50 and older, catch-up contributions remain the same at $1,000. Combined, this age group can contribute $7,500 to an IRA. The “phase out” range qualifying an individual to deduct IRA contributions is also being raised for 2023. If a taxpayer or spouse is covered by a workplace retirement plan, such as a 401(k), and earns above a certain amount, they may be limited or prohibited from making IRA contributions.

Lastly, simple IRA contribution limits are raised from $14,000 in 2022 to $15,500 in 2023.

More changes on the horizon.

Congress is negotiating other potential changes to retirement provisions. The Secure Act 2.0, which overwhelmingly passed the House in a 414 to 5 vote on March 29, 2022, is still working its way through the Senate and may potentially pass by December 2022 (or will start over with the new Congress in 2023). These “Securing a Strong Retirement” provisions under discussion may include the following:- A 3% automatic employee deferral (employee can opt out)

- Increase in catch-up contribution to $10,000, requiring these contributions to be made as a Roth 401(k) contribution

- Electing employer matching to be either after-tax or Roth 401(k)

- Adding an employer-matching program to pay toward college loans

- Increase in the age for Required Mandatory Distributions from age 72 to 73 and gradually phasing to age 75

Additional future changes may include limits to private stock holdings in Roth accounts and forbiddance of “back-door Roth” strategies (as mentioned above). If the Secure Act 2.0 passes Congress, employer plans would likely be amended to include these new provisions automatically.

Cost of living adjustments for inflation.

High inflation will generate additional adjustments in 2023, impacting the following:- Increases to Social Security checks by 8.7%

- Medicare premiums

- IRS tax brackets

- Standard deductions

- Earned Income Tax credit brackets

- HSA contribution limits

- Many other cost of living adjustments (COLA) adjustments built into the Internal Revenue Code

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®