The tax rate on capital gains has been in the crosshairs of the Biden administration since the early days of the campaign trail. Connecting the current historically low tax rate with the widening wealth gap in America, the President has rallied support for his tax plan among congressional Democrats and many left-leaning Americans. As part of this plan, there is a concentrated push to increase the long-term capital gains rate for high earners. The size and scope of the increase being proposed by the Biden administration have left many high-net-worth taxpayers eager to understand potential planning moves.

The Biden capital gains tax proposal.

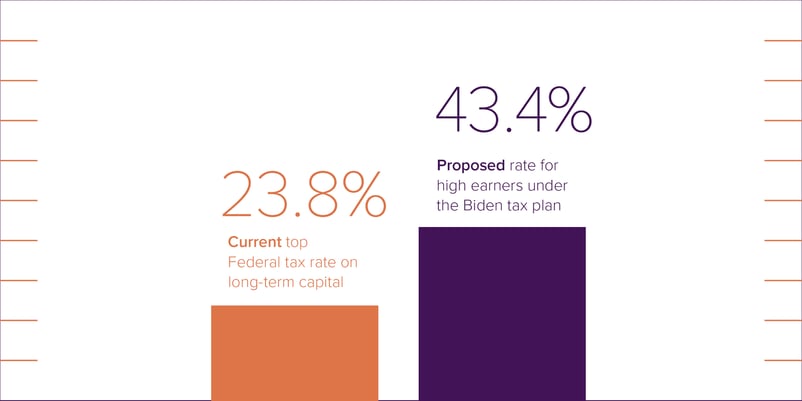

While the details still need to be negotiated, President Biden’s proposal generally increases the top Federal tax rate on long-term capital from 23.8% to 43.4% for high earners (a group yet to be defined, but likely taxpayers earning income over $1MM to as low as $400K). This near-doubling of the maximum rate does not consider state income taxes on capital gains, which can easily push the combined rate to well over 50% for high-net-worth taxpayers in high-tax jurisdictions such as New York and California. This extreme tax rate will impact decisions on whether to sell highly appreciated assets and will make investment reallocation decisions more complicated when considering the potential tax hurdles.

Another (and often ignored) impact of the increased rate on long-term capital gains is the tax rate’s connection to qualified dividends. While the receipt of dividend income is out of the control of many investors, its value measured by after-tax yield will be severely diminished by those taxpayers impacted by the Biden tax plan.

(Pre)planning for the rate increase.

A drastic increase in long-term capital gains rates is likely to draw ire and fear from many high and ultra-high-net-worth taxpayers. Definitive planning strategies will remain difficult to implement until legislation to enact the Biden tax plan takes shape.

At Sanderson Wealth Management, we caution our clients to be careful making any substantial planning moves until pertinent details are available. Many clients have inquired about selling assets and recognizing gains before any changes take effect. While this may be an effective strategy in some instances (especially if the need to raise capital is imminent), many other factors must be considered before essentially volunteering to pay taxes early. Additionally, taxpayers must keep in mind that new tax laws may only be as “permanent” as the next Congress or administration.

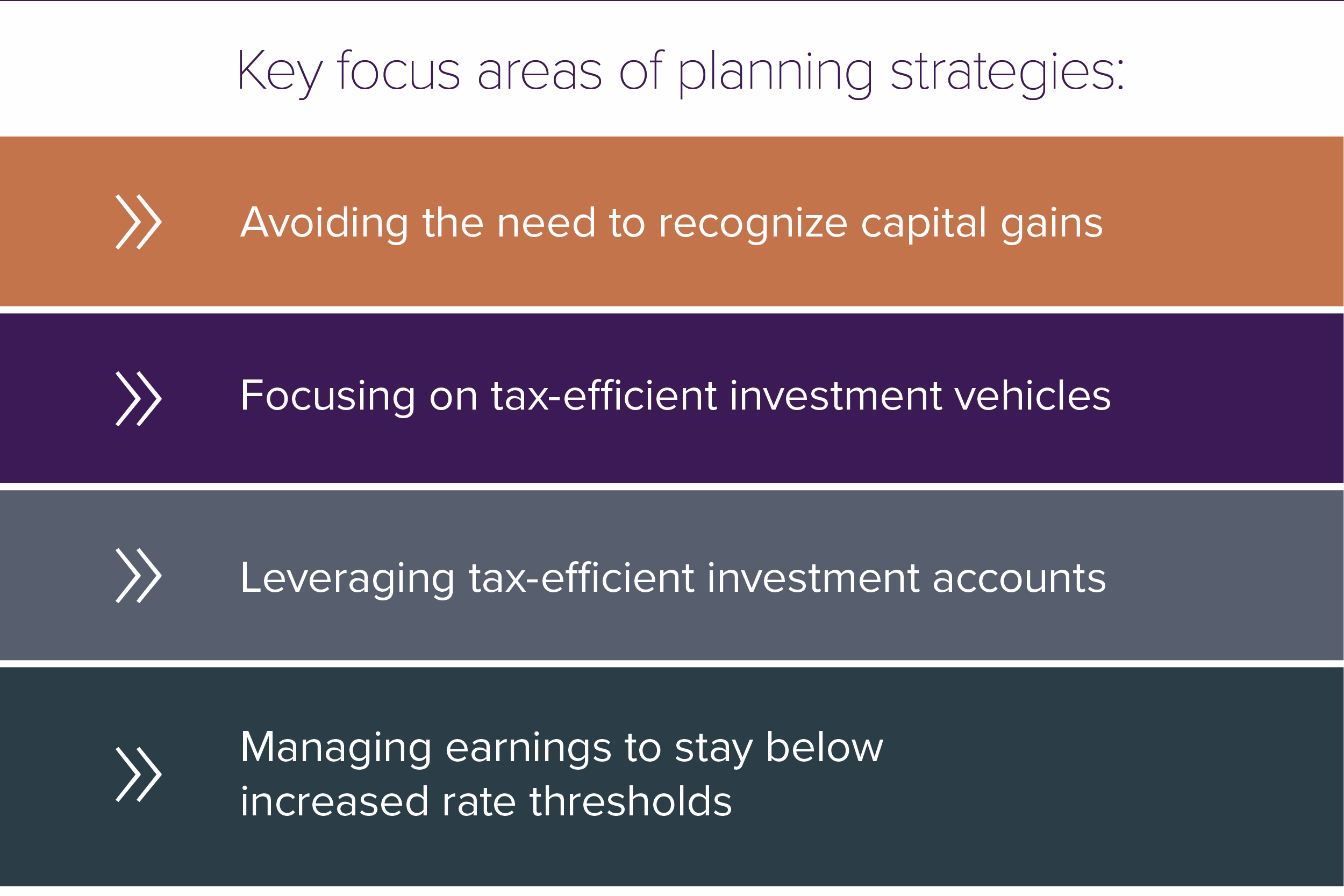

Sophisticated planning strategies to minimize the impact of the increased tax rates on long-term capital gains rates will undoubtedly emerge once the full extent of the new legislation is known. Many of these planning strategies will be focused on the following themes:

1. Avoiding the need to recognize capital gains

Eliminate the need to recognize capital gains that will be taxed at the highest rates until they can be recognized at lower rates.

- Reconsider dividend reinvestments

- Leverage security-backed loans and other borrowing opportunities

2. Focusing on tax-efficient investment vehicles

Minimize exposure to income that will be taxed at the highest rates or income that pushes you into the maximum marginal rates.

- The use of ETFs

- Understanding mutual fund turn-over ratios

- Monitoring and avoiding mutual fund distributions of capital gains

3. Leveraging tax-efficient investment accounts

Direct gain recognition and dividend income into investment accounts where taxation will be delayed (allowing for tax-deferred compounding) and possibly taxed at lower rates.

- Building Roth IRAs via conversions

- After-tax contributions to retirement accounts

- Insurance strategies

- Refocus on asset location strategies

4. Managing earnings to stay below increased rate thresholds

Defer income or accelerate expenses to stay under thresholds that could trigger the highest marginal tax rates.

- Deferred compensation planning

- Expense recognition

- Installment sales

The increasing need for coordinated wealth planning.

While the details remain elusive at this time, it is almost certain that high earners will see a substantial increase in the tax rate on their long-term capital gains and qualified dividends in the relative near future. Sophisticated tax planning around avoiding increased taxes will become an increasingly vital component of people achieving their financial goals and aspirations.

A renewed evaluation of the strategies discussed above and communication of quantifiable results should be a central focus for your relationship with your adviser. Additionally, “after-tax” investment returns should become a more important focus for clients, as inefficient investment advisors will place a dramatic drag on your overall wealth. Advisers who can provide “tax alpha” will become ever more in-demand. It is certainly time to “envision greater” from your investment adviser in this regard.

The Biden Tax Plan has also proposed a seismic shift in the treatment of appreciated assets at death, along with substantial increases in the application of the estate tax, as well as the transfer tax rates. These changes must be considered in close coordination with any planning strategy enacted by high- and ultra-high-net-worth taxpayers to avoid increased capital gains taxes.

At Sanderson, we view comprehensive wealth management as an essential component to our clients achieving their financial goals. Our highly integrated tax, wealth transfer, and financial planning services will provide even more value to our clients in the wake of the massive tax and estate planning on the horizon. Please do not hesitate to contact us if you would like to schedule a consultation on how we can help you and your family meet your financial goals.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®