Saving for a child's education is an essential part of financial planning for many families. With the ever-increasing costs of higher education, including tuition, fees, books, supplies, technology equipment, and room and board, starting a 529 College Savings Plan early—potentially from a child's birth—becomes a strategic decision.

This approach is particularly prudent for families with multiple children, as it allows for spreading the cost and savings over a more extended period. However, what happens if a child finishes their education with excess funds in their 529 account? The good news is there are various options for efficiently managing the funds, which we’ll explore in this article.

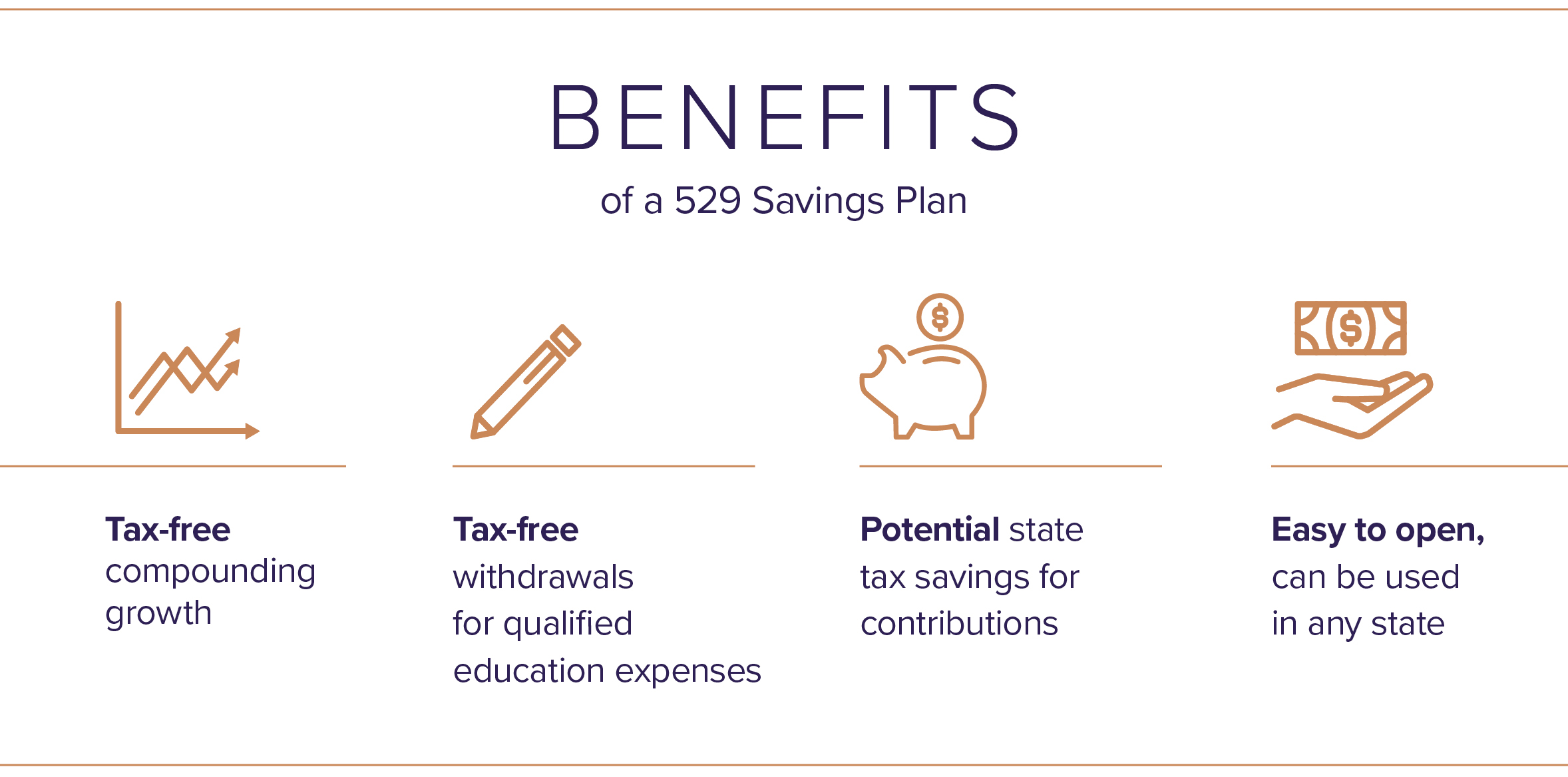

Benefits of 529 saving plan for education expenses.

There are many advantages of saving for college in 529 accounts, including tax-free compounding growth and tax-free withdrawals for qualifying educational expenses. 529 plans are typically offered by states but generally can pay for college tuition in any state.

While there is no federal deduction for making such college savings (they are instead deemed to provide federal gift tax incentives), many states provide tax savings for contributions. New York, for example, provides an income tax deduction for up to $5,000 single or $10,000 married filing jointly for contributions into New York plans for state taxpayers.

Finally, just about anybody can open a 529 account—parents, grandparents, other relatives or friends, or even yourself. The owner just needs to be a U.S. citizen or resident alien. The owner determines the amount of contributions, picks the investments, assigns a beneficiary (the future student), and determines how the money is used.

The overfunding dilemma.

529 contributions are often made years or decades in advance to pay for high-cost education expenses. However, the student may not need all the funds in their savings account. This can happen when the individual attends a lower-cost school, obtains scholarships, or does something completely different from attending college.

Given such limitations, there is an unforeseen potential for 529 plans to be overfunded—that is, the beneficiary (the student) completes their education, and funds still remain in the 529 plan.

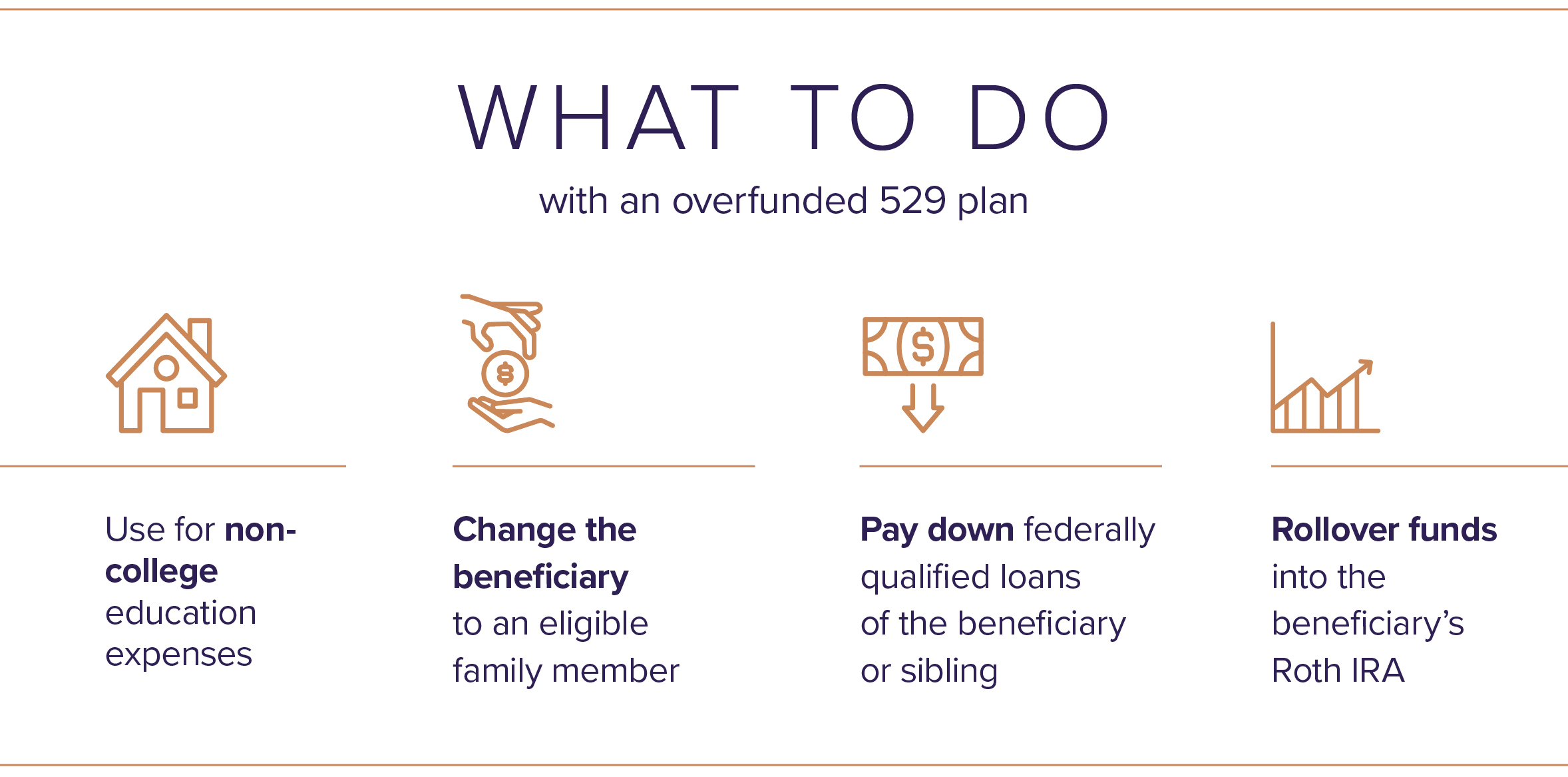

Fortunately, there are several options available. Two key planning points to consider while contemplating the options include:

- There is no age limit on when the money needs to be used.

- The owner can change the beneficiary to an eligible family member (spouse, child, grandchild, sibling, parent, nephew/niece, step- or in-laws—or the spouse of any such person) or transfer all or portions of the 529 plan to other 529 plans for eligible family members. Note: any such change or transfer between beneficiaries should consider the impact of federal gift tax rules.

The original intent of 529 plans was to provide a means to save for qualified post-secondary institutions, including two- or four-year colleges or universities, vocational or technical schools, or graduate schools in the United States or abroad. For federal purposes, to qualify for federal tax-free withdrawals on earnings, uses have been expanded to include:

- Tuition at an elementary or secondary public, private, or religious school (K-12 tuition) of up to $10,000 per year per beneficiary

- Expenses for fees, books, supplies, and equipment for registered apprenticeship programs

- Principal or interest payments of federally qualified education loans of the beneficiary or sibling of the beneficiary up to a $10,000 lifetime limit per individual (qualified education loan repayments)

Rolling a 529 into a Roth IRA.

The Secure 2.0 Act added a new option to the mix—a special rollover allowed from 529 plans into beneficiary Roth IRAs, effective on or after January 1, 2024. For federal purposes, this avoids the 10% penalty and avoids generating any federal taxable income.

To qualify:

- The 529 plan must have been maintained for the 15-year period ending on the date of the distribution. It is unclear whether this 15-year period restarts when there is a beneficiary change.

- The distribution cannot exceed the aggregate amount contributed to the program before the five-year period beginning on the date of distribution. Contributions that are not more than five years aged, along with any associated earnings, are ineligible for a tax-free rollover)

- The rollover must be done via a direct trustee-to-trustee transfer to the Roth IRA for the benefit of the designated beneficiary. In other words, not a check to the owner or beneficiary and then into the beneficiary’s Roth IRA, but a direct transfer of assets between custodians—and the beneficiary of the 529 must match the owner of the Roth IRA.

This can be an advantageous strategy for an overfunded 529 plan. However, there are limitations to keep in mind.

- Annual limitation: The exclusion only applies to the extent the distribution does not exceed the annual contribution limit for Roth IRAs, cannot exceed the earned income of the beneficiary in that tax year, and this amount is further reduced by any contributions made during the taxable year to all individual retirement plans maintained for the benefit of the designated beneficiary.

Note: The 2024 IRA Contribution Limit for Traditional IRAs and Roth IRAs combined is $7,000 for those under the age of 50. So, for example, if the beneficiary makes contributions of $2,000 to a Traditional IRA and $1,000 to a Roth IRA for that taxable year, then the 529 rollover to the Roth IRA would be limited to $4,000 remaining for that taxable year. Also, An IRA contribution made by April 2024 for the 2023 tax year counts as 2023, not 2024, for this calculation.

Also, a significant advantage is that 529 rollovers to Roth IRA are not subject to Roth IRA income limits (the single $146,000 to 161,000 phase-out and married filing joint $230,000 to $240,000 phase-out on Roth IRA contributions do not apply here. So, a higher income beneficiary can benefit from this rollover when they otherwise would not qualify.

- Aggregate Limitation: Lifetime limitation of $35,000 (per 529 beneficiary). Note: it would take five or more years of 529 Rollovers to the beneficiary’s Roth IRA to meet the aggregate limit, even if there were no new Roth or IRA contributions.

Other nuances to consider.

Earnings on non-qualified withdrawals may be subject to federal income taxes and a 10% federal penalty tax. Further, each of these expanded federally qualified purposes may not be deemed qualified for state purposes. They may cause state taxation on the earnings portion, recapture of previously taken 529 deductions, and penalties.

In New York, for example, K-12 tuition and education loan repayments are deemed non-qualified withdrawals and subject to recapture of any New York State tax benefits that may have accrued on contributions. It is believed that New York and other states would also deem 529 rollovers to Roth IRAs to be non-qualified withdrawals subject to state recapture and related state tax impacts.

There are limitations to each of these options for 529 plans. However, the lack of age limitations, along with the owner's ability to change the beneficiary's name or transfer balances (by making a gift) to other 529 plans within a broad list of eligible family members, allows the owner many planning opportunities. An unused or overfunded 529 plan for one child who finished their education can be transferred to another qualified family member, passed down to younger generations (grandkids or great-grandkids) to pay for their qualified educational costs, help pay down an education loan after college (if the loans do not get otherwise forgiven after 10 or 20 years of payments), or help fund the beneficiary’s Roth IRA.

Note that Roth IRAs further have the benefit of not being subject to Required Minimum Distributions, so they can be deferred for a lifetime or lifetimes when passed down. Roth IRAs are not subject to federal penalties for up to $10,000 for first-time home purchases, but beyond $10,000 in account earnings growth, the past contributions can also be taken out federal tax-free. Roth contributions (but not earnings) can be taken out without any federal tax consequences or penalties after a five-year holding period, so contributions can also be taken out simply as a backup emergency fund.

Put a strategy into action.

An overfunded 529 is often a good problem to have. Navigating the options can be complex, but the situation offers a unique opportunity to maximize your family's educational savings and financial strategy. If you have any questions about your 529 plan, we invite you to contact a Sanderson adviser to explore the best options for your unique financial situation and goals.

- Two primary advantages of 529 accounts are utilizing tax-free compounding growth and taking tax-free withdrawals for qualifying educational expenses.

- If a 529 plan is overfunded, the owner can change the beneficiary to an eligible family member or the funds can be used at a later date if applicable since there are no age limits on fund usage.

- The Secure 2.0 Act now permits a rollover from a 529 plan to a beneficiary Roth IRA to avoid the 10% penalty and federal taxable income for those who qualify.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®