November 2025 featured a brief “risk off” tone as investors reassessed enthusiasm around artificial intelligence, interest rates, and the recent government shutdown. Stocks were mixed while bonds gained ground as long term yields moved lower, and some of the year’s strongest areas – including growth stocks and cryptocurrencies – saw sharper pullbacks. With key government reports delayed or cancelled, there was no October Monthly Market Update, so this note serves as a catch up on recent developments.

Stock Market

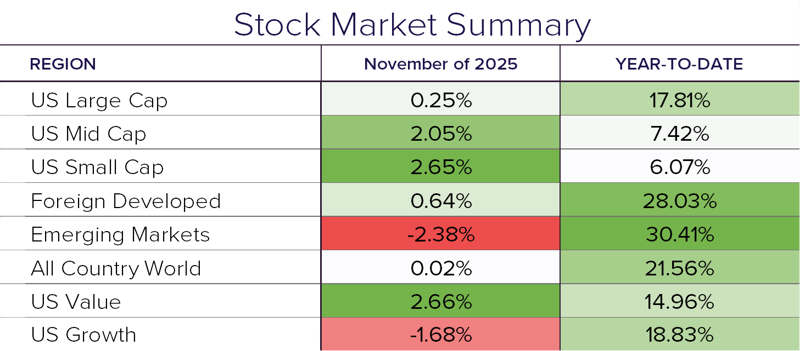

Global equities were nearly flat, but results differed by region, size, and style. In the U.S., large caps gained 0.3% for the month and are up 17.8% year-to-date. Mid caps rose 2.1% and small caps 2.7%, bringing their year-to-date gains to 7.4% and 6.1%. Value stocks were the standout, rising 2.7% in November and 15.0% year-to-date, while growth stocks declined 1.7% but remain ahead for the year with an 18.8% return, reflecting a modest shift away from the earlier narrow leadership of large growth and AI related names.

Outside the U.S., Foreign Developed stocks rose 0.6% in November and are up 28.0% year-to-date. Emerging markets fell 2.4% for the month but are still up 30.4% year-to-date, highlighting this year’s shifting regional leadership.

Bonds

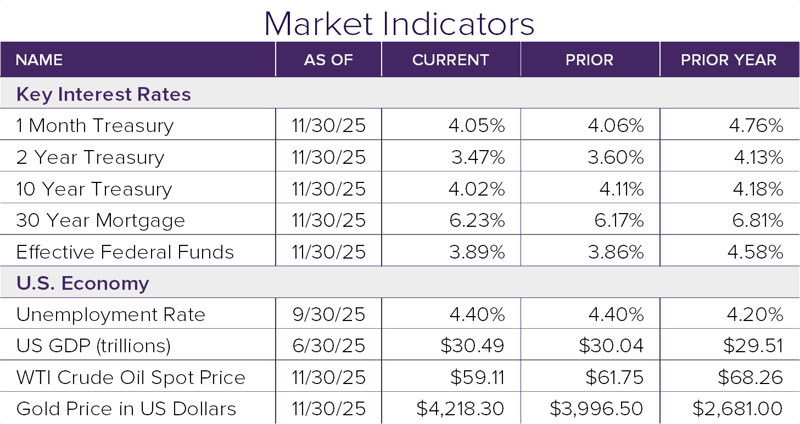

Bonds posted positive returns in November. The Bloomberg U.S. Aggregate Bond Index advanced 0.6% and is up 7.5% year to date, its best stretch since 2020, as the 10 year U.S. Treasury yield ended the month near 4.02% after briefly dipping below 4%. Note that the Bloomberg U.S Aggregate Bond Index reflects the entire U.S. Bond market which includes riskier and more volatile long term bonds dated up to 30 years which in themselves are having a very strong year to date performance.

Shutdown, Economic Data, and Sentiment

The 43-day government shutdown concluded with funding in place through January 2026 and had a direct impact on economic data. The delayed September jobs report showed payroll gains of 119,000 and an unemployment rate of 4.4%, the highest since 2021 but still low versus longer term history. A full October jobs report will not be published because the usual household and business surveys were not conducted, so some labor market information will only appear later in partial form.

These data gaps mean the Federal Reserve heads into its December meeting with an incomplete picture. Market based measures of interest rate expectations swung throughout November, underscoring how sensitive policy is to each new data point. Consumer sentiment also softened: the University of Michigan index fell from 53.6 to 50.3, reflecting concerns about jobs, prices, and household finances.

Overall, November combined a brief risk off episode with continued policy and data uncertainty. Despite those cross currents, global stocks and bonds remain notably positive for the year, and recent months have shown how quickly leadership can shift across regions, asset classes, and investment styles.

Disclosure

© 2025 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®