Stocks posted five straight weeks of gains in the month of November as the 10-year treasury yield retreated from the 5% mark. The 9.1% advance in the S&P 500 added to the streak of positive Novembers as now 11 out of the past 12 Novembers produced positive results. Economic data and a warning from retailers played into the narrative that the Federal Reserve’s rate hikes are impacting inflation.

Economy

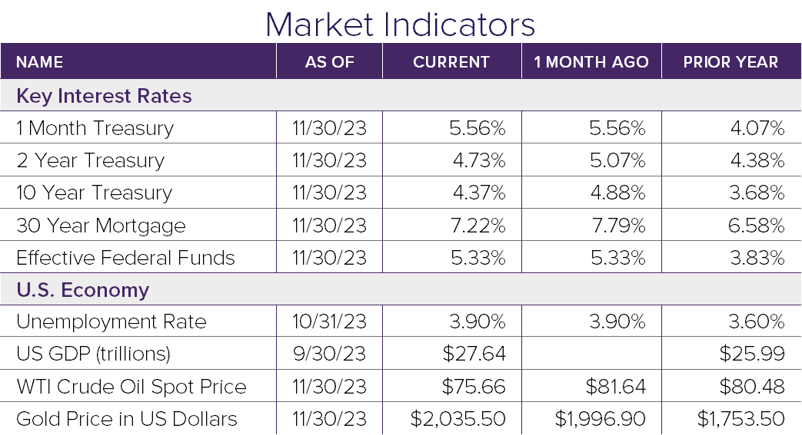

Prior to the start of the holiday shopping season, several retailers issued warnings that consumer spending trends are softening according to their data. This coupled with a soft jobs number and cooler-than-expected inflation numbers sent interest rates lower in dramatic fashion. The 10-year treasury rate peaked in late October at 5%, only to plummet to 4.37% at the end of November. This means that market participants are betting that the data is enough to prevent the Federal Reserve from raising rates any further. On December 1, Fed Chair, Jerome Powell, further hinted that tight monetary policy was slowing economic activity.

Markets

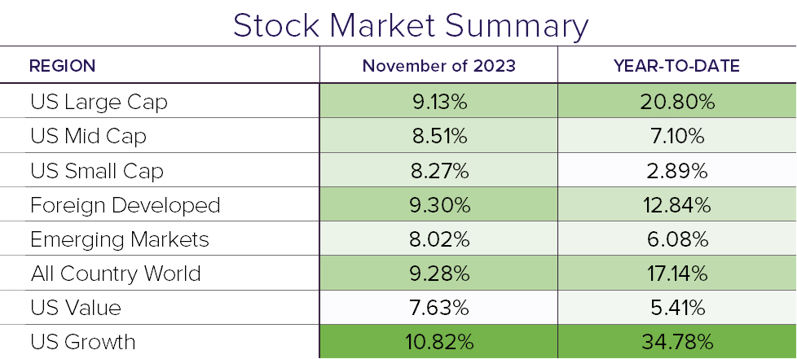

Major stock indices finished the month significantly higher with the S&P 500 rising 9.1%. US mid and small cap stocks followed suit, up 8.5% and 8.3%, respectively. Lower bond yields and decent earnings reports led growth stocks (up 10.8%) to outperform value stocks (up 7.6%.) Foreign developed and emerging markets also finished higher, up 9.3% and 8.0%, respectively.

Bond markets had a strong month, up 4.5%, as yields fell. Energy prices contracted from recent peaks with oil continuing to move lower thanks to increased supply from the US and OPEC ignoring production quotas. Natural gas prices slid 15% on estimates of lower demand.

Outlook

November certainly had investors giving thanks for the feast of gains from most major markets, including bonds. Data showing inflation is abating reinforced market sentiment that the Federal Reserve has finished raising rates. Consumer spending data will be an important statistic to monitor throughout the holiday season. If spending comes in weaker than expected, it could be viewed as a sign that the Fed may begin rate cuts sooner than expected. Despite market sentiment, the Federal Reserve continues to maintain it's "higher for longer" interest rate outlook.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®