Volatile Markets.

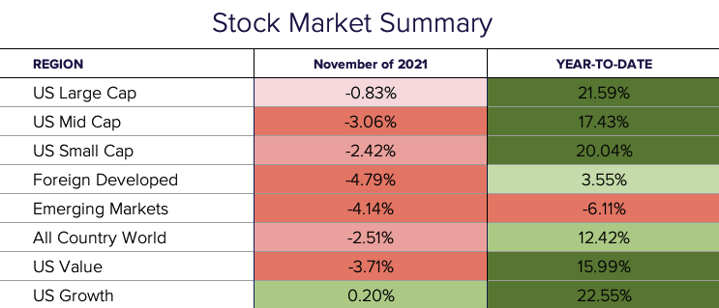

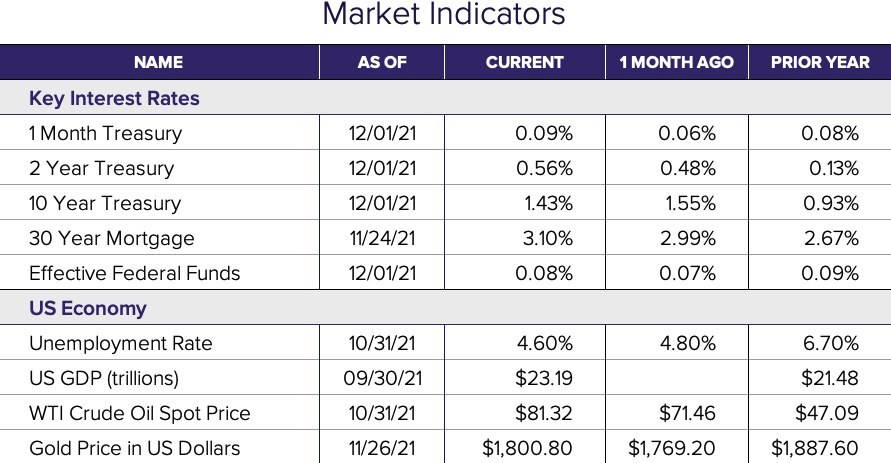

TVs and Apple Watches weren’t the only things that went on sale this month. Global equities finished the month 2.5% lower while the 10-year treasury fell .12% to 1.43%. Small-cap stocks had their worst month since March 2020, but the real doorbuster sale was in the commodity markets as the price of WTI Crude oil tumbled 20% during the month. The volatility was primarily driven by hawkish comments out of the Federal Reserve and the fear of the new COVID-19 variant, Omicron. The worst of the volatility was on Black Friday when we saw the S&P 500 tumble 2.3% and oil 13% in one day, marking the 9th worst day on record for oil.

The bond market saw another month of yield curve flattening referring to the narrowing gap between short-term and long-term rates. With the exception of September, this broad trend has been in place since March of this year. This is a result of investors’ worries over the potential for economic growth to slow due to the new COVID-19 variants as well as uncertainty over monetary policy. Historically, a flattening yield curve, and particularly an inverted one, has proven to be a signal that additional economic turmoil is looming. We continue to keep a close eye on the treasury yield curve.

The Fed.The current Federal Reserve Chair Jerome Powell was nominated for a second term in November. On the last day of the month, he put out a statement saying that not only should the term “transitory” be dropped when describing inflationary pressures, but that the Fed will be actively considering reducing their bond-buying program at a more rapid rate.

Closing thoughts.

The biggest thing the market doesn’t like is uncertainty and right now there is a whole new level of uncertainty, particularly around Omicron. We anticipate additional volatility in the short term as the market reacts to news of the first case in the US, the vaccine effectiveness against the variant, and the severity of symptoms. Fortunately, the market does love one thing: BTD, aka "buying the dip." Should data come out indicating it’s not as bad as the media is making it out to be, the Santa Claus rally may still come after all. Only time will tell, but maintaining a diversified portfolio with a prudent allocation to volatility-dampening strategies will no doubt prove to be a successful strategy for a long-term investor.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®