With the new year comes new changes, including ones to retirement accounts. After two years of no movement, the IRS has officially announced an increase in contribution limits for select retirement plans in 2022.

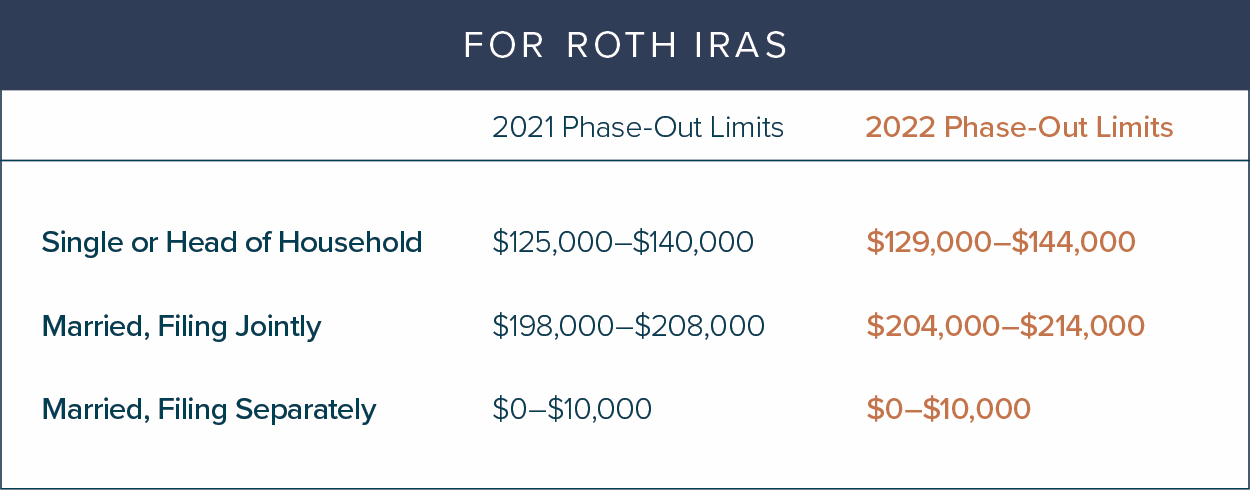

This new ruling applies to any 401(k) account, 403(b) account, most 457 accounts, and Thrift Savings Plans. Unfortunately, the IRS has confirmed that contribution limits to Individual Retirement Accounts, such as Traditional and Roth IRAs, will see no increase this coming year and remains at the 2021 levels. However, the phase-out limits for Traditional and Roth IRAs will increase in 2022.

Why is this happening?

Over time, the IRS adjusts contributions limits based on inflation. In the past year, we have experienced unusually high inflation rates. This will require many workers to save more today to afford the higher cost of goods and services during their retirement years. With only 8.5% of individuals maxing out their contribution limits per year, retirement insecurity will only become more of an issue if not taken care of early.

So, what's changing, and what's not?

One of the most significant changes for 2022 is the maximum contributions to your 401(k), 403(b), and most 457s will increase from $19,500 to $20,500 per year, with the catch-up contribution remaining at $6,500 for those who are 50 or older. Meaning, the IRS is granting you the ability to save even more in these tax-advantaged retirement accounts.

Another change in 2022 will be the increase in phase-out limits. Phase-out limit changes in 2022 are as follows:

The amount individuals are able to contribute to a SIMPLE retirement account is also increasing from $13,500 to $14,000 per year.

Individual Retirement Accounts (IRAs) will remain at the 2021 maximum contribution level in 2022 of $6,000, or $7,000 for individuals 50 or older using the standard catch-up provision provided.

Why is this important for you?

With inflation playing a major role in our future cost of goods, allocating assets today to save for future expenses is vital for retirement success. This $1,000 contribution limit increase will allow workers to combat retirement insecurity sooner rather than trying to play catch-up later.

An important reminder.

Many of us forget to update our beneficiary information in our retirement accounts. When increasing your contribution limits to the new maximum, don’t forget to review the beneficiary designations and see if any information needs to be adjusted.

Here to help.

As always, if you need assistance making sure your information is up-to-date or if you’d like to discuss any of these changes, please contact a Sanderson Wealth Management Financial Advisor.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®