May was a mixed month for the stock market as a whole, but the devil is in the details. Treasury yields spiked amid the debt ceiling debate. There are plenty signs of a slowing economy, but the labor market is proving resilient. These mixed signals make it difficult to determine the Fed’s next steps at their June meeting.

Seven Stocks

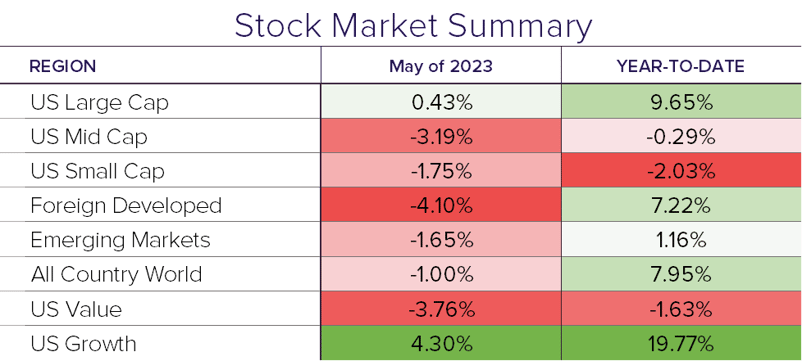

The S&P 500 rose 0.4% in the month of May. Otherwise, it was a down month around the rest of the world. Foreign Developed markets were down 4.1% and Emerging markets were down 1.7%. The real story of stock market performance lies within the top tech holdings of the S&P 500, the large cap stock index. There are seven stocks dominating the entire year-to-date return, predominantly driven by the market euphoria surrounding artificial intelligence, or A.I. technology. Stripping out these mega cap tech companies, the rest of the 493 companies are about flat for the year, roughly in alignment with the performance of mid cap stocks so far in 2023. The stock market seemed less concerned about the debt ceiling debates relative to the moves we saw in bond yields.

Treasury Yields

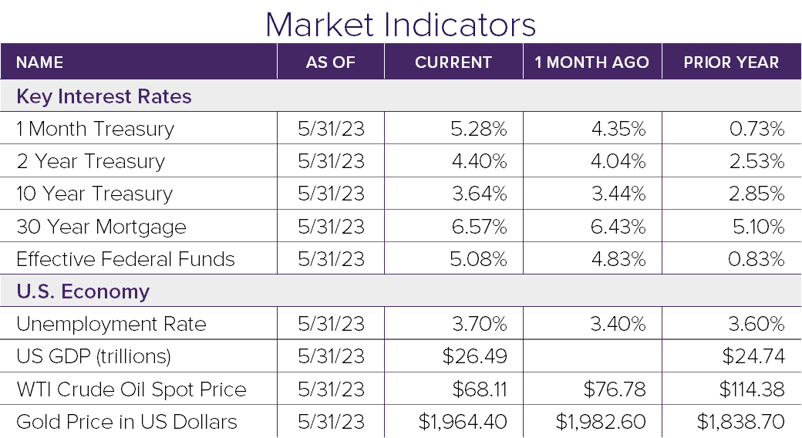

Bond prices fell during the month as yields rose on debt ceiling concerns. The 1-month rate spiked 0.93% to finish the month at 5.28%. The benefit to investors is that treasuries maturing up to a year out are now yielding over 5%. Longer maturities such as the 10-year also rose, but not to the degree of shorter-term rates. The 10-year rate is still the lowest point on the yield curve at 3.64%. This marks the 11th month in a row that the yield curve has been inverted.

Fortunately, a debt ceiling deal was struck in the final hours of May and approved on the first day of June by the Senate. Shortly after this good news, the market also saw an explosive employment growth number.

The Economy

Non-farm payrolls came in at 339,000 in May—well above the 190,000 estimate—showing a surprising sign of labor market strength. On the flipside, unemployment ticked up slightly to 3.7% from 3.4%. The headline payroll figure may make it more likely that the Fed could continue to raise rates, despite earlier this year appearing to be ready to pause. Inflation data comes out right before the Fed’s June meeting, so that will be a key figure to watch ahead of the meeting. Stay tuned.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®