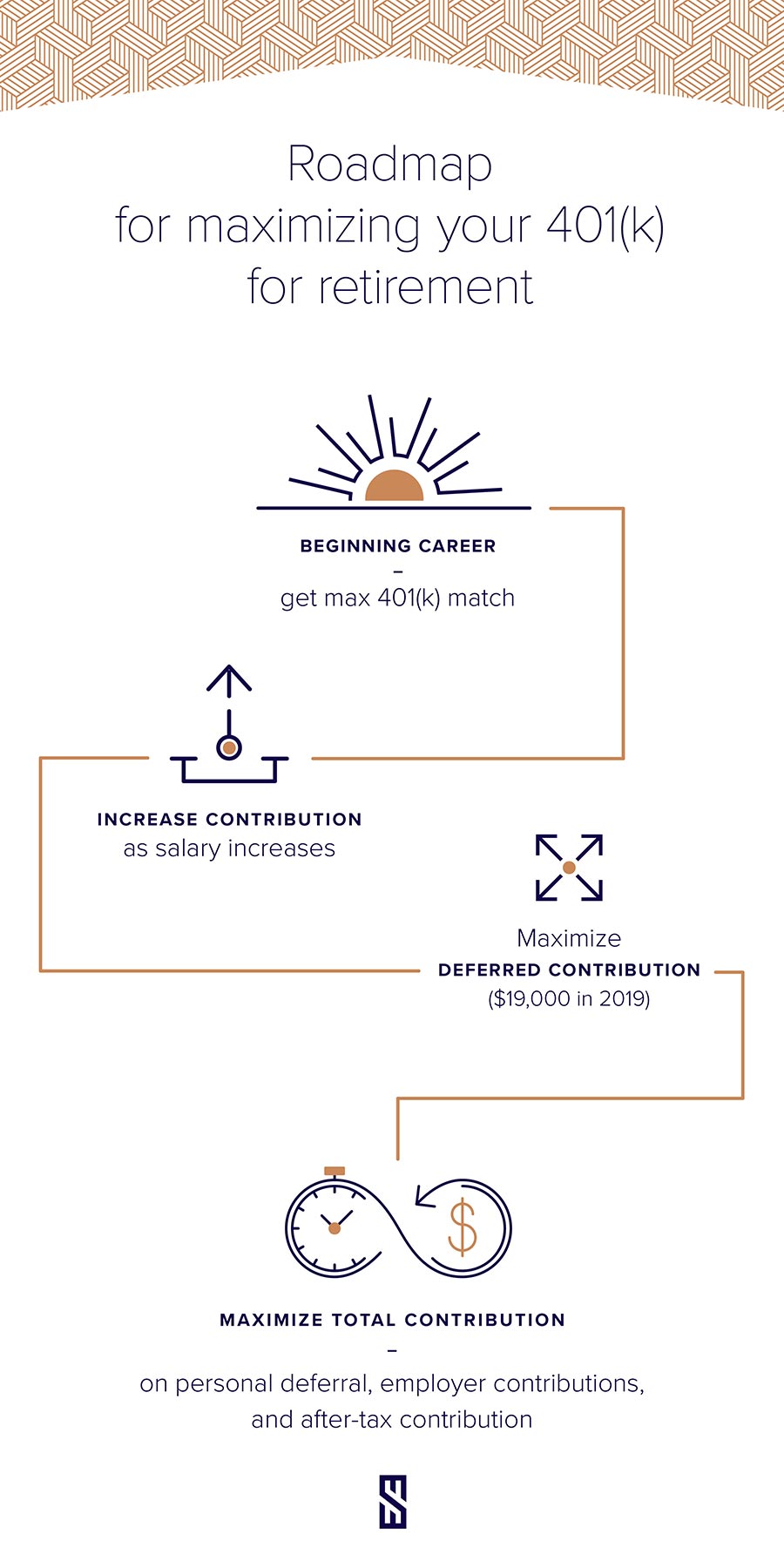

Whether you are just beginning in your career or approaching retirement, it’s important to take full advantage of the benefits that your 401(k) plan offers. These plans can be very simple but to maximize your savings potential, there are a few strategies that come into play at different points of your career.

Early in your career.

As a young professional, the first goal to accomplish in 401(k) savings is to take full advantage of an employer match program. Many employers will contribute a matching percentage of your own elective deferral, while others will make a contribution whether or not you participate. It’s important to review your employer’s summary plan description to see what their specific program offers, and to make the most of it.

Increasing your contributions.

As your salary increases during your career, it’s also important to increase your retirement savings. For those under age 50, you can contribute up to $19,500 in 2020. After age 50, you can contribute an additional $6,500.

One strategy that can be helpful in further building your retirement savings is to increase your deferral 1% each pay increase that you receive. This technique helps lessen the impact of the additional savings on your take-home pay, while still maximizing your deferral in the long run.

Benefits of after-tax contributions and Roth IRAs.

Once you have maxed out your deferral, more advanced strategies are available in the 401(k) plan wrapper. For those in higher tax brackets, certain hurdles present themselves in the path of saving in a tax-efficient manner.

Certain retirement plans allow for “after-tax” contributions. This additional feature, when offered, can be very powerful regardless of your tax bracket. The primary benefit of this strategy is to enable high earners, who are prohibited from making Roth IRA contributions due to income phase-outs under the IRS Code, to benefit from the tax advantages of Roth IRA investing (tax-free earnings and withdrawals).

The following bullet points highlight the facts and circumstances of this unique strategy.

- Income tax brackets and phase-outs present a huge roadblock for Roth IRA contributions outside of an employer plan

- For the Year 2020, the Roth IRA phase-outs are as follows:

- Single - $124,000 to $139,000

- Married filing Joint - $196,000 to $206,000

- For the Year 2020, the Roth IRA phase-outs are as follows:

- Where this strategy gains its strength is when “after-tax contributions” are allowed to be rolled out of the account and into a Roth IRA. By placing these funds in a Roth IRA, a long-term investor is able to lock in tax-free earnings and withdrawals on the account, to help fund their retirement.

- This chart displays the “bucket” for an investor to aim to save additional after-tax dollars within their employer plan.

| Under 50 | Over 50 | |

| 2020 max employee deferral | $19,500 | $19,500 |

| 2020 catch-up contribution | $0 | $6,500 |

| Total employee deferral | $19,500 | $26,000 |

| Potential for additional deferral | $37,500 | $37,500 |

| Max deferral allowed | $57,000 | $63,500 |

- High earners will want to fill up their max personal deferral first and then have the ability (per plan provisions) to contribute after-tax dollars up to the 415(c) limit – another $37,500. Please keep in mind that this figure would be reduced by any employer dollars that are put into the account.

- Having Roth IRA dollars as part of your retirement portfolio has many benefits. The tax-free withdrawal aspect of Roth IRAs can help an investor with income-smoothing and tax planning while in retirement. Also, the fact that there is currently no Required Minimum Distribution on Roth IRA accounts can benefit those over 70 that are not in need of current income.

Reaching your retirement goals.

With the percentage of workers who are covered by Defined Benefit Pension Plans dramatically reducing over the past decade, the 401(k) plan has become the dominant retirement planning tool for most workers. Maximizing what the 401(k) plan can potentially offer will truly allow you to envision a greater retirement.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®