In investing, sometimes the best action is inaction. When an investor is deep in panic mode, and the stomach acids are churning, often the best thing to do is resist the urge to make a reactionary change. Although selling one investment in favor of cash—or a competing investment that just happens to be doing well lately—may help an investor feel that they are taking control back from Mr. Market, those knee-jerk reactions are often harmful to your long-term financial health.

Remember, you are a smart investor with a plan and a long-term focus. You know that the best time to prepare for the sell-off is when times are good, and you did just that. So, what exactly did you do?

Since you prepared for the sell-off when times were good, your portfolio is ready to weather the storm now that times are bad. Yes, your portfolio balance will be down during the sell-off, but not nearly as much as those that did not take the above precautions.

Since you prepared for the sell-off when times were good, your portfolio is ready to weather the storm now that times are bad. Yes, your portfolio balance will be down during the sell-off, but not nearly as much as those that did not take the above precautions.

So, what comes next?

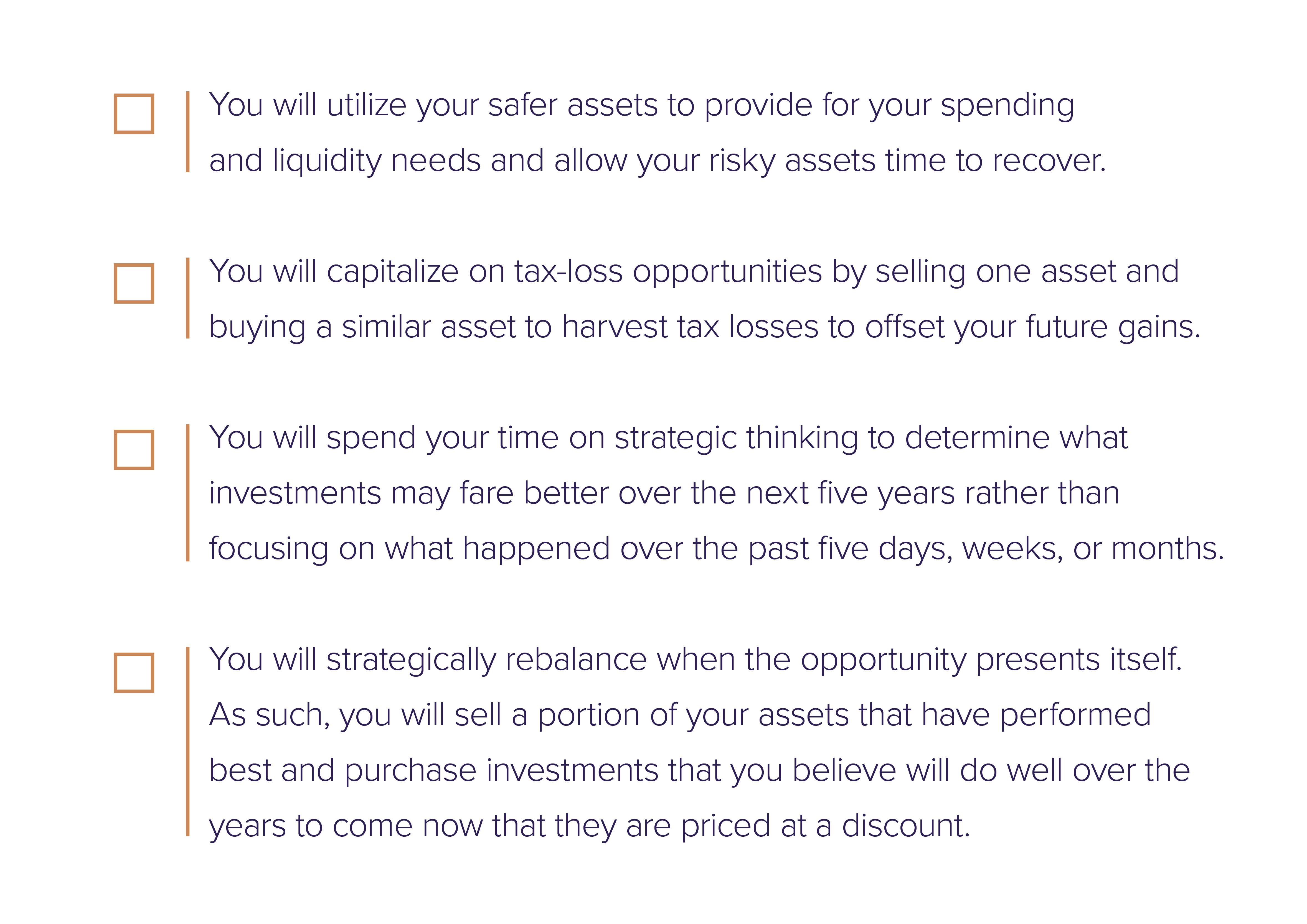

Now that the sell-off is underway, you can start to prepare for the recovery. You understand that it is important to position for the recovery when times are bad. Should the sell-off deepen, then: You may be thinking right now, “I am not sure I prepared when times were good, and I’m not certain how and when to position for the recovery.” Don’t worry, if you are working with a good adviser, they are thinking about and working on these tasks for you.

You may be thinking right now, “I am not sure I prepared when times were good, and I’m not certain how and when to position for the recovery.” Don’t worry, if you are working with a good adviser, they are thinking about and working on these tasks for you.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © May 2022 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®