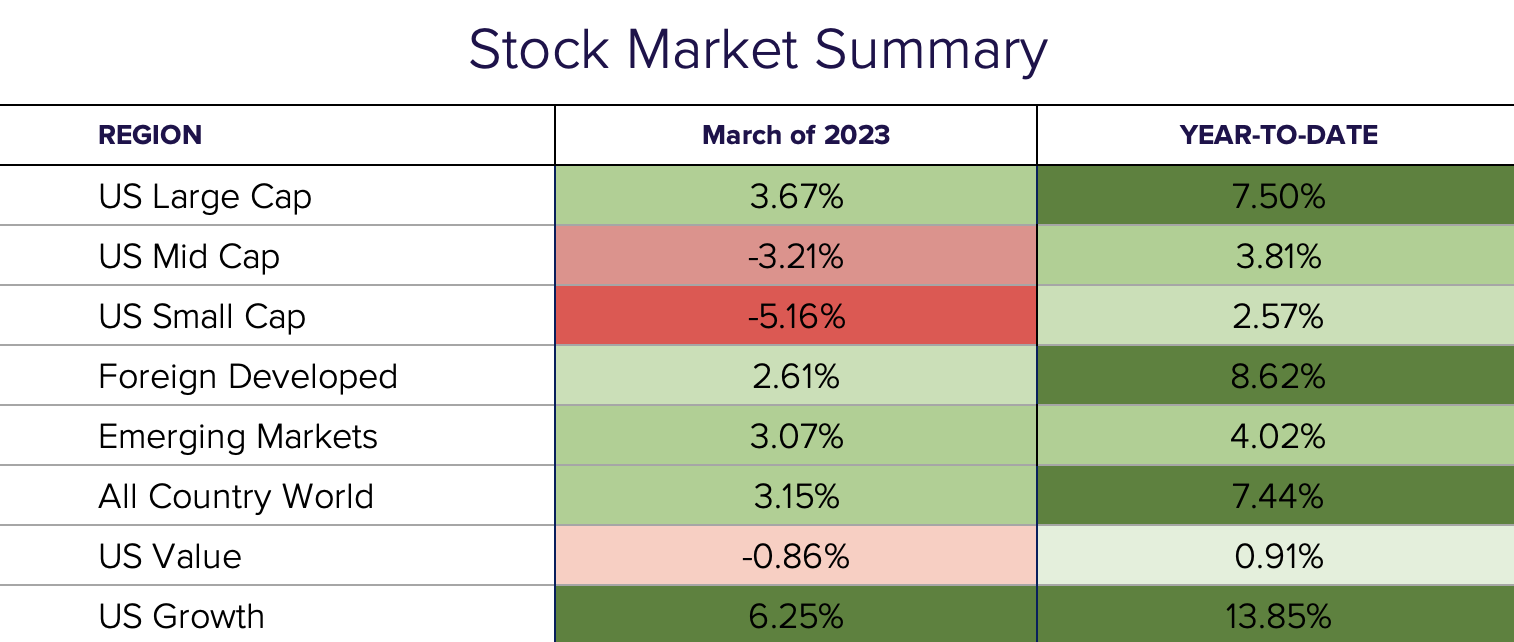

College basketball tournament brackets were not the only thing to go awry in March. The month began with the failure of two U.S. regional banks and a forced takeover of Credit Suisse, but markets mounted a comeback in the second half of the month. This comeback was largely attributed to the coordinated efforts of banking regulators and other large banks, as well as market participants’ take on future Fed decisions. March wrapped up a volatile but winning quarter as U.S. stocks finished up 3.7% for the month and 7.5% for the quarter.

The impact on rates.

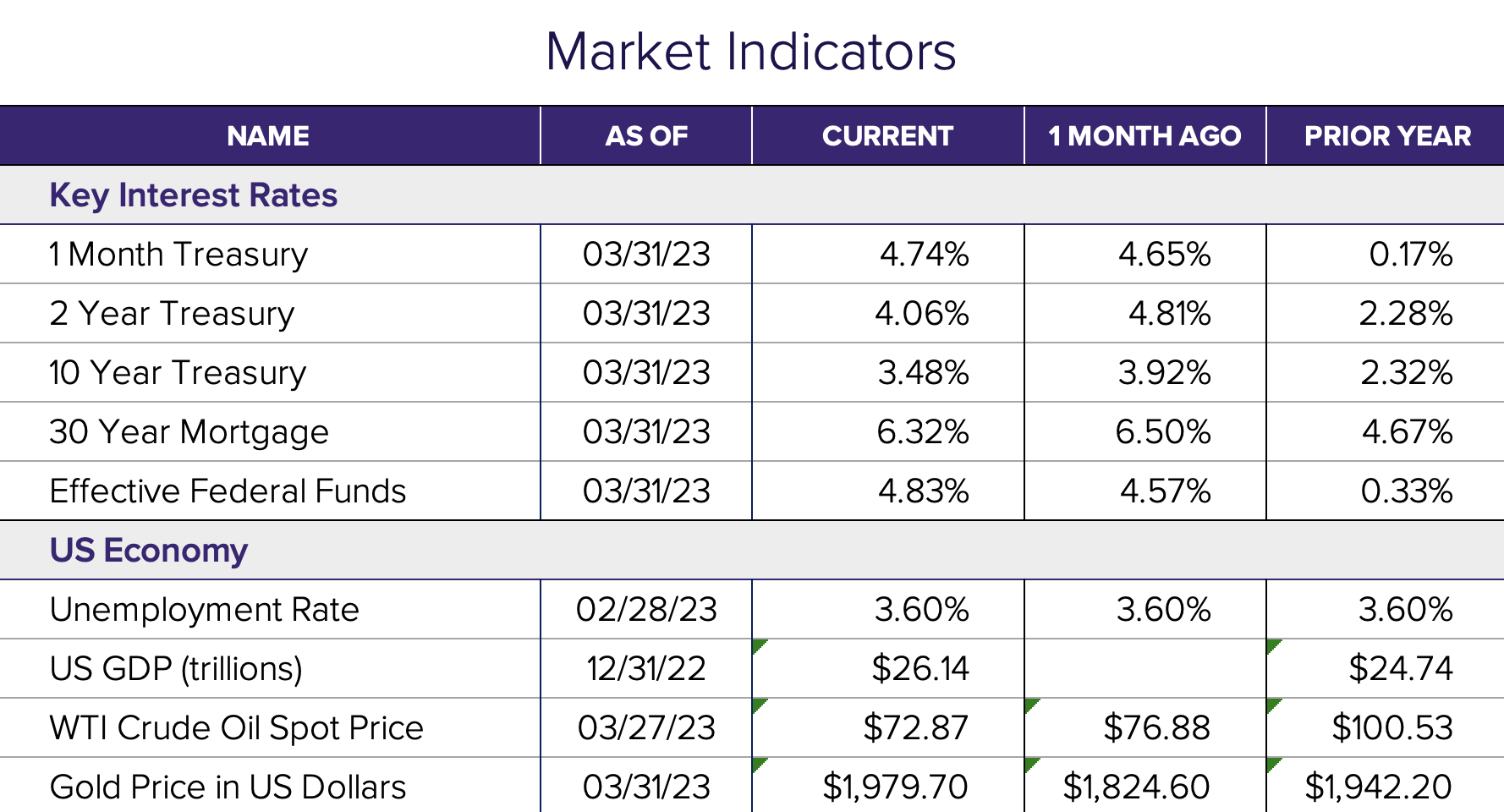

The failure of Silicon Valley Bank and Signature Bank was felt throughout the market. Most notable was the substantial drop in treasury yields as investors flocked to safe-haven government bonds. The yield on the 2-year treasury bond broke over 5% for the first time in early March before posting its largest 3-day drop since 1987!

A resilient economy.

Banking crisis aside, the economic data remains strong. Inflation continues to be elevated with month-over-month CPI coming in at +0.4%, bringing the year-over-year to 6%, much higher than the targeted 2%. The economy added 311,000 jobs, largely exceeding expectations. Meanwhile, the unemployment rate came slightly higher than expected at +3.6% versus expectations for +3.4%, primarily driven by a jump in the size of the labor force. The strong labor market and sticky inflation forced the Fed to continue to tighten monetary policy.

The FOMC raised another 0.25% to 4.75-5% for the Fed Funds rate during their March meeting, citing the ongoing battle with inflation as its primary focus. Federal Reserve chair Jerome Powell noted in his press conference that “financial conditions seem to have tightened” since the onset of the banking crisis, and included an updated outlook that forecasts just one more rate hike this year.

Stock market reaction.

Convinced that the Fed will not keep raising rates much longer, investors piled into mega-cap growth stocks at the expense of financial stocks. Growth finished the month up 6.25% while value was down 0.86%. Small and mid-cap stocks were more exposed to the regional banking sector, and dropped 5.16% and 3.21% respectively in March. Europe was dealing with a crisis of its own as Swiss regulators forced a Credit Suisse takeover by UBS to prevent further turmoil. Despite the headwinds, foreign-developed stocks were up 2.61% for March and up 8.62% for the quarter.

Outlook.

The stock market proved resilient in March, given all the uncertainty around the banking sector and tightening credit markets. If the recent moves by regulators have calmed markets, then perhaps economic fundamentals and corporate earnings will become the focus of financial markets once again.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®