The IRS recently released new guidance on the taxation of cryptocurrency, particularly the taxation of hard forks and airdrops. But first, what is cryptocurrency? Cryptocurrency is a virtual currency that functions as real currency but does not have any legal tender status by any government. It is held in a secure digital wallet. Two of the more popular cryptocurrencies are Bitcoin and Ethereum.

Beginning with the 2019 tax year, all taxpayers must answer a new question on Schedule 1 of Form 1040: “At any time during 2019 did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

Investing in cryptocurrency.

So, what are your tax obligations if you have invested in cryptocurrency? The IRS has previously stated that cryptocurrency is property – not currency – and should be treated as such. This means that taxpayers must track their cost basis and report any gains or losses from the sale or exchange of cryptocurrency on Schedule D. Your basis is determined by the price you pay, or if not purchased, then the fair market value of the property or services exchanged. Taxpayers must maintain sufficient records to support their transactions. Further, cryptocurrency transactions are subject to the 1099 reporting rules.

Cryptocurrency as business or personal income.

In the world of cryptocurrency, the term “miners” refers to taxpayers who use complex computer networks to validate transactions and maintain a public ledger of those transactions. They are usually paid for their services in cryptocurrency. If the taxpayer’s mining activities are a trade or business, rather than being performed as an employee, they file Schedule C with their tax returns. They recognize income as of the date of receipt and can deduct ordinary and necessary business expenses to offset their income. The net income is also subject to self-employment tax in addition to income tax.

Hard forks and airdrops.

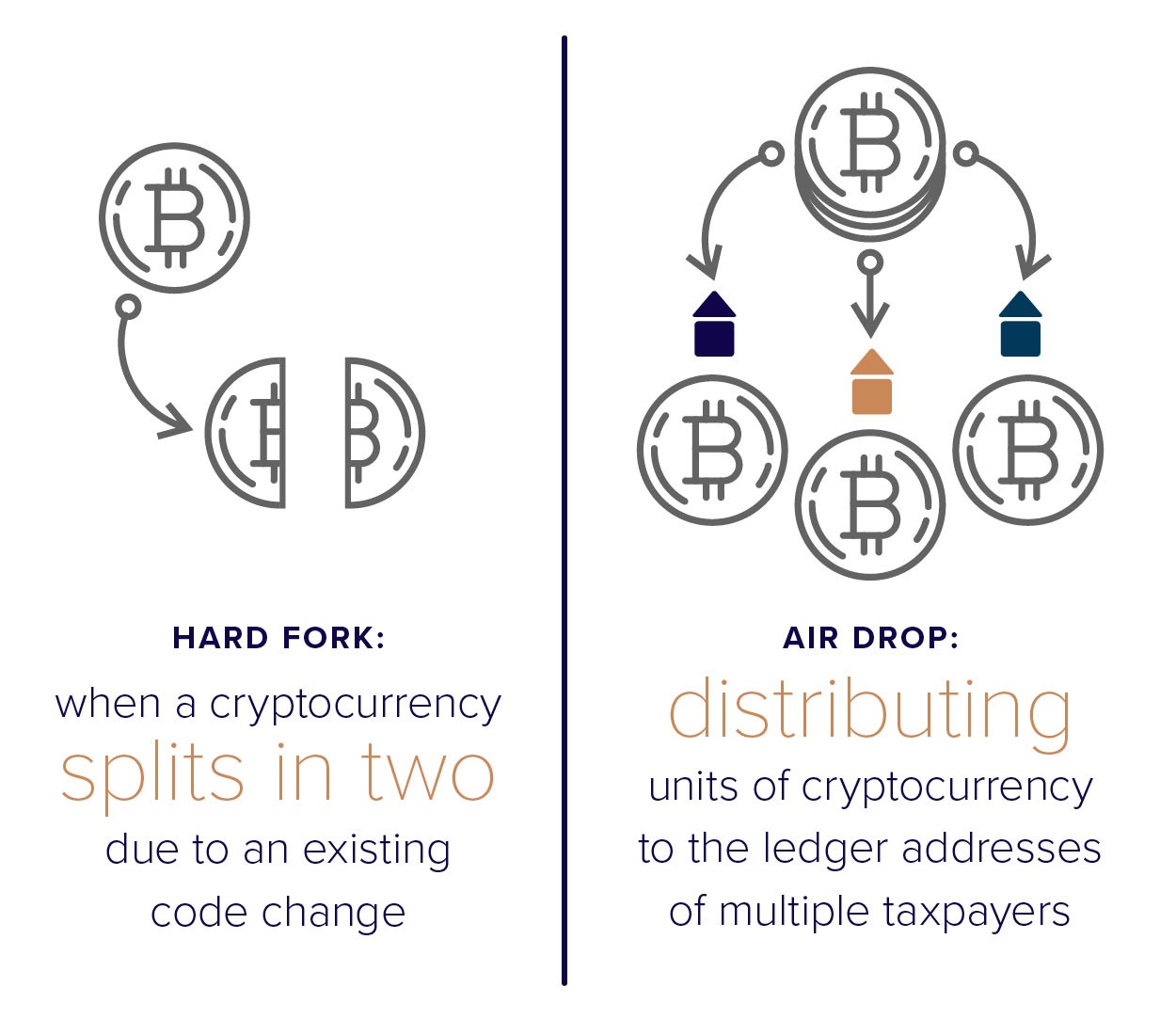

As mentioned earlier, the new IRS guidance addressed the taxability of hard forks and airdrops. A hard fork is when a cryptocurrency splits in two due to an existing code change. An airdrop is a means of distributing units of cryptocurrency to the ledger addresses of multiple taxpayers. An airdrop does not always follow a hard fork but when it does and the taxpayer receives the units of new cryptocurrency, then the taxpayer has ordinary income. However, a taxpayer does not have income as a result of the hard fork if they do not receive the units of new cryptocurrency.

Charitable donations with virtual currency.

The IRS added new FAQs to its website in January of 2020 which address the donation of virtual currency to charities. Again, the IRS is reinforcing the premise that virtual currency is property by stating that donations of it are noncash contributions and as such, donations valued at more than $5,000 should be acknowledged using Form 8283 (Noncash Charitable Contributions).

IRS increasing focus on crypto.

In addition to the new guidance, over the summer of 2019, the IRS sent 10,000 letters to taxpayers reminding them of their obligation to report their cryptocurrency transactions. The IRS received over 14,000 names and 8.9 million transactions from Coinbase, a digital currency exchange located in San Francisco, California.

The letters were one of three types: Letter 6174 and Letter 6174-A require no response. However, if you received Letter 6173, a response is required. In this case, the IRS received information leading them to believe that you have not filed the appropriate forms and it may be necessary to hire a tax attorney.

As new guidance is released on virtual currency, we will keep you updated. As always, if you have any questions, please do not hesitate to contact us.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®