This January, Tim Domino and I spent a week in Orlando at the 53rd Annual Heckerling Institute on Estate Planning, hosted by the University of Miami Law School. Throughout the conference we were able to hear from the foremost thought leaders in the industry, from Paul Lee and R. Hugh Magill of Northern Trust to Turney Berry. With topics ranging from the “big bang” of Qualified Small Business Stock (QSBS) following the Tax Cuts and Jobs Act to family governance spanning multigenerational families, we were able to gain insight into issues at the forefront of the wealth management industry. We came away with several bright ideas, as well as plenty of validation for strategies that we’ve been using with our clients since we began practicing. Here are a few of our favorite takeaways.

Business succession planning and QSBS.

As Paul Lee passionately emphasized during his presentation, the combination of the long-held preferential treatment of capital gains on the sale of QSBS, coupled with the reduction in corporate tax rate to 21% starting in 2018, has made this very interesting and nuanced area of planning for business owners a potential game changer.

Our big takeaway is that these strategies apply to many more business owners than we anticipated during our preparatory readings. Additionally, business owners may want to consider aligning new business opportunities, or even realigning their current structures, to better position themselves to capitalize on this tremendous planning opportunity in the future. We dive into more detail on this opportunity here.

Planning strategies after the TCJA.

Maximizing tax basis in assets to avoid income taxes on capital gains when they are sold continues to be a very hot topic. New life has been given to certain planning strategies after the TCJA, primarily as a result of the vast increase in the lifetime estate/gift tax exemptions to almost $23MM for married couples.

For example, the significant expansion of the exemption amount presents an interesting up-stream tax basis maximization strategy. In this strategy, a family trust is formed that benefits not only current and future generations, but also the oldest generations that may have some unused lifetime exclusion. Giving the up-stream generation certain forms of powers of appointment enables the assets within the trust to receive a step up in basis at the death of the older generation beneficiary. This benefits the surviving generations by reducing or eliminating the capital gains taxes when eventually selling the stepped up assets.

Evolution of estate planning for modern families.

Speaking of trusts—Hugh Magill gave a great comprehensive presentation on the evolution of estate planning and the scope of changing family structures. First, he’s found that the number of folks dying without wills is increasing for a variety of reasons, but largely because the evolution of the definition of who comprises a family makes it more and more difficult for people to address important planning questions. In our profession, it's important to help people see value in creating a will to help their successors fulfill their wishes, and save them time, headaches, and money.

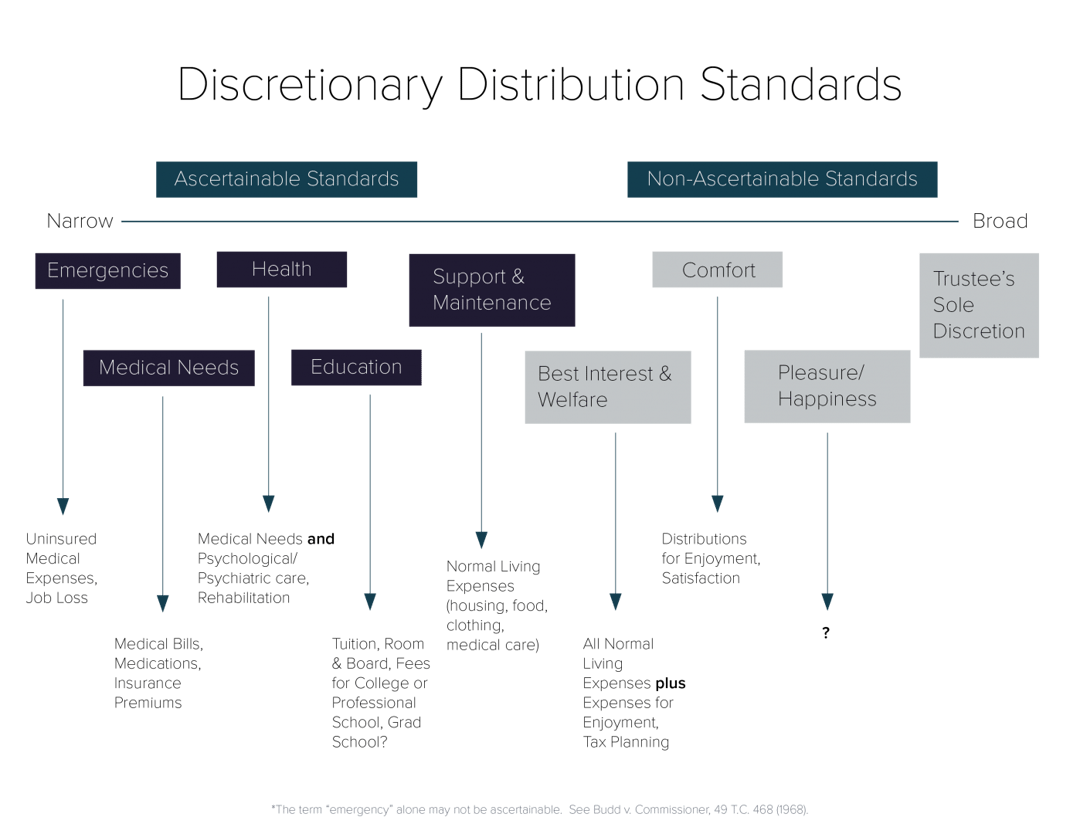

Hugh later focused on modern trust distribution provisions, and discussed the spectrum of spending provisions and the flexibility trustees have in making distribution decisions (see diagram below). The key takeaway here is that there are spending provisions that will fulfill any trust settlor’s wishes, and that trusts don’t have to become burdensome hurdles to accessing funds, nor do they need to force out money to beneficiaries that don’t wish to have them.

Clarifying purpose while planning.

Hugh was full of great actionable ideas, and he left us with one more. We spend a lot of time in the planning process creating documents and vehicles to help fulfill our clients’ goals and objectives for future generations. When we look back and are administering these trusts/estates, it’s often difficult to infer the donor’s/settlor’s/grantor’s purposes and wishes from the legalese contained in a trust document, particularly as planners focus on dynastic trusts that may live into perpetuity.

The takeaway is that future generations, advisors, attorneys, and courts will benefit from a direct purpose statement (in plain English) from the originator on the reasons why they set up the vehicle and what purpose the funds should have in the lives of the next generations. We’ll be placing emphasis on including this in more of our trust documents in the future.

Philanthropic and tax strategies.

We later heard from another great group of speakers on more specialized topics. We first spent some time in a panel about donor-advised funds (DAF), which we’ve been using more frequently since the change in tax laws ensued. The substantial increase in the standard deduction has led to fewer and fewer taxpayers itemizing their deductions. This may reduce, or even eliminate, the tax benefit taxpayers receive from their charitable contributions.

Donor-advised funds provide a vehicle to which taxpayers can make multiple years’ worth of contributions, and then send discreet payments over several years to their favorite qualified charitable organizations. This charitable bunching technique will enable taxpayers to still benefit from the charitable deduction in the year of contribution to the DAF and then maximize use of their standard deduction in other years. Another significant advantage is that unlike private foundations, DAFs are able to make non-binding pledges from their fund. DAFs may also be set up as the beneficiary to IRAs, so that complex giving instructions can be fulfilled by a designated individual after the decedent passes.

Improving family dynamics and accommodating values across generations.

During a session on family dynamics across generations, a common theme among the case studies was that the more dysfunctional wealthy families generally lacked a good platform for generations to openly discuss the things important to each distinct generation, as the values and concerns of each generation can differ greatly. The criticism came from both the older generations and younger generations.

Leveraging a solid platform and an open line of communication, families can shepherd the family wealth and legacy into the future more effectively. Studies have shown that when families meet formally and consistently to talk about financial and nonfinancial family governance issues, the dysfunction significantly drops. This is especially true when a professional facilitator is involved. Often times, the family meetings don’t focus entirely on the numbers, but rather on the qualitative factors that are equally important to families. We will be working on this topic more in the near future.

That wraps up our key takeaways from the event. It was incredible to be included in a group of specialists that live and breathe these topics in incredible detail on a daily basis. It felt like going back to graduate school and cramming a semester into 4.5 days of constant content, evening reading, and plenty of networking cocktails. We look forward to attending next year.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®