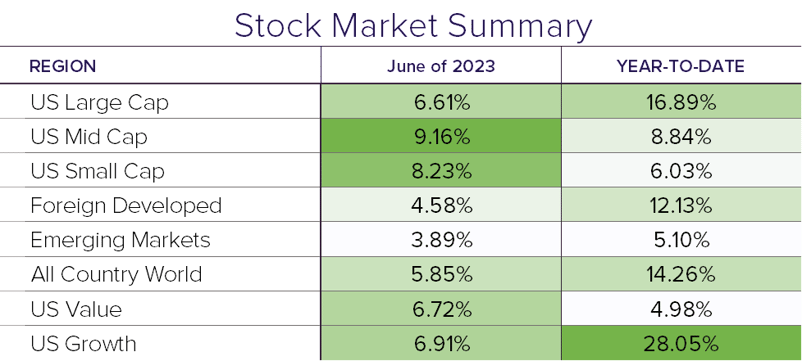

June proved to be a hot month for all major stock markets. Market optimism during the month was fueled by the Fed's decision to hold off on additional rate hikes and softer-than-expected inflation data. Thanks to continued strength from several mega-cap tech stocks like Apple, the S&P 500 finished the month 6.6% higher.

Here is where the S&P 500 stands halfway through the year:

• Positive performance in six of the last seven weeks of the quarter.

• Up 8.7% in the second quarter.

• Rose 16.9% in the first half of the year, marking the best first half since 2019.

Markets

Apple continued to dominate headlines in the final trading day of the month as it was the first company to ever close above a $3 trillion valuation. Despite the dominating comeback of tech stocks this year, the rally in June broadened. Every stock industry sector in the S&P posted positive returns for the month. Foreign and emerging market stocks were up 4.6% and 3.9%, respectively. Small and mid-sized domestic companies also performed well, up 8.2% and 9.2% in June. Despite the “risk on” nature of the stock market, the bond market continues to diverge in sentiment.

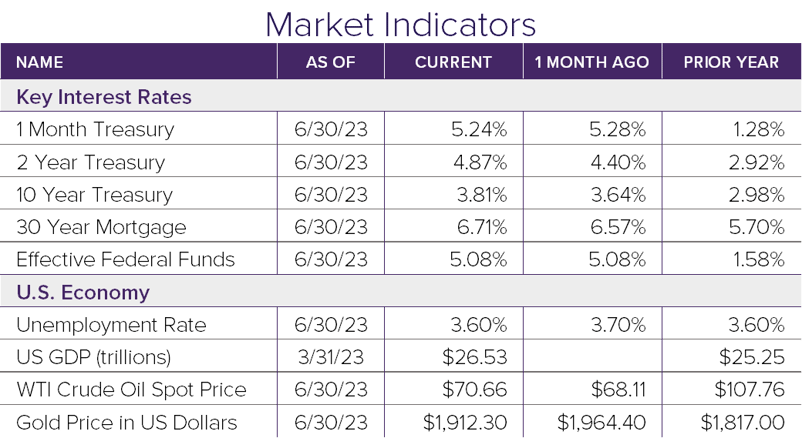

Fixed income yields continued to move higher even with the debt ceiling deal being reached on the first day of June. With rates moving higher, the bond market index finished the month slightly lower, down -0.36%. Treasury rates followed suit as the 10-year yield finished at 3.81%, up from 3.64%. Meanwhile, most short-term rates remain well above 5%. The continued inversion of these rates has the bond market signaling that a recession is looming.

Mixed Signals

With the bond market calling for a recession and the stock market shrugging off any concerns, the economic data is equally mixed. The Core PCE - the Fed’s preferred inflation gauge - came in under expectations, showing moderate inflation. The labor market continues to remain hot with unemployment at levels not seen in decades. The economy has slowed, but has avoided the widely anticipated recession.

The Fed’s decision to hold off in June ended a streak of ten consecutive rate hikes that quickly resulted in the Fed Funds Rate go from 0% to 5.00-5.25%. Even with the pause, Chair Powell hinted that two more rate hikes are in the cards, beginning in July. It seems the Fed may be equally baffled by the mixed signals in the economic data.

Looking Forward

Time will tell how this scenario plays out in the back half of the year. Worth noting, July has been the best month of the year for the S&P 500 with an average monthly gain of 2.4%, and positive returns since 2014. In the meantime, take a bite of the free lunch the market has offered with 5% yields in treasuries and money markets and enjoy the summer.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®