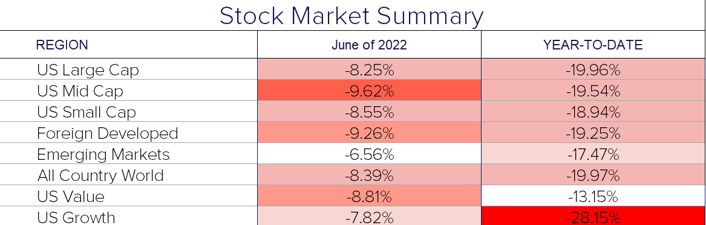

The June 30, 2022 stock market close marks the worst first half of a year for the stock market in over 50 years. A perfect storm of factors including surging inflation, rate hikes, the war in Ukraine, and COVID lockdowns in China have all contributed to the market decline, and fears of a global recession. And the drawdown has not been limited to stocks, but to all areas of the financial markets.

The S&P 500 was down 8.8% on the month and 20% on the year. The bond market was down 1.2% on the month and 10.4% on the year. The 10-year treasury rate climbed from 1.5% to 3%, and cryptocurrencies like Bitcoin have dropped over 50% this year. Commodities like crude oil have been one of the only markets to post positive returns on the year.

Inflation and the economy.

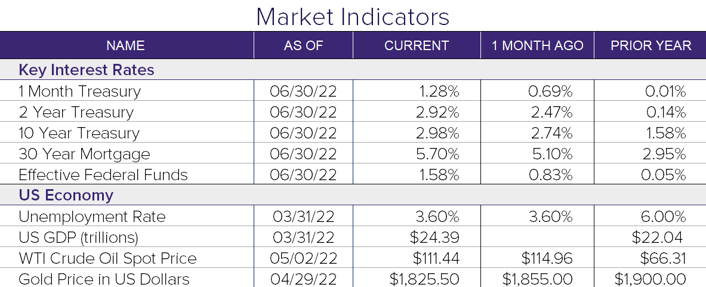

Heading into the back half of 2022, many investors are worried that the aggressive actions of the Federal Reserve to try and curb inflation could push the global economy into a downward spiral. At the June Fed meeting, they raised interest rates 0.75%, a move not seen since 1994. All indications point to another 0.75% hike at the July meeting as well. The dot plot—the Fed’s outlook for the path of rates—suggests a year-end level of around 3.4% for the Federal Funds Rate.

Increased borrowing and input costs are already being felt in the economy. 30-year mortgage rates are approaching 6%, nearly doubling in the past year. The housing market is showing signs of softening as existing home sales and housing starts fell in the past month.

A recession is typically defined as two consecutive quarters of negative real GDP growth. With Q1 already in the books (-1.6%), the Atlanta Fed’s GDP Now tracker is predicting real GDP growth in Q2 of -1%. The market seems to already be pricing in a recession, so time will tell if that prediction is accurate.

Outlook.

Third-quarter earnings season will begin shortly, and it will be important to keep an eye on trading activity and manager commentary. Any glimpse of good news could bring in buy-the-dip investors while continued revisions downward could induce additional volatility. All eyes and ears will continue to be tuned into economic data releases, earnings calls, and the Fed.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®