Heating up.

The end of June brought scorching temperatures and a close to a hot first half of the year for equity markets and the economy.

Highlights include:

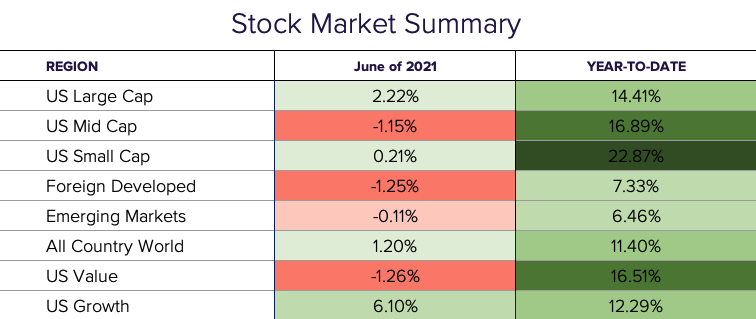

- The S&P 500 booked its fifth straight month of gains in June, bringing its total return for the first half of the year to 14.56%.

- For the month of June, large-cap stocks outpaced their smaller counterparts.

- Emerging markets ended the month in the green while foreign developed stocks finished lower.

- As a whole, global stocks returned 1.43%.

- The ongoing “reflation trade” trend, where value stocks show strength over growth stocks, took a pause this month as growth outpaced value by over 7%.

The blazing economic recovery showed no signs of cooling off in June as consumer confidence and spending jumped and unemployment continued to decline. We are also seeing a surge in summer travel and leisure after many restrictions were lifted, as nearly 60% of US adults who are now vaccinated blow off some steam built up over the past 15 months.

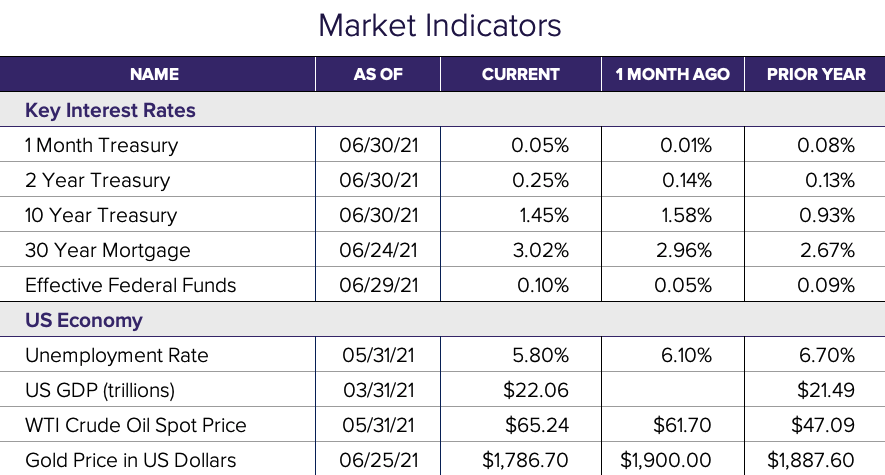

These rapid rises in demand for goods and services can lead to what economists refer to as inflation, where the imbalance of supply and demand leads to price increases. Despite its many other implications, inflation expectations are a key driver of the Federal Reserve’s decision as to when and how much to adjust its ultra-accommodative policies which have been the fuel behind the fire. All eyes have been and will continue to be on inflation and the Fed for any signs of change.

The yield curve modestly flattened as the short end of the curve jumped and the 10-year dropped to 1.47%.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®