July certainly did not disappoint. The S&P 500 closed higher for the fifth month in a row. The Dow Jones Industrial Average nearly tied a 126-year-old record for consecutive days of gains, with 13 straight this month. Falling inflation and resilient economic growth encouraged a broad market rally on hopes that the Fed is near the end of its tightening cycle.

Markets

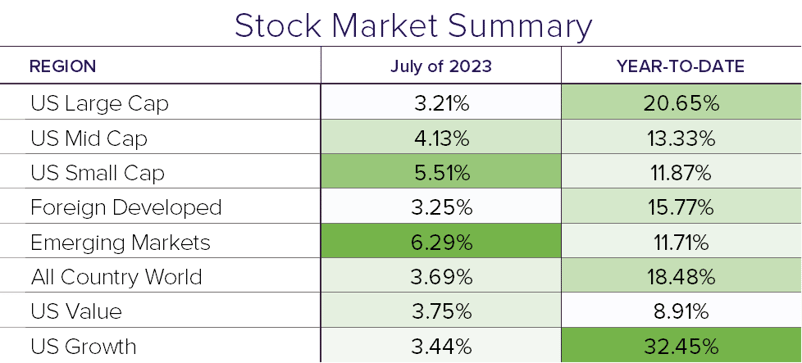

US stocks notched their longest monthly winning streak in two years. The S&P 500 closed 3.2% higher in the month of July, bringing the year-to-date return to 20.1%. Most of that return has been thanks to the Magnificent Seven (Microsoft, Telsa, Nvidia, Apple, Google, Facebook, and Amazon) particularly through the first five months of the year. Over the most recent two months, the market rally has begun to broaden out as the other 493 companies in the index start to catch steam. In fact, an equally weighted version of the index has been up 10.6% since the start of June, compared to the -0.6% return for the first five months of the year.

Elsewhere, we have seen additional strength across the global equity market. For July, mid and small cap stocks were up 4.1% and 5.5%, respectively. Foreign developed markets gained 3.2%, while emerging markets were the standout this month, posting gains of 6.3%.

Economy

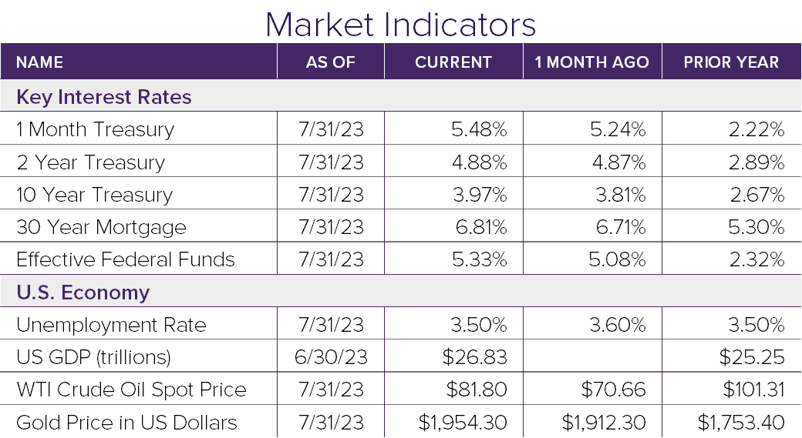

The broadening strength of the market comes as recent economic data suggests the Fed may avoid pushing the US into a recession. In July, the Federal Reserve raised rates another 0.25% to push the Fed Funds target rate to 5.25-5.50%—its highest level in 22 years. The data indicates that the rate hikes are beginning to take effect as inflation (CPI) came in below 3% for the first time in over two years. Core inflation (excluding food and energy) was below 5% for the first time since November 2021. This inflation data came in alongside the GDP report, which showed that the economy grew at a rate of 2.4% year-over-year, beating economists’ forecasts of 1.8%.

Wrap Up

If these trends of slowing inflation and steady growth continue, then the market’s hopes will be validated. If more data comes in suggesting otherwise, then we could see the Fed continue on its path, likely leading to a spike in volatility.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®