Macro matters.

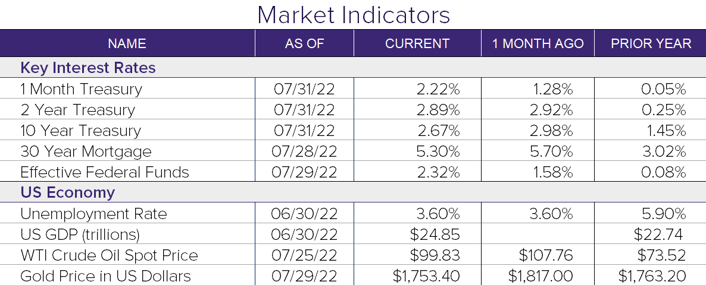

We now have two consecutive quarters of negative GDP growth after Q2 GDP came in at -0.9%, the historical definition of a recession. Whether the eight economists at the National Bureau of Economic Research (NBER) Business Cycle Dating Committee officially coin it a recession or not is less clear. Despite the weakness in GDP growth, the strong labor market is bucking the typical recessionary trend evidenced by 3.6% unemployment and 375K jobs/month payroll growth in Q2. Economists will keep a close watch on the labor market to assess the effectiveness of the Fed rate hikes on the inflation front. Any weakness in initial jobless claims will act as proof that the Fed’s action are a necessary sacrifice to labor demand, a key factor for making progress to get inflation under control.

Market pivot.

During the July FOMC meeting, Jerome Powell indicated that the Fed’s future rate decisions will be taken “meeting by meeting.” The market’s interpretation seemed to be that they may slow the pace of hikes in the back half of 2022 and may be forced to eventually reverse course. This is based on the further inversion of the treasury curve, a closely watched recessionary signal, and the subsequent stock market rally that ensued.

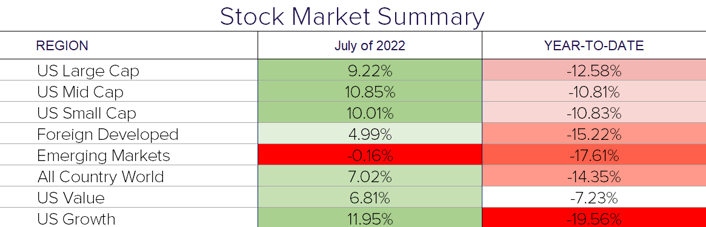

The +9.2% July 2022 advance in the S&P 500 marks the best month since November of 2020 for the large-cap stock index. Small and mid-cap stocks followed suit, up over 10% on the month. Several factors such as the ongoing war, US dollar strength, and China’s troubles weighed on the performance of foreign and emerging market stocks which were up +5.0% and down -0.2%, respectively. Growth stocks mounted a comeback against value stocks this month, and tech stocks rallied off the lows thanks to the potential for a Fed pivot.

Earnings season has been mixed, but generally better than the anticipated disaster scenario that was priced in June. Fears quickly eased thanks to a few large tech companies that have reported strong results. Future earnings estimates have been revised slightly lower, but it remains a wait-and-see environment.

Final thoughts.

The “bad news is good news” market rally has been a welcome change in the short term. The longer-term challenges of a slowing economy and stubbornly high inflation still lie ahead. A lot will have to go right before the Fed can declare victory. For now, the focus will be on the key economic data related to the labor market.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®