Stocks higher... sound familiar?

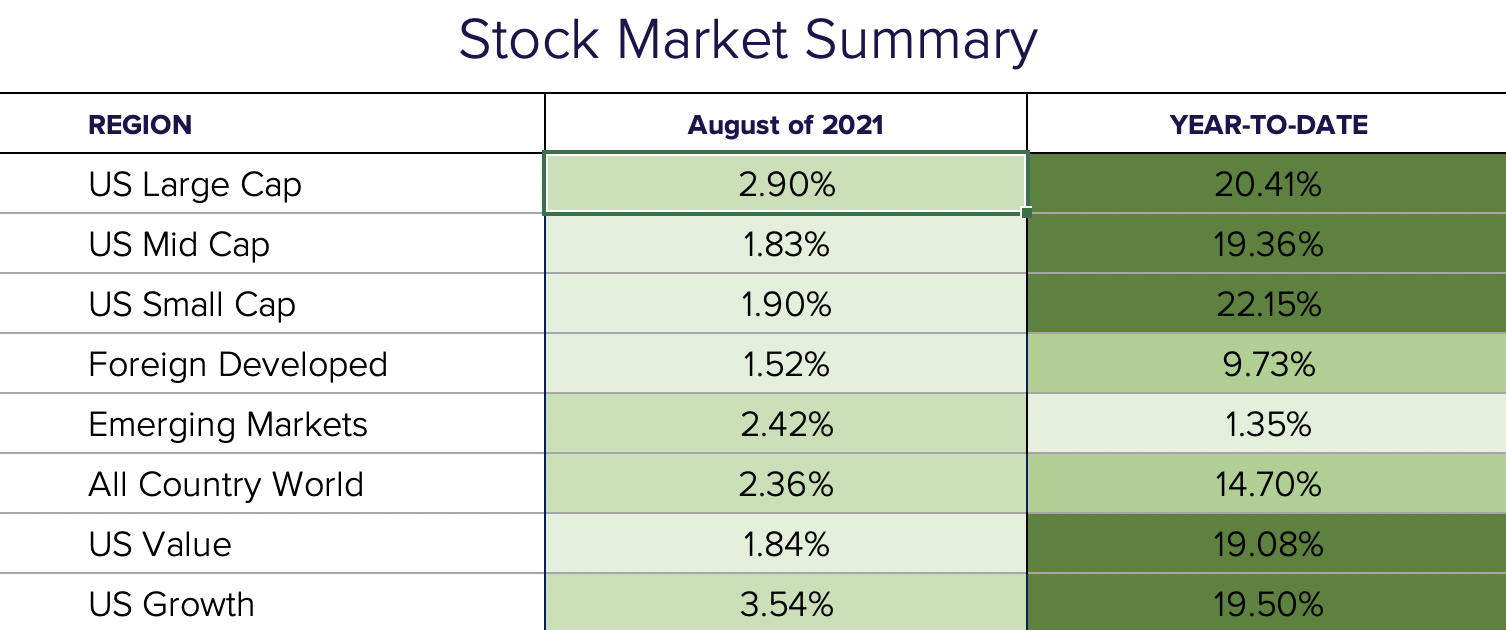

The stock market is proving ultra-resilient as the close of August marks the seventh positive month in a row for the S&P 500. Despite Fed talk, an Afghanistan take over, the Delta variant, Hurricane Ida, and rising inflation, the market moved higher by 2.9% this month, bringing the year-to-date return for the large cap stock index to 20.4%.

The markets.

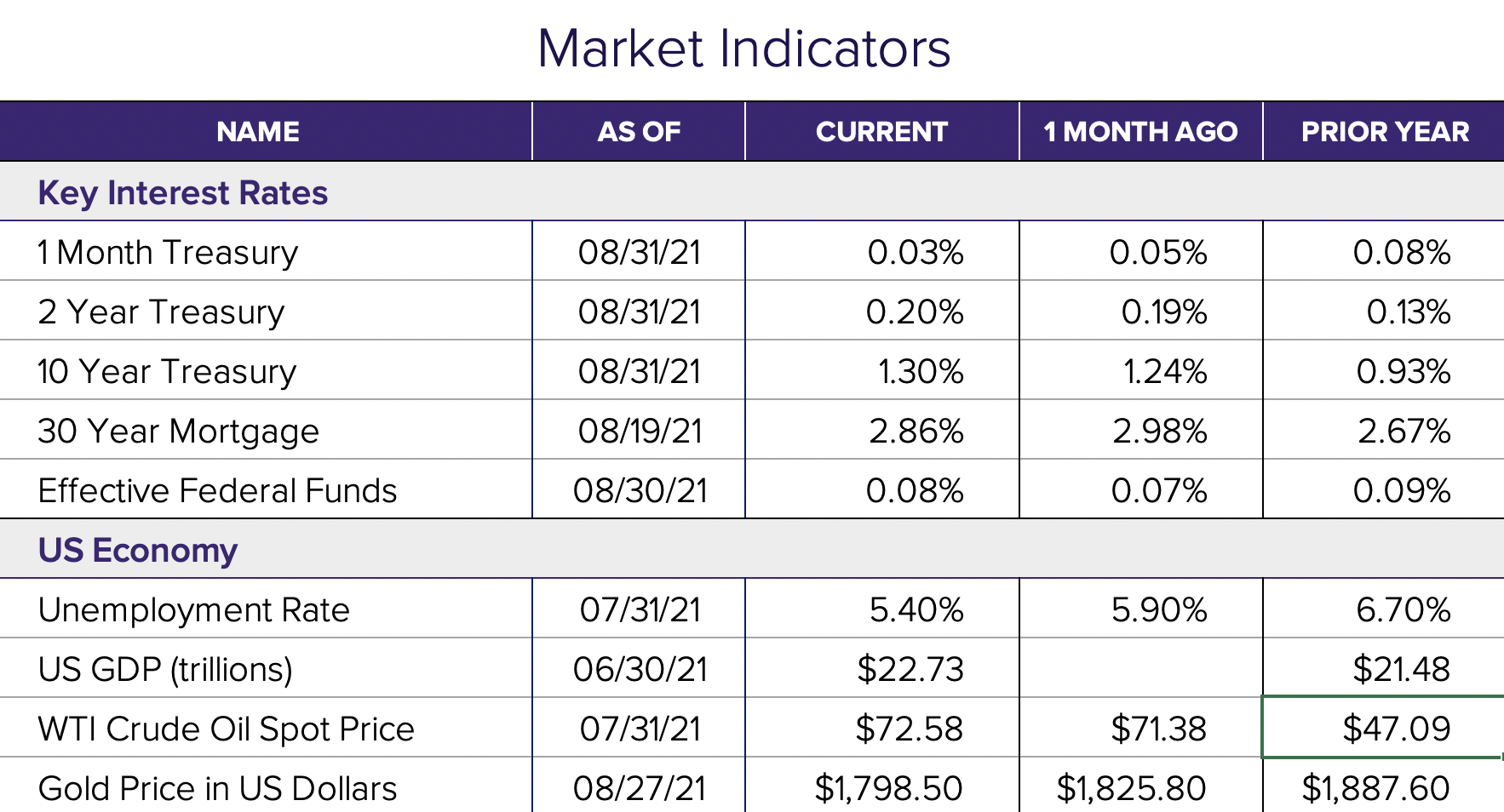

The general trends in the equity markets continued into August where we saw large capitalization stocks outpace smaller stocks, and growth stocks beat out value stocks. The bond markets took a breather this month as the benchmark 10-year treasury yield rose a modest .06% this month. Mortgage rates on the other hand continued their decline with the 30-year mortgage rate ending around 2.86%

Dovish Fed chair.

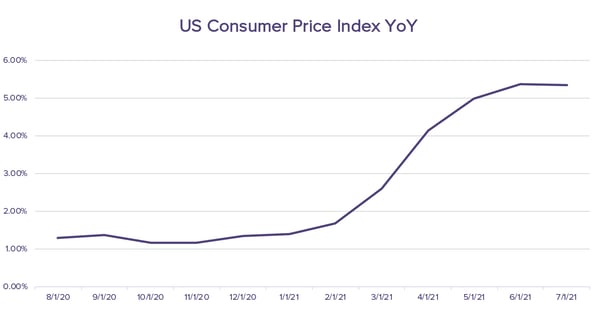

Jerome Powell, the head of the Federal Reserve, said he was in no rush to raise rates and would be guided by the data, but may start paring back the $120 billion per month in bond purchases in the next few months. He stuck to his view that the recent run-up in inflation was “transitory.” Transitory or not, price increases evidenced in the chart below have serious effects…ask anyone trying to buy or build a house.

Final thoughts.

The market moves this year are proving that the tailwinds from the recovering economy, continued Fed accommodation, and improving company earnings are stronger than many had expected. We will continue to keep a close eye on how all of these dynamics affect equity prices going forward.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®