A busy month.

Global stocks wrapped up another positive month, advancing +0.59%, despite an uptick in volatility. In fact, the +2.28% return for the S&P 500 in July marks the 6th straight month for gains in the US large cap index.

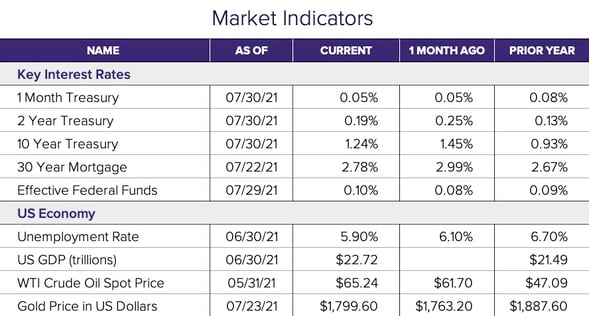

In the bond markets, yields dropped significantly, leading to price increases. The 10-year Treasury yield fell 25 basis points to 1.23%, marking the largest monthly decline since March of 2020.

A number of notable events have led to an interesting month in the markets.

Fed meeting- no change.

The Federal Reserve kept interest between 0 and .25% this month. Fed Chair Jerome Powell signaled he is in no hurry to begin tapering the $120 billion-a-month rate of bond purchases.

Soft data.

Economic data released this month suggested the pace of growth may be slowing. The U.S. economy expanded at a 6.5% annualized rate in Q2, but that was below the Dow Jones expectation for 8.4% GDP growth. The latest weekly jobless claims also came in higher than expected. The core personal consumption expenditures price index advanced 3.5% in June YOY; however, this was below the Dow Jones 3.6% inflation expectation.

The Delta variant- masks are back.

Growing fears over the rise of Delta variant COVID-19 cases and recent CDC suggestions have companies reconsidering mask requirements and vaccination policies while returning to offices. Some of the reopening stocks, particularly travel and leisure stocks, have seen a pullback this month. Time will tell how this plays into broader investor sentiment.

China crackdown.

Chinese authorities imposed tough restrictions on some of the hottest sectors that spooked investors and led to a significant selloff in Chinese companies. This caused the broad emerging markets index to pull back -7.04% for the month of July.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®