January kicked off 2026 with a steady gain for most markets, but the month was anything but quiet. Markets absorbed geopolitics, Fed policy uncertainty, and severe weather, then repeatedly reset and moved on - a reminder that fundamentals often matter more than the headlines in the long run.

Market Moves

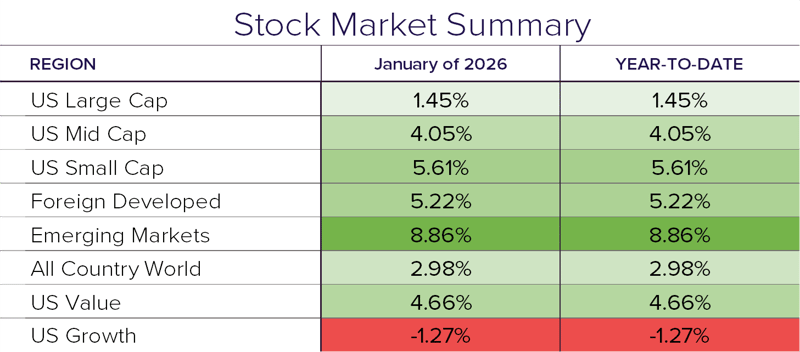

Stocks started the year on solid footing. U.S. large caps gained 1.45% in January, while mid caps rose 4.05% and small caps jumped 5.61%. Value stocks (+4.66%) outpaced growth (-1.27%), a notable change after a multi-year run led by large-cap tech and growth. Outside the U.S., last year’s leadership continued as foreign developed stocks gained 5.22% and emerging markets rose 8.86% thanks to a softer U.S. dollar.

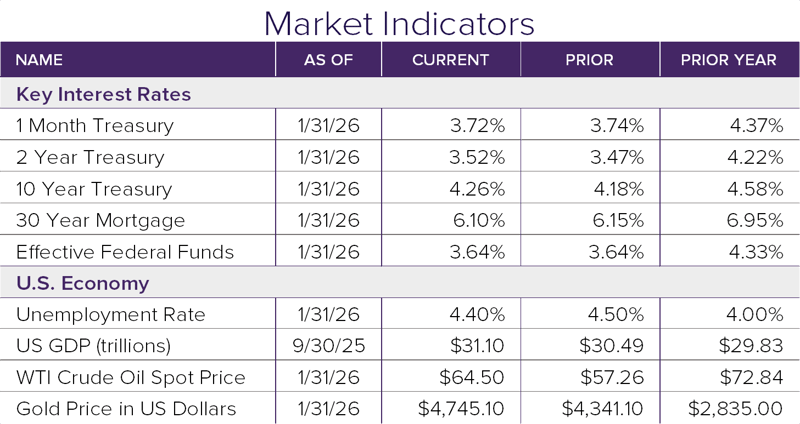

In fixed income, returns were modest as longer-term yields drifted higher. The 10-year Treasury yield ended the month around 4.24% while broad bond indices were only slightly positive.

Headlines and Volatility

Volatility briefly picked up as markets digested developments ranging from Venezuela to Greenland. The volatility index, or VIX, moved above 20 at points during the month, but pullbacks were short-lived. Late in January, Winter Storm Fern created widespread travel disruptions and pushed some energy prices higher, while Washington ended the month with a partial government shutdown.

Fed Pause and the 'Debasement Trade'

The Federal Reserve held its policy rate steady at 3.50% to 3.75% at its January meeting, pausing after three quarter-point cuts in the second half of 2025. With inflation still above the Fed's 2% target, policymakers signaled a wait-and-see posture and longer-term yields stayed firm.

That uncertainty showed up in currencies and precious metals. The U.S. dollar slid to its weakest level in nearly four years early in the month. This helped fuel the so-called “debasement trade,” or the idea that persistent deficits, policy uncertainty, and a weaker dollar can make hard assets like gold and silver more attractive. Both metals surged to record levels late in January before reversing sharply on January 30, after President Trump said he intends to nominate Kevin Warsh as the next Fed Chair—sending the dollar modestly higher and metals lower.

Earnings Check-In

FactSet reports that about one-third of S&P 500 companies have posted results so far and 75% have beaten earnings expectations, putting the blended earnings growth rate near 11.9% for the quarter. On a trailing 12-month basis, earnings growth has accelerated to roughly 12.8% based on consensus estimates.

Of course, the spotlight remains on AI and the largest technology companies, since they’ve driven a meaningful portion of returns in recent years. Interestingly, even when these companies beat estimates, market reactions have been mixed—an indication that expectations are high and investors are debating how long the current pace of AI-related spending can remain elevated. The encouraging takeaway is that earnings strength hasn’t been limited to one corner of the market, which helped stocks stay resilient despite January’s headline-driven volatility.

Looking Ahead

If January is any guide, 2026 may bring plenty of headline-driven swings. A diversified portfolio aligned to your long-term plan remains the best way to stay invested through the inevitable noise. Stay tuned!

Disclosure

© 2026 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®