Markets are off to a slow start in 2024 after a strong end to 2023. Strong economic data further fueled the markets’ hopes for a “soft landing". This optimism was softened after the Federal Reserve Chair said they are “not declaring victory at all at this point.” This led to mixed performance across assets classes by the end of January.

Mixed Markets

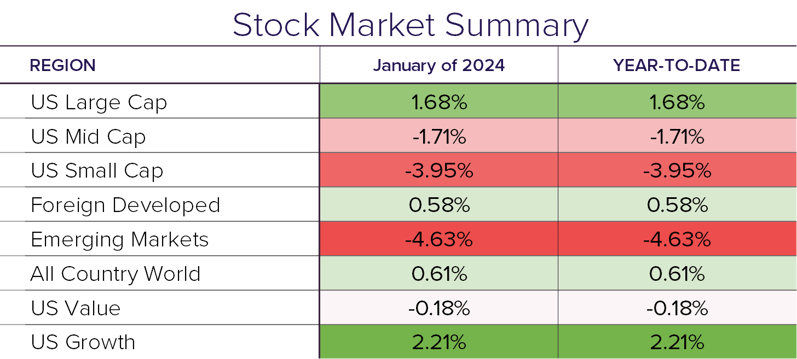

Growth stocks continued their dominant trend over value stocks in the U.S. as the Magnificent Seven cohort of mega cap technology companies rallied to start the year. The S&P 500 finished the month up 1.7%, while large growth stocks were up 2.2% compared to their large value counterparts, down 0.2%. Mid-cap and small-cap stocks did not fare as well, down 1.7% and 4.0% respectively. Globally, foreign developed (+0.6%) outshined emerging markets (-4.6%) as concerns about the Chinese economy, and conflict in the Middle East escalated.

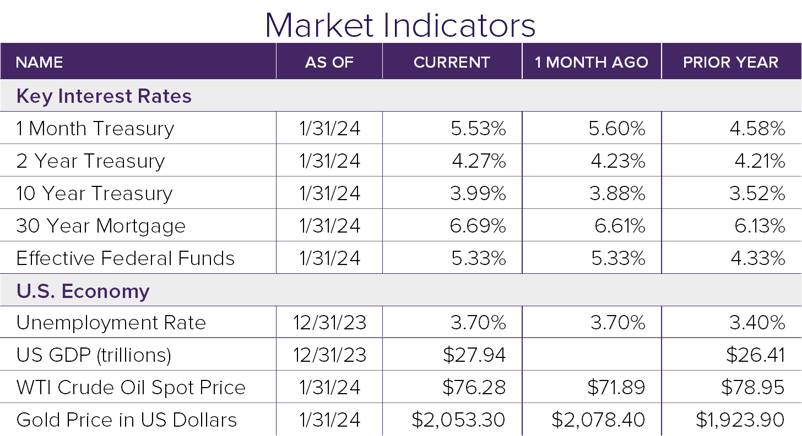

Fixed income markets had an uneventful month as interest rates were relatively stable. The Aggregate Bond Index was down 0.3% in January. The 10-year treasury yield ended the month roughly where it started at 3.86%, despite reaching 4.18% prior to the Federal Reserve inaugural meeting.

First Fed Meeting

At the January 31 Fed meeting, the committee left rates unchanged at 5.25-5.50%, and they signaled that rate cuts will commence in the next several months. Prior to this meeting, the markets were anticipating the first rate cut to begin in March. However, during his remarks, Fed Chair Jerome Powell indicated that a March cut was not the base case as more good inflation data needs to be seen.

Economy Exceeds Expectations

The economy continued to exceed expectations as a host of data encouraged the notion of a “soft landing” which is a scenario where inflation declines without a substantial increase in unemployment and a deep recession. 353,000 jobs were added in January, nearly doubling expectations of 185,000. The latest GDP print of 3.3% annualized growth blew out expectations. Finally, we saw unemployment remain steady at 3.7%.

Summary

Coming off the huge year-end rally of 2023, January saw mixed results across markets. Stocks were initially lifted by the recent economic data, but performance retreated post-Fed meeting. Bond prices hovered around flatline with rates staying steady. Going forward, it will be important to keep an eye on geopolitical tensions and the next round of inflation data. Stay tuned!

Disclosure

© 2024 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®