Stocks and bonds were in harmony for the data-heavy month of January. The risk-on sentiment was driven by key economic data reports that garnered investors’ hopes for a dovish tone out of the Fed. All bets have been placed for a soft landing.

The data.

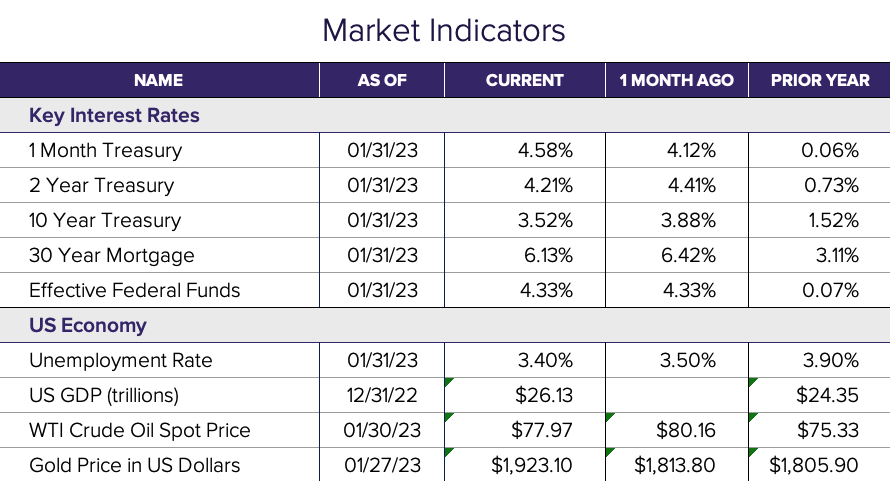

The aggressive rate hikes and action of the central bank have led to signs of decelerating inflation. The employment cost index— a measure of wage increases— came in lighter than expected. The personal consumption expenditures price index— the preferred inflation measure of the Fed— grew at the lowest rate since September of 2021. The US economy grew faster than expected in the fourth quarter of 2022 with GDP coming in at 2.9%.

The data-dependent central bank continued on its path to lower inflation from excessively high levels by raising rates another 0.25%, down from the previous hikes of 0.50%-0.75%. The federal funds rate is now 4.5-4.75%. This move was largely priced into the market already and it seems investors are more optimistic than Tommy in the famous Bon Jovi song, Livin’ on a Prayer. This is despite Jerome Powell saying their focus is not on “short-term moves.”

The market crescendo.

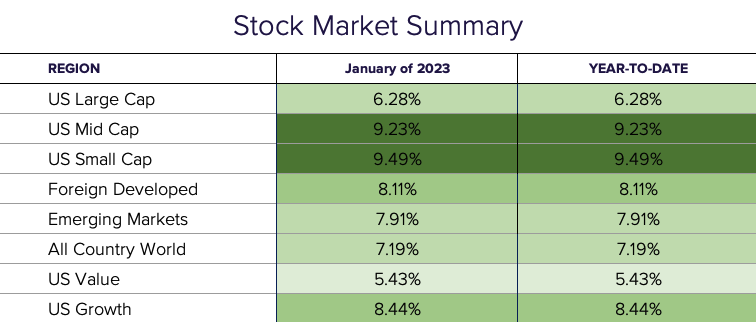

Global markets blissfully rejoiced as the economic data rolled in during January and finished on a high note, up 7.2%. foreign developed and emerging markets fared better than the domestic large-cap stocks, coming in at 8.1%, 7.9%, and 6.3% respectively.

Bond markets joined in the chorus as the yield on the 10-year treasury finished at 3.40%, down from 3.88% at the end of 2022. Bond prices rise as yields fall. The US bond index was up over 3% in January.

The U.S. Dollar closed out its fourth consecutive monthly loss, down 1.57% for January. The dollar has devalued significantly in recent months as the pace of rate hikes slowed. This has been a tailwind for gold and other precious metals with gold finishing up 6% for the month.

Outro.

Corporate earnings are rolling in and they are a bit off-key. Despite several large disappointments, the recent signs of falling inflation and encouraging data have helped offset any losses from earnings. All eyes remain on the economic data and whether good economic news translates to good news for the markets.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®