Wild price swings were the name of the game in January. All major stock indices finished the month in the red, primarily driven by a selloff in interest rate sensitive, growth-oriented tech stocks. The selloff came as the Federal Reserve took a hawkish tone indicating its readiness to tighten monetary policy in an effort to combat red-hot inflation.

Markets

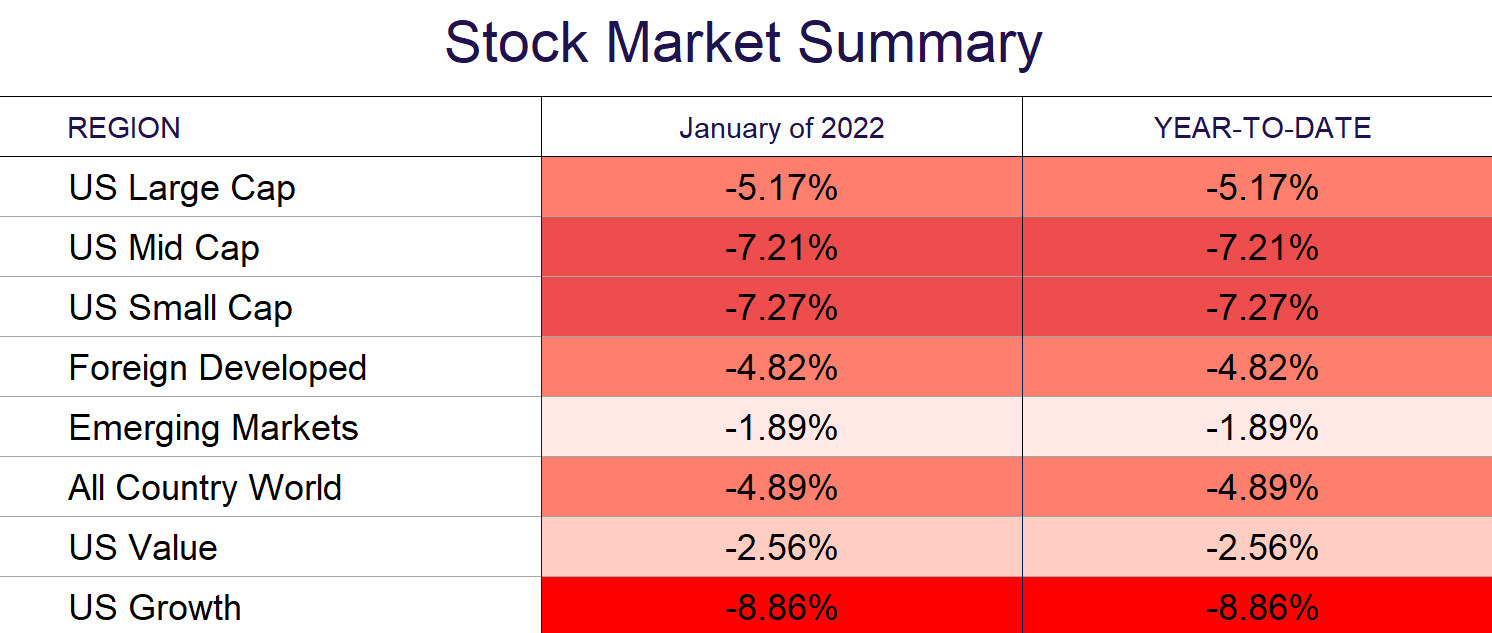

With rate increases looming on the horizon, markets are adjusting to the transition in monetary policy. US Large cap stocks reached correction territory intraday (10% drop from its high.) However, they finished the month down 5.2%. US Value stocks and Emerging markets withstood the volatility best, only giving up 1.9% and 2.6% respectively. Speculative pockets of the market such as cryptocurrencies and tech stock IPOs dropped over 20%.

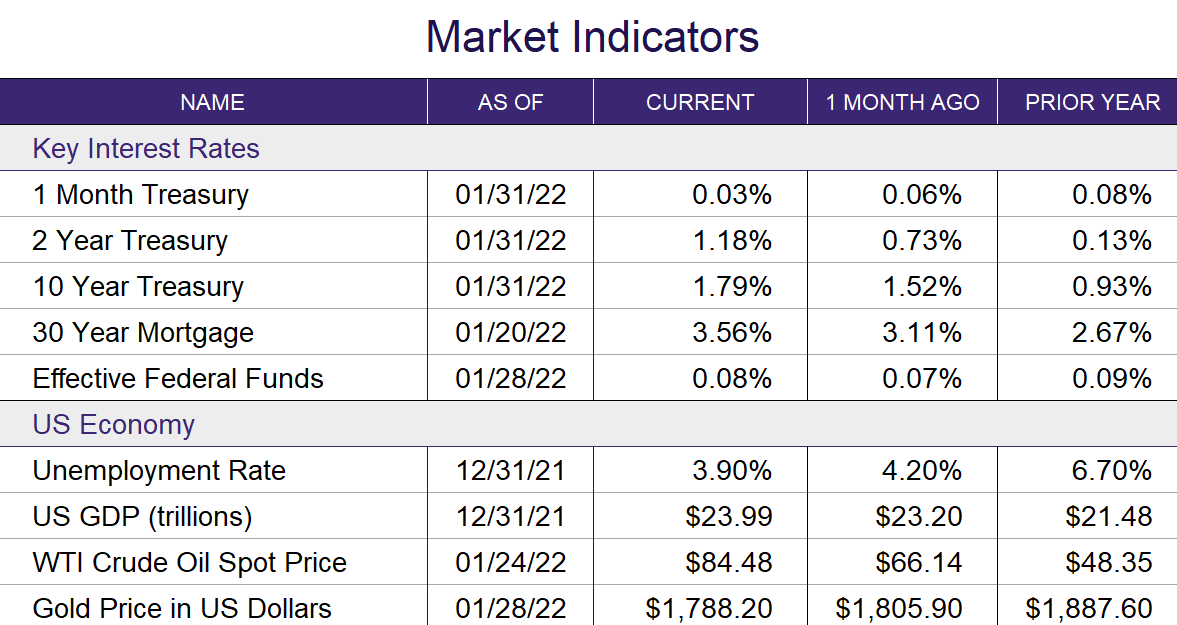

In the bond market, we saw negative returns, a significant yield curve flattening, and widening credit spreads. These are all important to monitor particularly if this flattening continues to the point of inversion or credit markets deteriorate as either one may cause the Fed to alter their tightening course.

When volatility presents opportunity

Despite the uptick in volatility, market corrections are normal and healthy. They frequently occur during a long-term bull market and are not an indication of an end of a bull market or a recession. In fact, they may offer an entry point for those investors with cash on the sidelines or an opportunity to rebalance your existing portfolio.

Outlook

As the year progresses, we would expect to see a market pattern with softer returns and larger bouts of volatility but overall remain in a positive uptrend. There will certainly be winners and losers within the broader markets but maintaining a diversified portfolio and diligently rebalancing will help weather any storm.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®