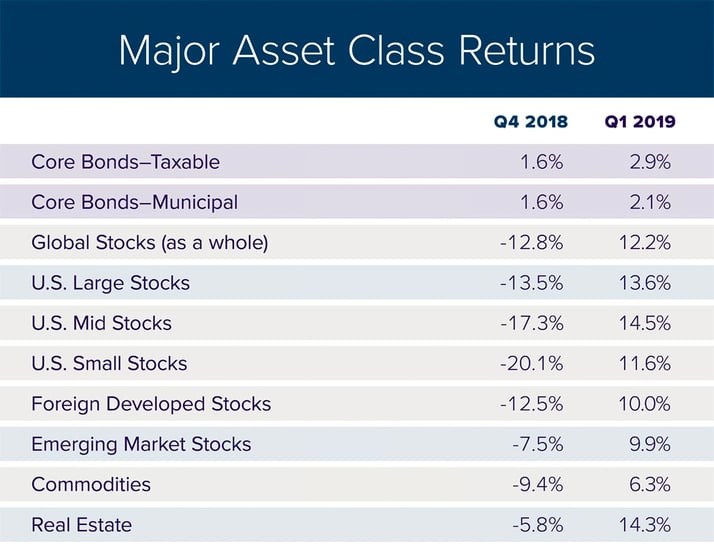

Risky assets suffered deep losses in the 4th quarter of 2018. With losses greatest on December 24, many investors spent Christmas morning nervous and concerned over what would transpire when the stock market reopened on the 26th. Fears of continued selling, however, were put to rest when a risky asset rebound began in late December and continued through the first three months of 2019.

U.S. large company stocks, which had suffered greatly in the tail end of 2018, gained 13.6% in the first quarter. Foreign stocks experienced healthy gains as well, with foreign developed country stocks up 10.0% and emerging markets up 9.9%. It was, however, the most interest-rate-sensitive asset classes that fared best, with infrastructure and real estate holdings gaining 15.9% and 14.3%, respectively.

Powell Pivot.

So, what caused the risky asset rebound? It was the Powell Pivot. Throughout the 4th quarter financial markets were concerned about slowing economic growth prospects and continued interest rate increases from the Federal Reserve. The latter fear was reinforced on December 17, when a Federal Reserve press release indicated “it was likely that the economy will grow in a way that will call for two interest rate increases over the course of next year.”

With steep losses occurring in the financial markets, the tone changed to one of “patience” in early January. In a series of speeches by Chairman Powell, the message no longer highlighted additional interest rate increases, but addressed the belief that financial markets were signaling concern and downside risks. The committee was now stressing patience: “the ability to be patient and watch patiently and carefully as we see the economy evolve.”

Growth in 2018 and beyond.

2018 was a good year for economic growth. Fiscal stimulus in the form of tax cuts and increased government spending helped economic growth reach 2.9%. This was much higher than the post-recession average annual rate of 2.2%.

Economic activity, however, was strongest in the middle part of last year and appears to be moderating as the effects of fiscal stimulus wear off. This is evident in a few economic indicators such as manufacturing orders and retail sales. Currently, growth in both manufacturers’ new orders and retail sales remain positive at 0.9% and 2.2, respectively. With inflation hovering around 2%, increases appear to have more to do with changes in prices, rather than a true increase in demand for products and services.

Brexit.

The United Kingdom was scheduled to leave the European Union on March 29 of this year. With no agreement in sight, the deadline was first extended to April 12, and then later to October 31. While the debate is ongoing, there appears to be four main options for the U.K.:

- Join European Economic Area, which, for a fee, permits non-E.U. countries the ability to move goods, services, people, and capital freely across borders

- A customs union, which would provide only the duty-free movement of goods and services across borders

- A hard Brexit, where the U.K. regains full control of its borders and loses access to the single market entirely

- Force a second referendum and hope for no Brexit at all

Either way, businesses in the U.K. and greater Europe now face several more months of uncertainty.

U.S. China trade tensions.

While progress towards a new trade deal to reduce the U.S. China trade imbalance and reverse recent tariffs imposed by the Trump administration has been made, there are still several sticking points left to be negotiated. They include: the timing of tariff removals, how much and what additional goods and services will be purchased by the Chinese, intellectual property protections, an end of forced technology transfers for U.S. companies operating in China, as well as a framework for how to monitor and enforce the agreement once it is complete. While no easy issues to resolve, a new deal could be quite beneficial for the U.S.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®