A 2024 IRS update to insights post “The IRS’s Significant Changes to Inherited IRAs” by Tucker Weppner, CFP:

In 2022, the IRS proposed additional guidelines based on the Secure Act 2.0. The rule would apply to certain beneficiaries of inherited IRAs for individuals who passed away in 2020 or later and after their required beginning date (RBD) for required minimum distributions (RMDs). The IRS states these beneficiaries must withdraw a minimum distribution annually for each of the first nine years, and the entire balance must be distributed by the end of the tenth year. This marks a change from the original directive, where these beneficiaries were not required to take annual distributions during the first nine years but had to distribute the entire account balance by the end of the tenth year.

This requirement triggered discussion, leading the IRS to waive the annual inherited IRA RMD for 2021, 2022, and 2023. In a recent announcement, detailed in Notice 2024-35, the IRS extended the exemption for annual inherited RMDs in 2024, guaranteeing no penalties for failing to take annual distributions in the years 2021, 2022, 2023, and now 2024.

For more information on the inherited RMD rules and the beneficiaries affected under the Secure Act, refer to the following updated insights article written by Joe Bartelo, CPA:

-------------------------------

The IRS's Significant Changes to Inherited IRAs

by Joe Bartelo, CPA Sep 21, 2023, updated July 30, 2024 for IRS Notice 2024-35

The Secure Act of 2019 significantly changed the rules regarding inherited IRA distributions. The “stretch” rules were removed for many beneficiaries, but the requirement to take Required Minimum Distributions (RMDs) every single year remained unclear.

Upon further discussion and interpretation of the rule changes, Congress passed the Secure Act 2.0 in the fall of 2022, which provided more clarity to those affected. As advisers understand these changes and their impacts on beneficiary accounts, we have uncovered more information that is valuable to share with our clients.

Beneficiaries applicable under old “stretch” rules

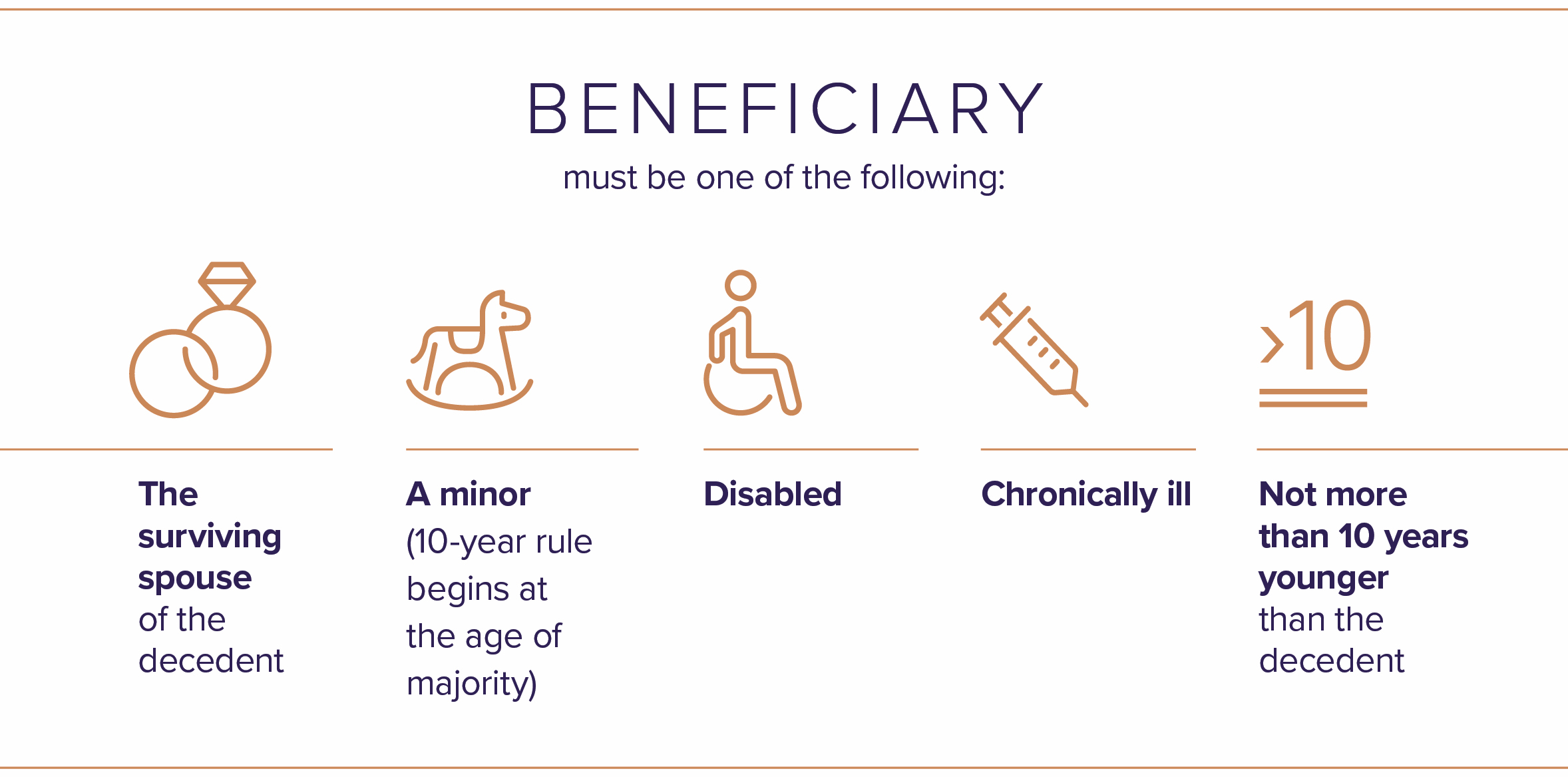

First, let’s look at which beneficiaries are still applicable under the old “stretch” rules. To be considered an eligible designated beneficiary and take advantage of the more favorable distribution rules, the beneficiary must be one of the following:

- The surviving spouse of the decedent

- A minor (10-year rule begins at the age of majority)

- Disabled

- Chronically ill

- Not more than 10 years younger than the decedent

Beneficiary requirements under The Secure Act 2.0

For beneficiaries of IRAs who do not meet one of the above exceptions, The Secure Act 2.0 began enforcing annual RMDs depending on the RMD status of the original account owner at their date of death.

- If the original account owner died before their RMD age, while the 10-year rule still applies, the new account owner is not required to take annual RMDs each year within the 10 year window.

- If the original account owner died post-RMD age, Secure Act 2.0 now requires the beneficiary to take annual RMDs for 10 years following the death of the decedent until the account is fully liquidated.

When signed in the fall of 2022, this new legislation was retroactively enforced as of the beginning of 2020. However, the IRS will not impose a penalty on any RMDs that were not taken during 2021, 2022, 2023, or 2024 and will not force beneficiaries to take distributions for the aforementioned years.

Missing future RMDs can result in penalties of up to 25% of the missed distribution. Ensuring that the distributions are taken properly at the time when they are required is extremely important.

As the IRS continues to interpret the Secure Act and Secure Act 2.0, please consult with your Sanderson Wealth Management adviser and tax accountant to help better understand and plan for the continuously changing financial landscape.

- In the fall of 2022, Congress passed The Secure Act 2.0 to provide more clarity to those affected by the changes instilled by The Secure Act of 2019.

- For beneficiaries of IRAs who are not still eligible under the old "stretch" rules, The Secure Act 2.0 began enforcing annual RMDs depending on the RMD status of the original account owner at their date of death.

- The new legislation was retroactively enforced as of 2020, yet will not force beneficiaries to take distributions for 2021, 2022, 2023, or 2024. Without a distribution in those years, the beneficiary is still required to liquidate the entire balance by the end of the tenth year of the decedent's death.

- It is important to take distributions at the timing of when they are required in order to avoid penalties of up to 25% of the missed distributions.

Disclosure

© 2024 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®