As we look back at 2022, it’s evident that the global economy has reached an inflection point. While no one can predict the future, the next decade looking significantly different than the previous is a safe assumption.

- The Russia-Ukraine War, now in its second year, has made an immediate impact on the global economy, and its repercussions will be felt for years to come.

- While 2022 was the first year of post-pandemic life for most of the developed world, policies in developing countries, such as China, continued to tighten global supply chains. This has accelerated a shift to deglobalization that will have a ripple effect on manufacturing and labor.

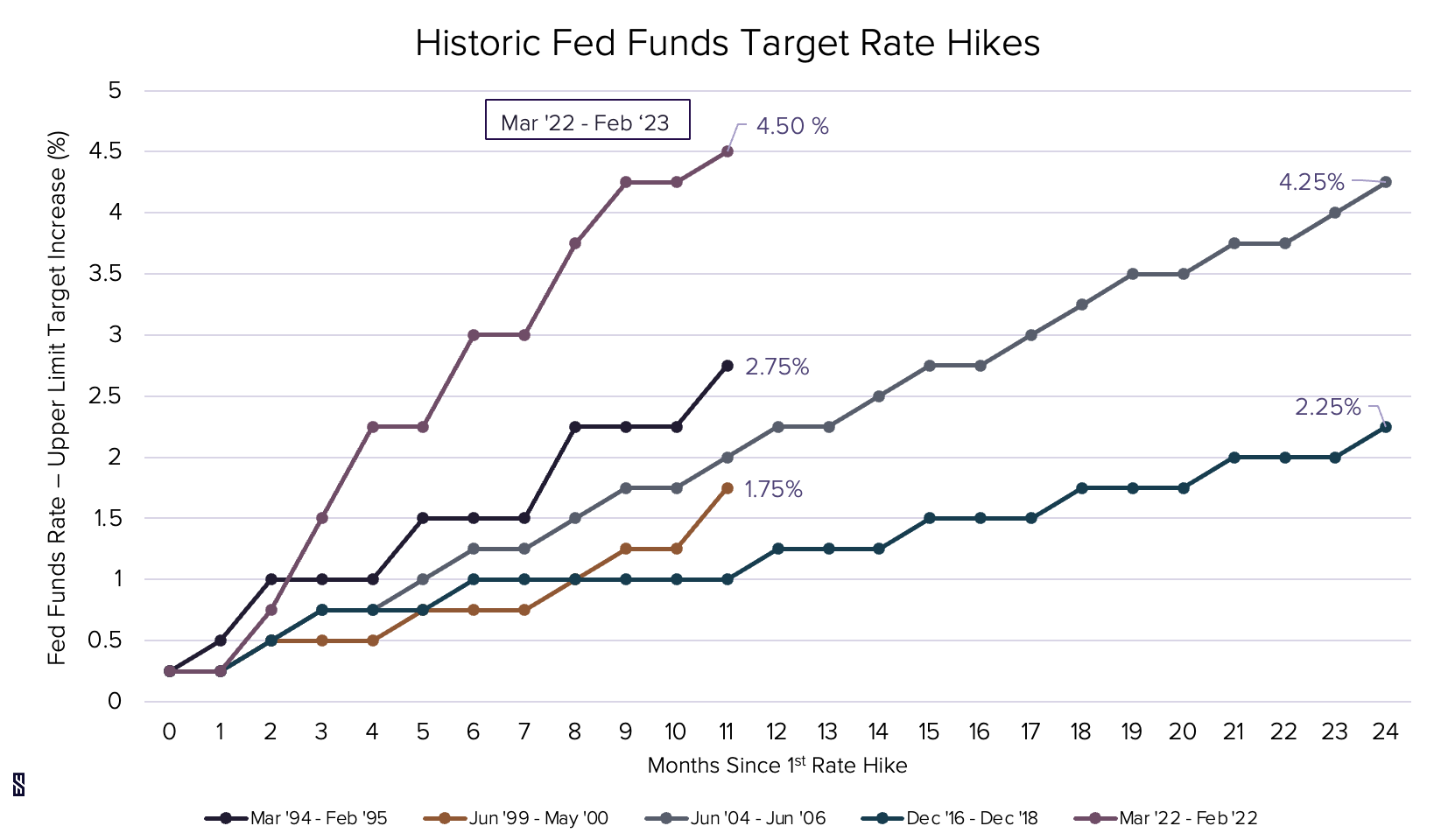

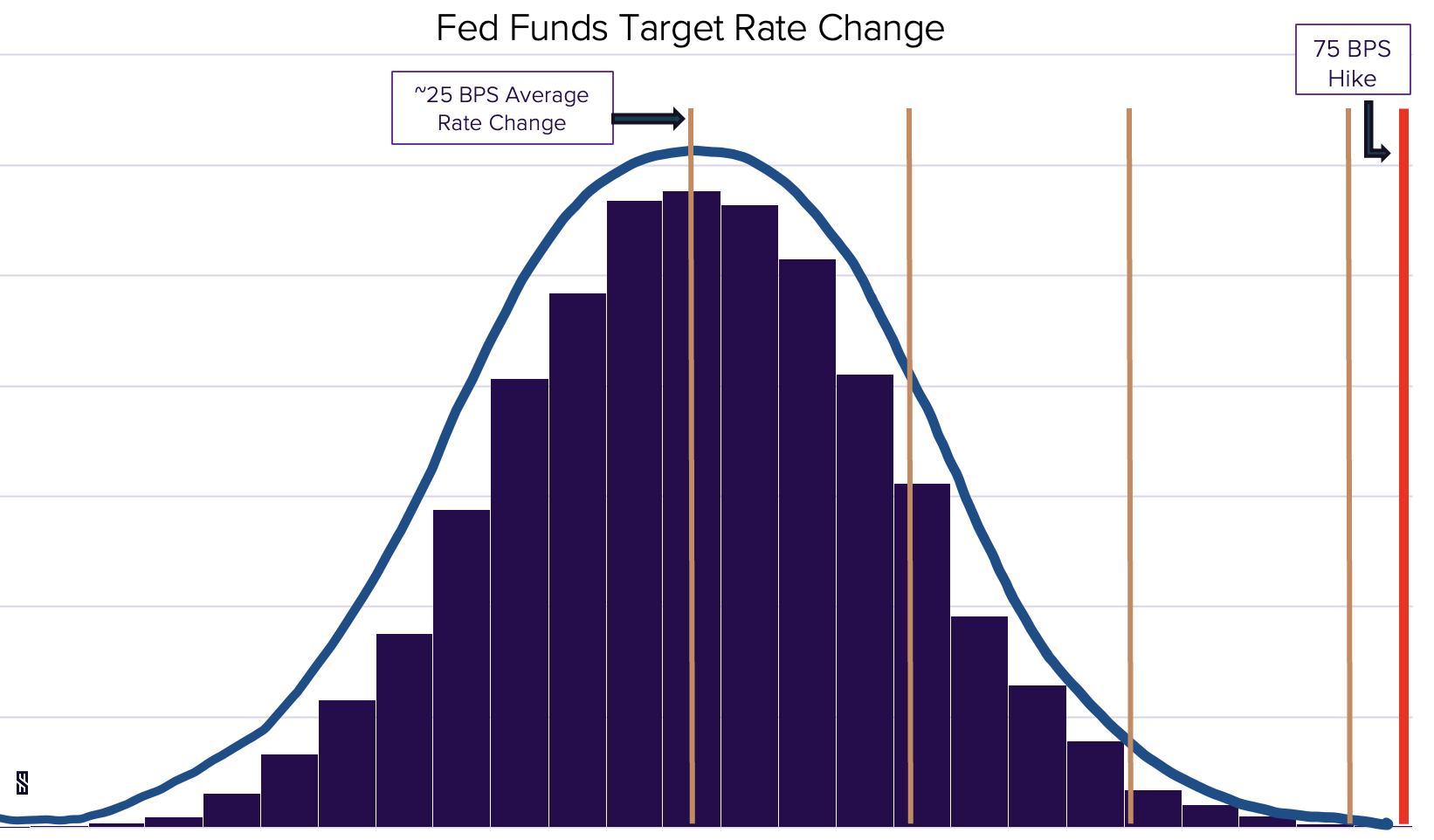

- We’ve all felt the impact of high inflation rates, which averaged 8% in 2022. To combat soaring inflation, the Federal Reserve raised interest rates at an unprecedented rate—eight times since February 2022, with four of the increases being 75 basis points. It is impossible to predict the unintended consequences of raising rates with such severity in a short period of time.

- The Federal Reserve also embarked on a quantitative tightening policy change, intended to reduce the balance sheet, which ballooned from about $900 billion in 2007 to $9 trillion today. Winding down the money supply is necessary for the Fed to regain leverage in case they need to stimulate the economy again in response to future unexpected events that affect the economy.

Recently, I had the pleasure of moderating a panel discussion with John Sanderson, our Founder and Chairman; John Gullo, Chief Investment Officer; and Tim Domino, Director of Wealth Planning. The insightful conversation covered a wide range of topics and examined what consumers and investors can anticipate over the next economic cycle.![]()

.jpg?width=60&height=60&name=104-183_PostGraphics_A-answer%20(2).jpg) John Gullo: It was a difficult year in the global stock market. Overall, global stocks were down 18.4% with some sectors being a little better or worse depending on where you invested. Across the US, foreign developed, and emerging markets, most stocks saw significant losses. The big difference wasn’t whether you were in domestic or foreign stocks, it was whether you held value stocks or growth stocks. Last year, value stocks were down about 5%, while growth stocks were down nearly 30%.

John Gullo: It was a difficult year in the global stock market. Overall, global stocks were down 18.4% with some sectors being a little better or worse depending on where you invested. Across the US, foreign developed, and emerging markets, most stocks saw significant losses. The big difference wasn’t whether you were in domestic or foreign stocks, it was whether you held value stocks or growth stocks. Last year, value stocks were down about 5%, while growth stocks were down nearly 30%.

![]()

.jpg?width=52&height=52&name=104-183_PostGraphics_A-answer%20(2).jpg) John Gullo: Prior to 2022, growth stocks had performed great for about 10 years. We had a huge run-up in prices, and honestly, valuations looked expensive at the start of the year until we experienced a correction through the rest of the year leading to a poor overall 2022 performance.

John Gullo: Prior to 2022, growth stocks had performed great for about 10 years. We had a huge run-up in prices, and honestly, valuations looked expensive at the start of the year until we experienced a correction through the rest of the year leading to a poor overall 2022 performance.

Presently, valuations are better than they were. If we rewind the clock to the beginning of 2022, and we look at the S&P 500, valuations were extremely high—the second highest that they’ve been since World War II when looking at 10-year PE ratios. If we look historically, in 97.5% of the occurrences prior to 2022, stocks were cheaper than where they were at the end of 2021. After the correction, valuations remain elevated but are no longer at extreme levels.

The momentum growth stocks are driven largely by investors’ appetite. They’re not necessarily looking at how profitable companies are with cash flows. Investors are excited about the companies, and every time we get a notion that the Federal Reserve may be done raising interest rates or maybe there’s a possibility of a cut later in the year, people get excited about growth stocks. We see growth managers on CNBC and on Bloomberg saying, “I told you guys; look, we’ve had five days in a row where growth stocks are once again outperforming.” ![]()

.jpg?width=60&height=60&name=104-183_PostGraphics_A-answer%20(2).jpg) John Sanderson: Since 1980, the US has grown at 2.54% on the average GDP. If you just look at the positive years, the average growth is 3.12%. In 2022, we hit a pretty nasty drop. But when you blend the drops and the recovery, we’ve averaged about 2% recently. Looking forward, economists are projecting somewhere between 1-2%.

John Sanderson: Since 1980, the US has grown at 2.54% on the average GDP. If you just look at the positive years, the average growth is 3.12%. In 2022, we hit a pretty nasty drop. But when you blend the drops and the recovery, we’ve averaged about 2% recently. Looking forward, economists are projecting somewhere between 1-2%.

One of the big things is the labor force. When I started working in the mid-1970s, the labor force was growing at 2.5% per year. Right now, the labor force is growing at around 1% per year. In order for GDP growth, we must increase productivity, the amount of product per person times the number of people, to increase faster than it is. -jpg-4.jpeg)

What are we seeing in emerging markets?

.jpg?width=60&height=60&name=104-183_PostGraphics_A-answer%20(2).jpg) John Sanderson: If you look at China, they did not report a recession. Now, economists are looking at 4% growth in China, which is still respectable, but not the double-digit growth we’ve seen. India is rapidly growing and projected to have the second largest GDP in the global economy, second to only China.

John Sanderson: If you look at China, they did not report a recession. Now, economists are looking at 4% growth in China, which is still respectable, but not the double-digit growth we’ve seen. India is rapidly growing and projected to have the second largest GDP in the global economy, second to only China.

-jpg-Oct-24-2022-05-27-34-33-PM.jpeg)

What are your thoughts about a soft landing versus a hard landing for the economy?

-jpg-3.jpeg) John Sanderson: Recently, the Labor Department reported that the US added 517,000 jobs in January and unemployment remained low at 3.4%, which means the economy is showing resiliency despite increased interest rates from the Federal Reserve. Retail sales also jumped to 3% in January–the best they’ve been since early 2021. Even if the stock market continues to be shaky, the Fed may continue to hike rates in response to a resilient economy.

John Sanderson: Recently, the Labor Department reported that the US added 517,000 jobs in January and unemployment remained low at 3.4%, which means the economy is showing resiliency despite increased interest rates from the Federal Reserve. Retail sales also jumped to 3% in January–the best they’ve been since early 2021. Even if the stock market continues to be shaky, the Fed may continue to hike rates in response to a resilient economy.

The Federal Reserve is projecting unemployment increases up to about 4.6%. Unfortunately, we’ve never increased the unemployment rate by more than a percent without going into a recession. That being said, a soft landing is possible. It’s interesting that two of the Fed’s main goals, employment stability, and price stability, are fighting each other right now. The end result is quite unpredictable.

![]()

The gross national debt of the United States has now topped thirty trillion, and we know some generation is going to have to pay for that. What’s going on in taxes right now?

-jpg-4.jpeg) Tim Domino: Well, the good news is nothing. The Tax Cuts and Jobs Act back in 2018 was a big change. The legislative rate cuts on ordinary income and capital gains income took away exemptions and shuffled around the deductions a bit. Those in small businesses remember the 20% qualified business income deduction, which was intended to get small businesses on par with the corporate rate cuts.

Tim Domino: Well, the good news is nothing. The Tax Cuts and Jobs Act back in 2018 was a big change. The legislative rate cuts on ordinary income and capital gains income took away exemptions and shuffled around the deductions a bit. Those in small businesses remember the 20% qualified business income deduction, which was intended to get small businesses on par with the corporate rate cuts.

Since this big change, we’ve had a couple of quiet years. We had the first Secure Act, which moved the required minimum distribution (RMD) age from 70 and a half to 72 and took away the stretch IRA that a lot of beneficiaries could enjoy. The government also enacted a few minor employer retention and child tax credits in response to the Covid pandemic. The recent roll out of Secure Act 2.0 pushed out the RMD age further to 73 but did not have material changes to traditional tax rates or deductions. -jpg-Oct-24-2022-05-20-50-54-PM.jpeg)

Do you think the change in the RMD is an early indicator for policy decisions around social security?

-jpg-Oct-24-2022-05-21-22-81-PM.jpeg) Tim Domino: We’ve heard the chatter. I think to some degree, they’re setting the groundwork for social spending plans a little bit.

Tim Domino: We’ve heard the chatter. I think to some degree, they’re setting the groundwork for social spending plans a little bit.

There are some other provisions in the Secure Act 2.0 that boost catch-up contributions. At age 60 and 63, people can put an extra $2,500 on top of the $7,500 they were contributing before. These changes add to the narrative of setting the stage for people to be ready for a revision to the social spending programs. But until we have a Congress that can agree on something, I don’t think we’ll see anything.

-jpg-Oct-24-2022-05-21-31-45-PM.jpeg)

For many of us on the younger side, this is the worst inflation we’ve ever experienced. What’s going on with inflation here in the US?

-jpg-Oct-24-2022-05-22-06-69-PM.jpeg) John Sanderson: One of the reasons people are talking about inflation right now is because this is the highest inflation rate since 1981. After reaching a mid-year peak at 9.1%, the inflation rate has dropped down to the mid to low sixes - still higher than it was in 1981. We have bounced around 2% for a long, long time. That’s where the Federal Reserve wants us to get back to.

John Sanderson: One of the reasons people are talking about inflation right now is because this is the highest inflation rate since 1981. After reaching a mid-year peak at 9.1%, the inflation rate has dropped down to the mid to low sixes - still higher than it was in 1981. We have bounced around 2% for a long, long time. That’s where the Federal Reserve wants us to get back to.

Let’s look at when the inflation started. February 2021. Now, what happened before that? During early Covid the economy was shut down then with five trillion dollars of stimulus and eager consumers, demand spiked. High demand in concert with broken supply chains across the world created an imbalance between supply and demand resulting in inflationary prices.

Initially, the Federal Reserve labeled these high inflation rates as transitory until Russia invaded Ukraine and China ordained their Covid Zero policies, accentuating issues brought on by Covid specifically in the energy and food sectors. Inflation became no longer transitory and remains a concern, especially considering the economy’s resilience against the Federal Reserve’s high interest rates.

-jpg-Oct-24-2022-05-22-18-01-PM.jpeg)

Let’s talk about the fixed-income environment. What’s happening from a lending perspective?

-jpg-Oct-24-2022-05-22-45-34-PM.jpeg) John Gullo: As investors and savers, it’s the first time in a long time we’re earning interest, and it feels good. If you have a money market account right now, you’re yielding more than 4%. If you have an online savings account, you’re probably somewhere around 3.5%. All those accounts yielded zero last year. When we have all these interest rate increases, short-term interest rates go up. As savers, it’s very appealing right now to be in something like a very short-term bond or in a money market account that you’re getting 4-4.5% right now.

John Gullo: As investors and savers, it’s the first time in a long time we’re earning interest, and it feels good. If you have a money market account right now, you’re yielding more than 4%. If you have an online savings account, you’re probably somewhere around 3.5%. All those accounts yielded zero last year. When we have all these interest rate increases, short-term interest rates go up. As savers, it’s very appealing right now to be in something like a very short-term bond or in a money market account that you’re getting 4-4.5% right now.

When we look at long-term bonds, we should be getting more interest, but we’re not. Right now, we have a phenomenon known as an inverted yield curve. What that means is that longer-term bondholders are being paid less interest than shorter-term bondholders. This happens because everyone is expecting short-term interest rates to go up. But the current market conditions cause some to think the Federal Reserve is going to cut interest rates later in the year because the economy’s going to begin stalling out a bit. Right now, longer-term interest rates yield less than shorter-term. But yields change every single day and it is something that we continuously look at to evaluate what makes sense for clients on an ongoing basis.

![]()

What about credit risk? What’s going on in the credit spread market?

-jpg-4.jpeg) John Gullo: It’s a little better. Spreads are how we evaluate the pricing on a higher yield bond, a junk bond, a non-investment grade bond—all names for the same fixed income securities. We try and figure out how much additional interest we are getting for lending to a less reputable borrower when compared to what we could receive from a risk-free investment like the US Treasury. If we look over a long period of time, multiple decades, 5% is the average. This means investors should get about 5% more interest to take on more risk.

John Gullo: It’s a little better. Spreads are how we evaluate the pricing on a higher yield bond, a junk bond, a non-investment grade bond—all names for the same fixed income securities. We try and figure out how much additional interest we are getting for lending to a less reputable borrower when compared to what we could receive from a risk-free investment like the US Treasury. If we look over a long period of time, multiple decades, 5% is the average. This means investors should get about 5% more interest to take on more risk.

Looking at the middle of 2021, that premium was 3%– so it wasn’t any good. Investors were not getting compensated for lending to our less-reputable borrowers. If we look towards the third quarter and into the fourth quarter of last year, that premium was 5%. So then, spreads were at the average and starting to be compensated fairly. But again, these markets are moving so fast and could change daily. -jpg-Oct-24-2022-05-20-50-54-PM.jpeg)

How do all these rapidly changing areas affect financial planning decisions?

-jpg-Oct-24-2022-05-21-22-81-PM.jpeg) Tim Domino: We talked about the Tax Cuts and Jobs Act (TCJA), on top of the income tax changes, which resulted in a changed estate tax landscape. Prior to 2018, we already had a roughly $6 million exemption with married individuals avoiding estate taxes if their estates were under $12 million combined. As a result of the TCJA, that got boosted up. Today, the threshold for married individuals is up to almost $26 million combined before we start to see tax implications.

Tim Domino: We talked about the Tax Cuts and Jobs Act (TCJA), on top of the income tax changes, which resulted in a changed estate tax landscape. Prior to 2018, we already had a roughly $6 million exemption with married individuals avoiding estate taxes if their estates were under $12 million combined. As a result of the TCJA, that got boosted up. Today, the threshold for married individuals is up to almost $26 million combined before we start to see tax implications.

Since the TCJA came into play, there’s really been a sense of complacency around estate planning because there really aren’t dire consequences of obtaining a 40%+ estate tax anymore. People are planning a lot more for qualitative reasons. When do you want your kids to have money, and what kind of strings do you have around it? But that act sunsets at the end of 2025. When the calendar turns and it’s 2026, all those rules will be gone, and we’ll be back to roughly $12 million combined at the state tax level for married individuals.

With the inaction in Congress, chances are they’re not going to agree on anything around this. It’s a lot easier to raise taxes by letting provisions expire than come up with new provisions that people have to agree upon. That really puts planning under the microscope right now and makes it vital that we start thinking about planning in this limited time window that we have.-jpg-Oct-24-2022-05-21-31-45-PM.jpeg)

Is there a risk that if we act too early and legislation changes, the IRS can undo our plans?

-jpg-Oct-24-2022-05-22-06-69-PM.jpeg) Tim Domino: There was a lot of concern about that because people are making very meaningful moves. If you think about the way you use your exemption, you start from the bottom up. Before you can benefit from the almost $26 million combined exclusion we have today, you have to first use the first $12 million. People were very hesitant to do any sort of material planning because the prospect of an IRS clawback of the additional exclusion above $12MM. Well, the IRS came out in 2019 and said they will not claw back any sort of savings from strategies that are put into place during this time period. It really gives us a lot of assurance that we can go ahead with those plans and make those meaningful changes and benefit them before the window closes.

Tim Domino: There was a lot of concern about that because people are making very meaningful moves. If you think about the way you use your exemption, you start from the bottom up. Before you can benefit from the almost $26 million combined exclusion we have today, you have to first use the first $12 million. People were very hesitant to do any sort of material planning because the prospect of an IRS clawback of the additional exclusion above $12MM. Well, the IRS came out in 2019 and said they will not claw back any sort of savings from strategies that are put into place during this time period. It really gives us a lot of assurance that we can go ahead with those plans and make those meaningful changes and benefit them before the window closes.

-jpg-Oct-24-2022-05-22-18-01-PM.jpeg)

Are there any other planning priorities you’re thinking about?

-jpg-Oct-24-2022-05-22-45-34-PM.jpeg) Tim Domino: Yeah, I think from the RMD standpoint, that extra runway gives people a lot of time to do some income tax optimization. It may be time for some to look at some of those tried-and-true strategies like basic gifting trusts, defective grantor trusts, and grantor retained annuity trusts. Those may all be great things to put into play if you want to make use of your exemption and transfer assets to the next generation.

Tim Domino: Yeah, I think from the RMD standpoint, that extra runway gives people a lot of time to do some income tax optimization. It may be time for some to look at some of those tried-and-true strategies like basic gifting trusts, defective grantor trusts, and grantor retained annuity trusts. Those may all be great things to put into play if you want to make use of your exemption and transfer assets to the next generation.

There have been some strategies developed recently, which I think will get a lot of traction in the next couple of years as we get closer to that window closing. One, in particular, is called a spousal lifetime access trust. Basically, it's a way to use your exemption with a gift in trust to a spouse, and still have the family unit able to benefit from those assets to some degree. Like having your cake and eating it too. That “SLAT,” as they’re called, is going to be a popular planning exercise in the next couple of years. Perhaps some domestic asset protection trusts in different jurisdictions may be on the table as well. They’re all not without risks, though. With any good planning strategy, you have a trade-off, sometimes a significant one.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®