Owning your own property, having a white picket fence surrounding your backyard and having a spouse with children are all things that we consider to be part of the American Dream. They all represent a form of financial success, independence, stability, and control. Unfortunately, the homeownership piece to the American Dream is becoming harder and harder to obtain for first time home buyers. As I am sure you have noticed, the prices of goods and services have soared over the last 3 years, and housing certainly was not immune to those increases. According to the National Association of Realtors, the average monthly mortgage payment rose 85% from January 2022 to September 2023 alone. I am confident that most Americans did not receive an increase in salary from their employer close to that number over that same 21-month time span. Let’s break down one of the main reasons for that increase in mortgage payments, namely interest rates.

The interest rate impact.

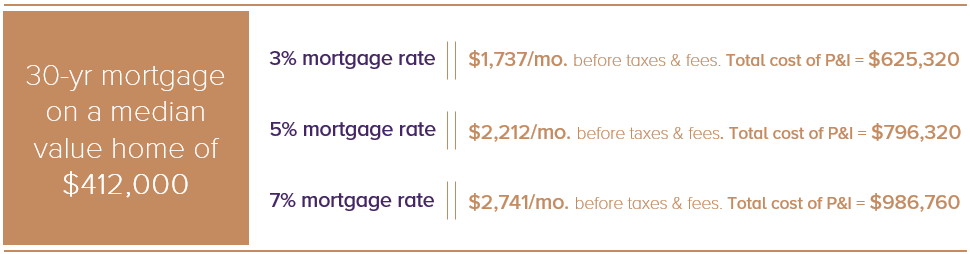

The interest rate is one of the biggest factors affecting monthly mortgage payments. When interest rates are higher, payments are higher if you are borrowing the same – or even sometimes less - amount of money. For example, the current median home price in the United States is $412,000. A 30-year mortgage on the median home price value with no down payment is:

The increase in costs on a 2% increase in 30-year mortgage rates from 5% to 7% is $529 per month or $190,440 over the 30-year span of the loan. The increase in costs on a 4% increase in 30-year mortgage rates from 3% to 7% is $1,004 per month or $361,440 over the 30-year span of the loan. I am going to go out on a limb and assume that you prefer those savings in your bank account as opposed to being paid out to the bank.

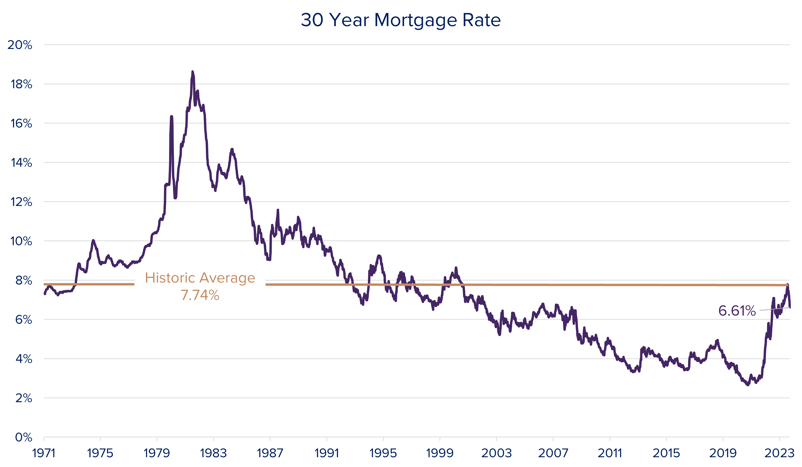

Historically, the median 30-year mortgage rate is 7.41% according to Freddie Mac, who began tracking rates in April of 1971. However, people have grown accustomed to rates under 4% since the great financial crisis, allowing them to purchase more expensive homes because of it. This is a luxury that first time homeowners seemingly won’t be able to have as we look into the next couple of years.

High interest rates and purchasing power.

Higher interest rates also lead to less purchasing power for a homebuyer. Purchasing power is the amount of money you can afford to borrow to buy a house. When rates are higher, you must put down a larger down payment or buy a less expensive home if you want the monthly mortgage payment to be the same as if rates were lower.

For instance, to buy a $412,000 house, with a 20% down payment of $82,400 you would have to take out a $329,600 mortgage. At a 5% mortgage rate that monthly payment would be $1,769.

To buy a $412,000 house and maintain that same monthly payment of $1,769 with a 7% mortgage rate you would have to put down a down payment of $146,050, which is a 35.5% down payment. That is an extra $63,650 that needs to be put down upfront out of pocket compared to the last scenario due to the 2% mortgage rate increase.

To maintain a $1,769 monthly payment and 20% down payment on a house at a 7% mortgage rate you would have to buy a house worth $332,438 to get there. That means you get $79,562 less house for the same monthly payment due to the 2% mortgage rate increase.

To maintain a $1,769 monthly payment with a $82,400 down payment on the house at a 7% mortgage rate you would only be able to buy a house worth $348,275 to get there. That means you get $63,725 less house for the same monthly payment due to the 2% mortgage rate increase.

Loan approval in a high interest rate environment.

Lastly, higher interest rates also lead to more difficulty qualifying for a loan in the first place. Lenders look at your debt-to-income ratio when deciding whether or not to approve you for a mortgage. This ratio is all your monthly debt payments divided by all your monthly income. When interest rates are higher, banks may be stricter in their lending practices, meaning that debt-to-income ratios that may have been approved in a low-rate environment are now being denied, while in general the higher payments will cause inflated debt-to-income ratios.

Home values remain high.

Typically, higher mortgage rates would lead to lower demand from buyers and, given a flat or increased level of supply, lower home prices. The lower home prices could offset the increased mortgage rates making the net effect on monthly mortgage payments even, slightly increased, or slightly decreased. However, we live in real life and not a textbook. Existing homeowners have locked themselves into lower mortgage rates with lower payments, as you can see in my first example, over the last 15 years and they are hesitant to sell and give themselves a new mortgage payment. That new, higher mortgage payment would be for a home that is likely a lateral move. An upward move into a home with more square footage or in a more desirable area would likely cause a payment so high they can’t justify the move. This reluctance to move is causing downward pressure on supply and has created flat and even upward pressure on home prices over the last year and a half, despite the higher interest rate environment we are in.

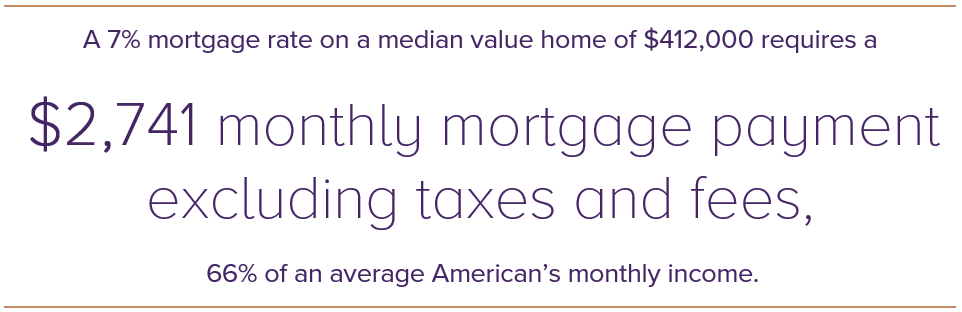

All of this leads to the dilemma that first time homebuyers are facing today. Assuming the average first time home buyer is an average American, they are likely earning around the gross median salary in the US of $58,136 before taxes. Using the 2023 federal tax brackets, FICA payroll taxes, and assuming no state income tax, that salary will be taxed at roughly $8,500, leaving a net salary after tax of $49,636. That annual number can be broken down into $4,136 per month after tax. Given the mortgage payment at a 7% mortgage rate on a median priced home without taxes and fees added to it of $2,741, that would take up 66% of one’s monthly income.

If you have a partner that also makes the median salary, that would go down to 33% of the household’s monthly income which is more in line with basic financial planning advice but still higher than what is recommended. However, not everyone has a partner, and you still must account for state taxes coming out of your income and property taxes, in addition to fees being added to your mortgage payment. If you are fortunate enough to have a partner who also works, the other part of the American Dream of having a family with children is still hard to obtain financially. This is due to having to budget for the increased cost of housing, homeowner’s insurance, cars, automobile insurance, childcare, food, entertainment, etc.

Tips for navigating high interest rates when purchasing a home

1. Be patient. The market is cyclical regarding both prices and interest rates. However, if the right house comes along and the payment is affordable for you, consider buying the home regardless of market conditions.

2. Shop around for the best rate by getting pre-approved from multiple lenders.

3. Consider an adjustable-rate mortgage (ARM) if you are going to be in the home for a short period of time as they may have lower mortgage rates in the early years. It is important to understand the risk of them, however, leading to higher payments in the future if rates continue to go up over the long term.

4. Whether you go with a fixed rate mortgage or an ARM, you could eventually look to refinance at a lower interest rate if the opportunity presents itself. There is a breakeven analysis here as there will be additional closing costs and fees when going to refinance.

5. Consider building new if you have the flexibility of time on your side as well as the finances to do so.

- The average monthly mortgage payment rose 85% from January 2022 to September 2023.

- As interest rates rise, the mortgage payment increases drastically. On a median priced home of $412,000, a 2% increase from 5% to 7% on a 30-yr mortgage is $529 more per month or $190,440 over the 30-yr span of the loan.

- People have grown accustom to low interest rates since the great financial crisis; however, the current 30-yr mortgage rate of 6.61% is less than the average mortgage rate and median mortgage rate of the last 50 years.

- A high interest rate drastically lowers a buyers purchasing power and may be more difficult to obtain loan approval from the bank.

- Home values have remained constant or even slightly increasing - atypical for a high rate environment - putting more financial constraints for prospective buyers.

Disclosure

© 2024 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®