In 2018, Apple became the first $1 trillion company in the world—an impressive feat that took 34 years to accomplish. Yet, a mere few years later, the company surpassed the $2 trillion mark. Did Apple do something dramatically different or innovative during that short period to double in size? Not really.

Apple is a good example of how we’ve seen market valuation dislocating from economic fundamentals. This is not to disparage a wildly successful company or the market as a whole. However, it’s one reason why Sanderson has been exploring new asset classes for our clients. Non-traditional assets have long been part of our diversification strategy, but as you’ll find out below, certain alternative investments—particularly private equity—are becoming a larger part of portfolio construction moving forward.

What's happening in the market?

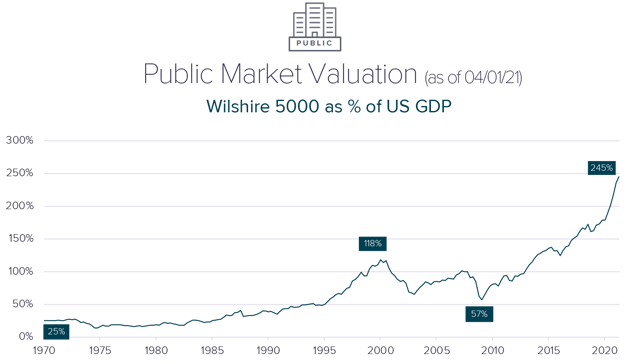

The fact that the S&P 500 has enjoyed nearly a 40% increase since January 2020—during a global pandemic—is incredible. However, if we peek under the hood of what’s happening in the U.S. market, we notice a few concerning signals:- The Wilshire 5000 currently accounts for 245% of the U.S. GDP. During the tech boom in the late 1990s, this figure peaked at 118%.

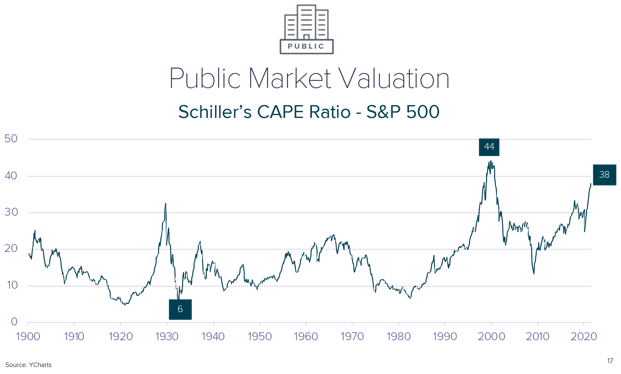

- Schiller’s CAPE (cyclically adjusted price-to-earnings) ratio is currently 38. This figure indicates how much you pay for a normalized dollar of earnings. The previous peak was 44 during the tech boom.

- Furthermore, the trading environment is more crowded than ever—for two reasons. First, the number of U.S. public companies has decreased from 8,000 to 3,400 over the past 25 years. Second, technology has made investing in the market more accessible to the masses while essentially eliminating the information advantage that experienced investors have long relished.

So, what about bonds?

In times of uncertainty, the bond market has historically been a safe harbor to provide portfolio stability risk reduction, source, spending, and rebalancing in volatile markets. Unfortunately, that is currently not the case due to the following factors:

- Interest rates – While it’s a great time to be a borrower, it’s unusually risky to invest in bonds with return rates of less than 2%. While interest rates should eventually rebound, they are currently being held artificially low by Central Bank intervention in the U.S. and other global institutions.

- Inflation – For the first time since pre-2008, inflation is a genuine concern. The Federal Reserve predicted higher prices following fiscal stimulus and monetary policy, but they seem to be happening faster than expected. Both core and headline inflation measurements are at or close to their highest levels since the 1980s.

Seeking alternative opportunities.

Everything so far paints a rather bleak picture, but we’re not running for the exit by any means. Instead, the current market is making us look for other opportunities over the next 5–7-year investment cycle.

Primarily, we are exploring strategies to fulfill certain objectives:

- Provide some inflation protection

- Maintain equity exposure with less risk

- Additional diversification

- Significant downside protection

The case for private equity.

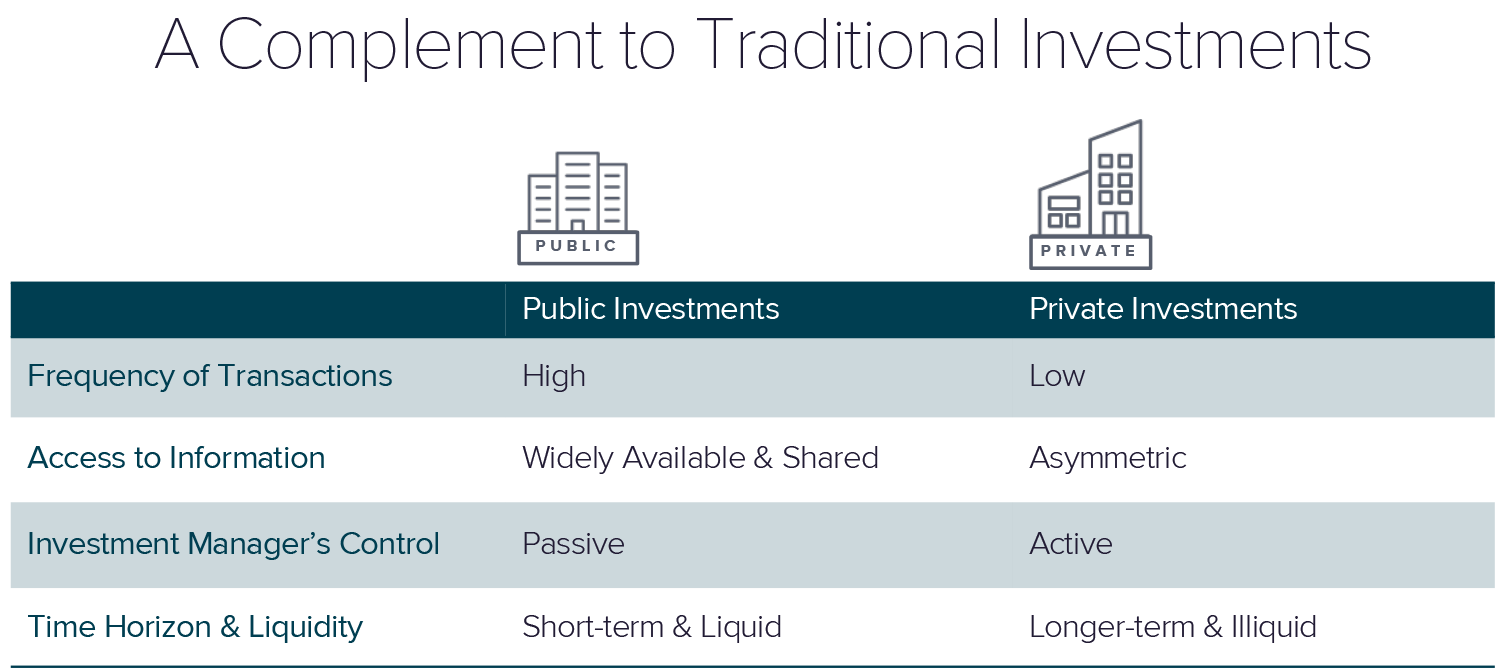

One alternative sector we feel very strongly about as a complement to traditional investments is private equity. This asset class has evolved, and we’re able to find access to private equity investments for very reasonable amounts of money without long-term lockups. Traditionally, these investments committed investors to 10 years or so, but now we’re looking at a minimum of one year, and then quarterly from then on.

With private equity, we can get back to the fundamentals of buying companies with good cash flow and solid management. If you’re new to this asset class, here’s a quick primer:

- Private equity firms create value by acquiring companies, improving performance, and then selling at attractive prices.

- Private companies span many industries, including service, consumer goods, financial, industrial, telecom, healthcare, and more.

- The fund manager can lend expertise and has more influence over operations that can impact sustainable growth.

- Our funds find companies focused on building long-term value, not just their 10Q, which is the quarterly earnings report to the SEC.

What's next.

While it’s not time to throw out everything we know about investing, Sanderson will continue to evolve portfolio construction for today’s market realities and long-term growth based on sound fundamentals.

Along with private equity, our investment team is working diligently to identify opportunities in:

- Private real estate

- Private debt

- Venture capital

- ESG investing (Environmental, Social, and Governance)

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®