Do you know someone who is bearing the weight of exceedingly high federal student loan debt? Total student loan debt topped $1.7 trillion in Q2 2021, with the average student loan balance hovering around $30k per individual. The cost of higher education has certainly increased in recent years and has led to higher amounts of post-graduation indebtedness.

Do you know someone who is bearing the weight of exceedingly high federal student loan debt? Total student loan debt topped $1.7 trillion in Q2 2021, with the average student loan balance hovering around $30k per individual. The cost of higher education has certainly increased in recent years and has led to higher amounts of post-graduation indebtedness.

The CARES Act (Coronavirus Aid, Relief, and Economic Security Act) suspended federal student loan payments and interest in March of 2020. Through several extensions, this benefit is now set to sunset on January 31, 2022. For those individuals with loans in forbearance, that means a return of regular monthly payments.

But did you know that on October 6, 2021, the Department of Education made major changes to the federal student loan forgiveness program? Some of the important qualifications include:

Employment

Employment

Borrowers must work for the government, a 501(c)(3) not-for-profit or other not-for-profit organization that provides a qualifying service. These occupations include teachers, nurses, first responders, service members, and other public service workers.

Full-Time Work

Full-Time Work

Must have worked a minimum of 30 hours per week for a qualifying employer(s) while making payments.

Direct Loans or Direct Consolidation Loans

Federal Family Education Loans, Federal Perkins Loans, or any other types of federal student loans that are not Direct Loans must be consolidated into the Direct Loan program by October 31, 2022.

-

-

-

- To determine the current status of your student loans, please visit Federal Student Aid. Upon clicking the link, you will need to create an account that will summarize your loan status and help determine if further action is needed to take advantage of the Public Service Loan Forgiveness (PSLF) Program waiver form.

-

-

Payment Plans

Payment Plans

Under previous qualifications, only on-time income-driven repayment plan payments qualified, BUT now payments (current or historical) under ANY payment plan qualify regardless if made in whole or even on time.

-

-

-

- Only payments after October 1, 2007 qualify

- Borrowers MUST submit a PSLF form by October 31, 2022, to take advantage of the limited opportunity

-

-

Potential Refund

If your loan payments under the limited-time, relaxed qualifications result in more than 120 qualifying payments, you will receive a refund for any qualifying payment in excess of 120.

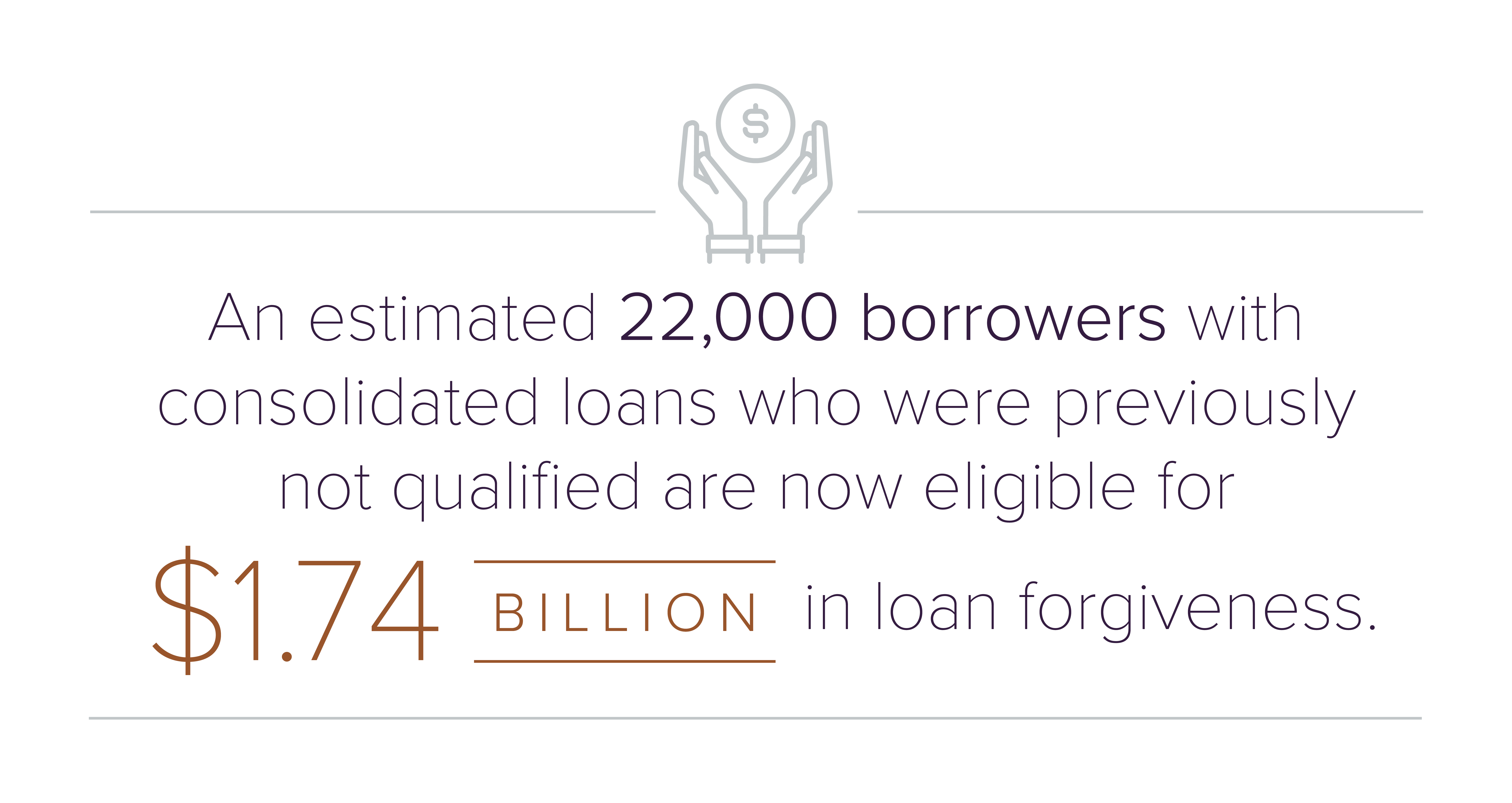

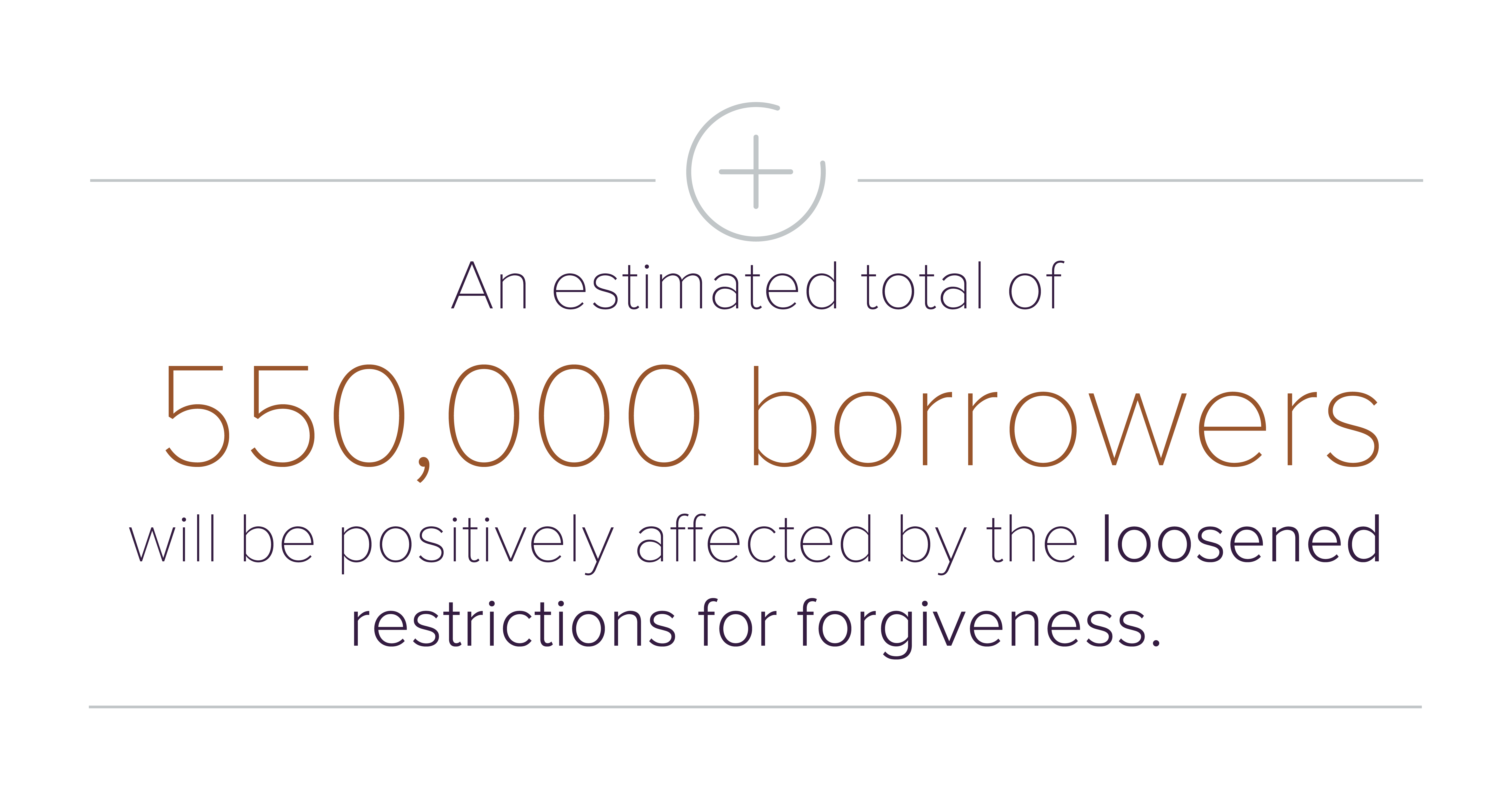

In totality, the plan will result in an estimated 22,000 borrowers with consolidated loans becoming eligible for $1.74 billion in forgiveness who were previously not qualified, while an additional 27,000 borrowers will potentially qualify pending employment verification. The Department of Education estimates that a total of 550,000 borrowers will be positively affected by the loosened restrictions for forgiveness.

The Biden administration has made it a point of emphasis to help relieve the financial burden on public service employees during the trying times of the pandemic. If you, or someone you know, might qualify for this limited-time opportunity, click here to understand the updated changes further and take action. Envision Greater and help a loved one take steps to achieve increased financial freedom.

Disclosure

© 2021 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®