Stocks made big moves in February to extend the 4-month rally. A slew of data pointing to a strong economy and labor market coupled with a feverish rally from a handful of growth stocks led to the S&P 500 closing above the 5000 level for the first time. Meanwhile, bond prices fell after hawkish comments from the Fed.

Strong Start

The S&P 500 was up 5.3% in February and 1.7% in January. Historically, this solid performance for the first two months of the year bodes well for the next 10 months. In fact, out of the past 28 times that January and February have been positive for the S&P 500, the final 10 months were positive 26 out of those 28 times. Not only were they positive in those cases, but the returns were better than average.

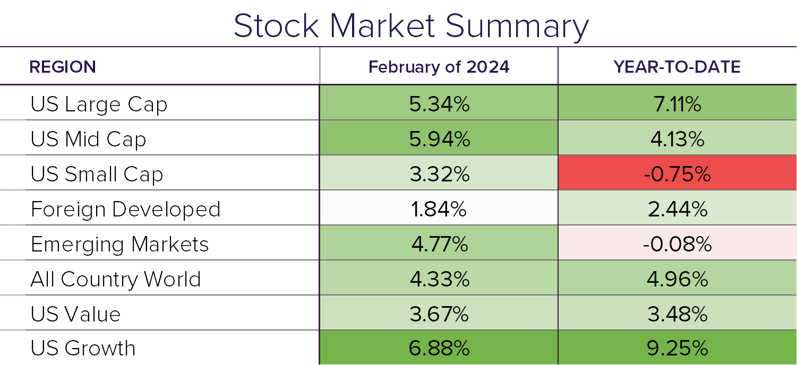

Driving the strong performance for the large-cap index were a handful of growth stocks. For example, two of the largest holdings in the index, Nvidia and Meta, were up over 25% for the month. Growth stocks in aggregate were up 6.9%, while value stocks finished 3.7% higher. Mid-cap stocks turned positive for the year thanks to the 5.9% monthly return. Globally, emerging markets outpaced foreign developed, returning 4.8% and 1.8%, respectively.

Data Dependency

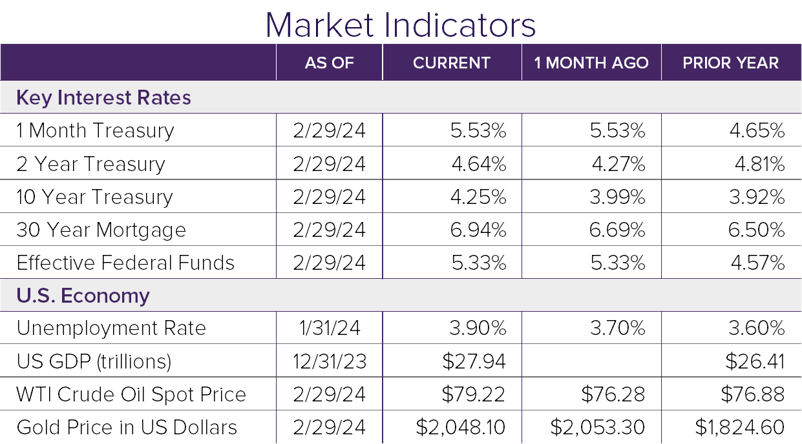

The disinflation trend is still in vogue despite some strong recent data points. The CPI and PPI inflation measurements came in higher than expected, the unemployment rate remained low at 3.7%, and the Fed’s preferred inflation measurement (PCE price index) had its largest monthly increase in over a year. Despite the recent monthly spike, inflation compared to a year ago continues to trend closer to the Fed’s 2% target.

Unsurprisingly, interest rates spiked as rate-cut expectations have been repriced coming out of the January Fed meeting. This led to bonds being down 1.4% for the month.

Looking Ahead

In March, we have Fed chair Powell speaking on Capitol Hill, updated CPI and PPI inflation numbers, and a Fed meeting. Stay tuned!

Disclosure

© 2024 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®