Most major asset classes took a pause in February after a solid start to the year. A steep rise in treasury yields dampened investors’ love for stocks. Some stronger than expected economic data caused expectations to shift toward the idea that inflation is still ongoing, and the economy is resilient in the face of headwinds.

Markets and rates.

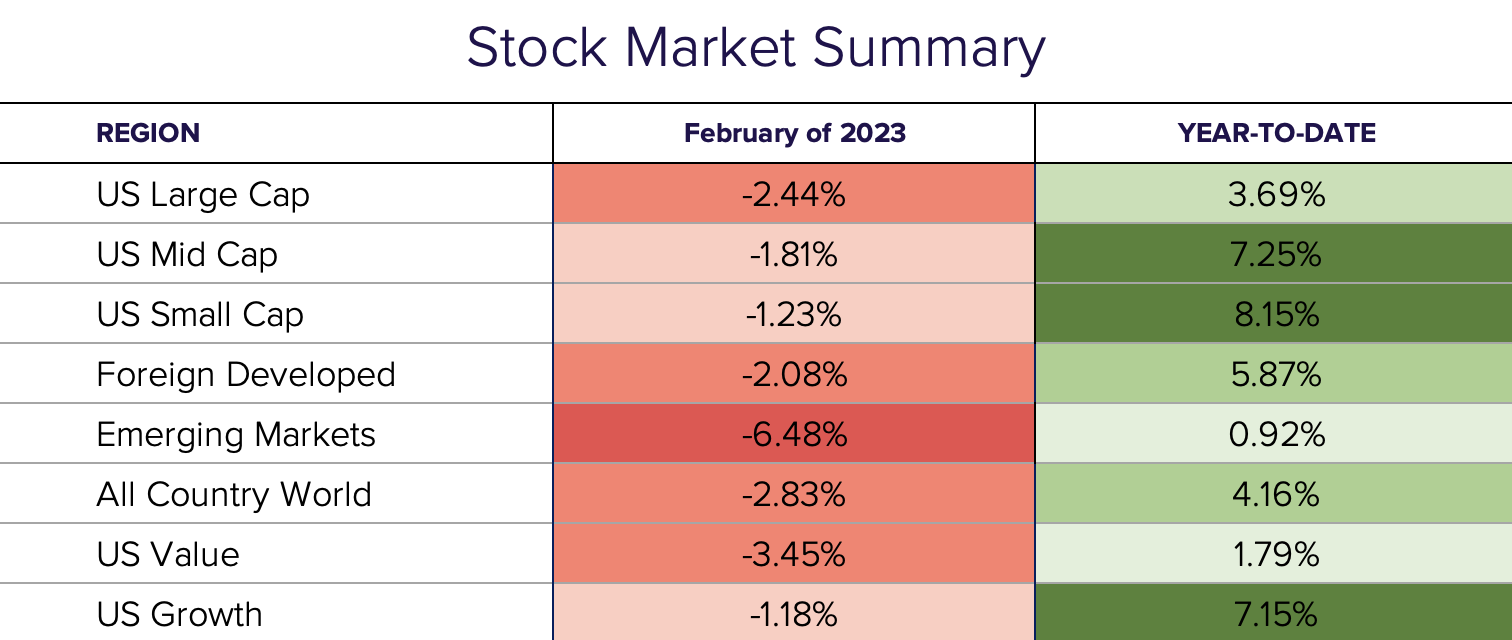

U.S. stocks finished down 2.4% for the month with value leading the way, down 3.5% versus growth, down 1.2%. Mid and small stocks held up better, down only 1.8% and 1.2% respectively. Emerging markets got hit hardest in February, down 6.5%, but are still positive on the year.

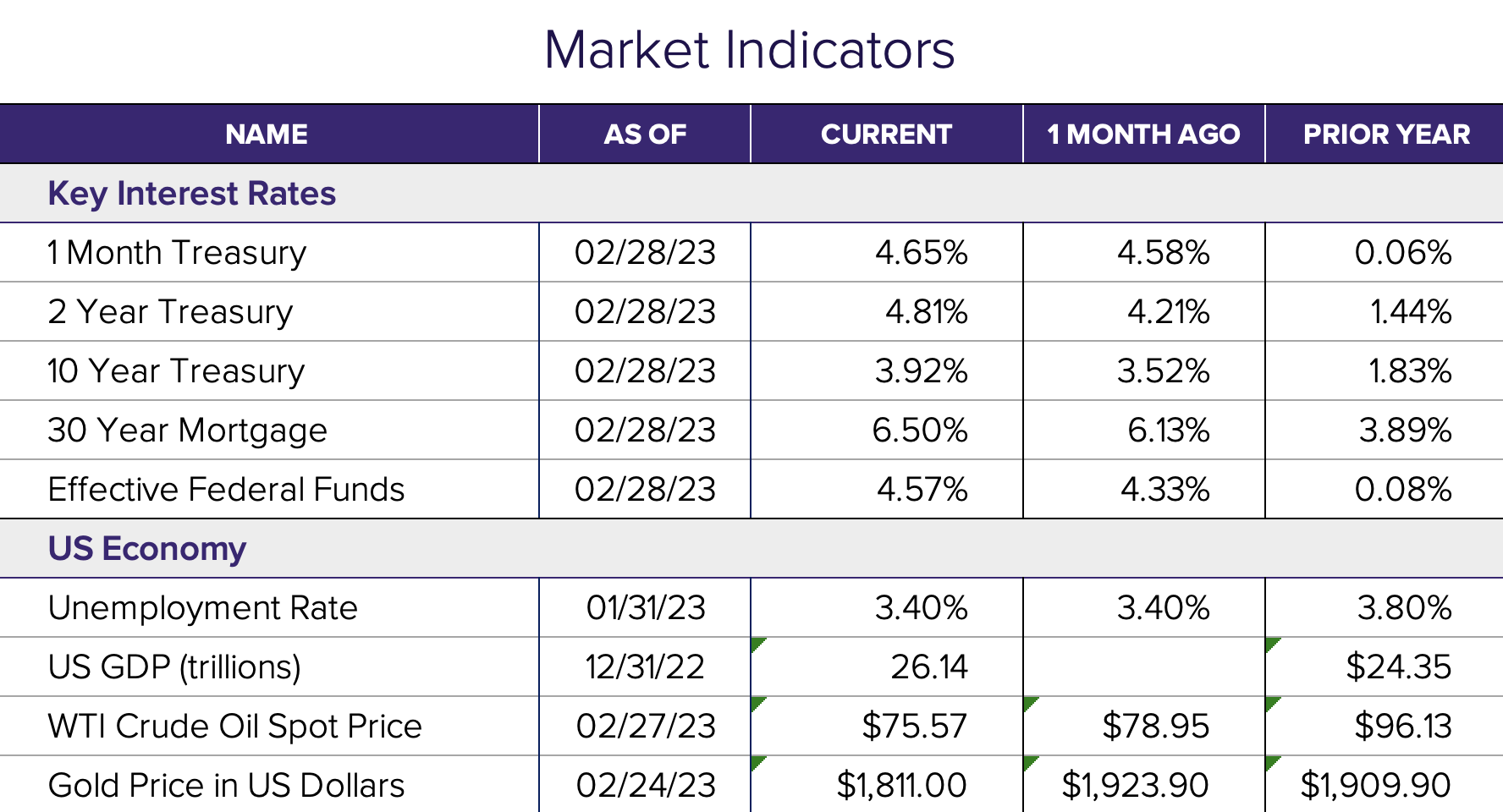

The big story this month is in the bond market. Interest rates on government bonds reached 5% for the first time since 2007. Rates on the six-month and one-year treasury bills finished at 5.17% and 5.02%, respectively. Meanwhile, the rate on the ten-year finished at 3.92%, making it the lowest rate on the yield curve. That represents an 11% month-over-month increase. It is also important to note that the 0.89% spread between the two-year rate (4.81%) and the ten-year rate (3.92%) is at the deepest level since 1981! When that spread is negative, the yield curve becomes inverted. Historically, an inverted yield curve has been a reliable signal of a looming recession.

Economy.

Unemployment fell to its lowest level in over 50 years and labor force participation increased month-over-month. Year-over-year inflation as measured by the consumer price index (CPI) is currently at 6.4%, down from 9.1% in June of 2022. On a monthly basis, the CPI and personal spending recorded their highest monthly moves in some time. U.S. manufacturing also bucked eight straight monthly declines in February. Lastly, the housing market continued its slowdown as monthly existing home sales fell for the twelfth straight month, and the median existing home price dropped another 2%.

Outlook.

Markets continue to be driven by the interest rate outlook as the Fed continues to combat inflation. Despite inflation coming down from the June 2022 highs, this recent round of economic data leads to uncertainty about the end game of the Federal Reserve. In March, important labor market data will be released, as well as another Federal Reserve meeting. Stay tuned.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®