January’s volatility continued into February; however, this month it is caused primarily by the geopolitical shockwave of an unprovoked Russian invasion of Ukraine. This comes on top of stubborn inflation, rising interest rates, and growth concerns here in the US.

The Russia/Ukraine conflict is the largest military offensive on European soil since World War 2. The speed of Russia’s offensive and escalation is extraordinary; however, what’s more extraordinary is the unified response from the European Union, NATO, and other members of the free world—including Switzerland, a historically neutral country.

An enduring financial and economic hit to Russia will be felt from losing access to SWIFT, the interbank messaging system. SWIFT is an essential network of more than 11,000 banks around the world used to immediately and securely transact across borders. Russia is only the third country to have ever been removed, joining North Korea and Iran.

Market reaction.

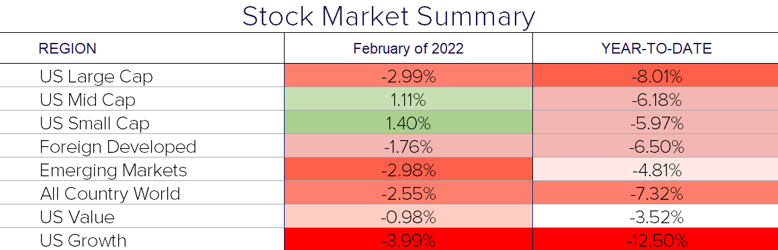

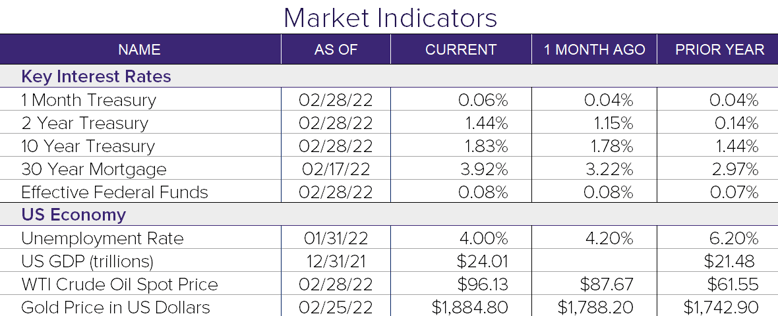

Generally, a geopolitical conflict of this magnitude would send shocks through the global capital markets; however, it has not been nearly as significant as one might expect. Global stocks were down 2.5% for the month. Bond prices were slightly lower as yields ticked higher. Commodities’ prices—primarily oil and natural gas—rose sharply on the month. The Russian stock market and currency has been halved this year. Additional sanctions may lead to further deterioration. It’s important to note that Russia comprises only 1.6% of the MSCI Emerging Markets Index.

Economic implications.

Fortunately for the U.S. economy, our direct trade volume with Russia is minimal. Europe does significantly more trading with Russia, particularly in the energy markets, which could have more pronounced economic effects for the EU.

The conflict makes the Fed’s priorities of managing inflation and growing the economy even more difficult. The crisis has the potential to slow economic growth which may lead the Fed to take their time raising rates; however, it may also fuel higher inflation. The Fed’s 2021 claim that inflation is “transitory” is already under scrutiny. This week Jerome Powell indicated that the policy change in March will proceed as planned. Regardless of the Fed’s statements, their eyes are clearly on the escalation and its economic impact.

What to do.

The situation in Ukraine is still very fluid and the Federal Reserve’s pending actions warrant a wait-and-see approach. As always, we will continue to monitor all areas of the financial markets. Should a buying and rebalancing opportunity present itself, we will act accordingly.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®