When people think of retirement, they imagine relaxation, low stress, and perhaps traveling or relocating. Planning accordingly for retirement is essential; however, as Hurricane Ian reminded us, emergency preparedness is also crucial. Overlooking this area can have a trickle-down effect that could throw off your entire future plan.

Where you live matters – understanding geographic risks.

Climate change impacts the globe, but when it comes to relocating for retirement, there are risks and threats to take into consideration around the U.S. For instance, Hurricane Ian was a devastating reminder of how mother nature can damage the southern states, while wildfires and droughts are higher risks out west, such as in California and Arizona.

No matter where you choose to live, each area has its upsides and downfalls. The federal government’s U.S. Global Change Research Program’s 2018 Third National Climate Assessment reports that “extreme weather and climate events have increased in recent decades… [and forecasts that] global climate is projected to continue to change over this century and beyond.” These are important considerations to consider when balancing your retirement plan and wealth strategy.

Insurance and new expenses as part of your retirement strategy.

Sanderson advisers recommend an evaluation of your insurance policies, such as homeowners insurance (including flood coverage), life insurance for you and your spouse, and coverage of other high-value belongings. As natural disasters increase in frequency and severity, there is an added need for high-coverage insurance policies that cover storm destruction, flood damage, etc.

Furthermore, it’s important to take into account the increasing costs of insurance coverage based on the higher risk of natural damages. As climate change increases the prevalence and severity of natural disasters, insurance policies increase in cost for corresponding coverage. Environmental risks not only impact insurance costs but also home values and equity, both of which could negatively impact overall wealth.

Cost to replace personal items.

It’s important to consider the essential and high-ticket items that you may have to replace after a disaster. Insurance may cover some of these items but oftentimes, not all.

While the cost to replace many items can be minimal or offset through insurance, note that the time necessary for replacement varies, especially with the dramatic fluctuations in product availability and supply chain complexities. A limited supply of building materials and lumber or a shortage of cars in stock will result in a slow rate of return on your items.

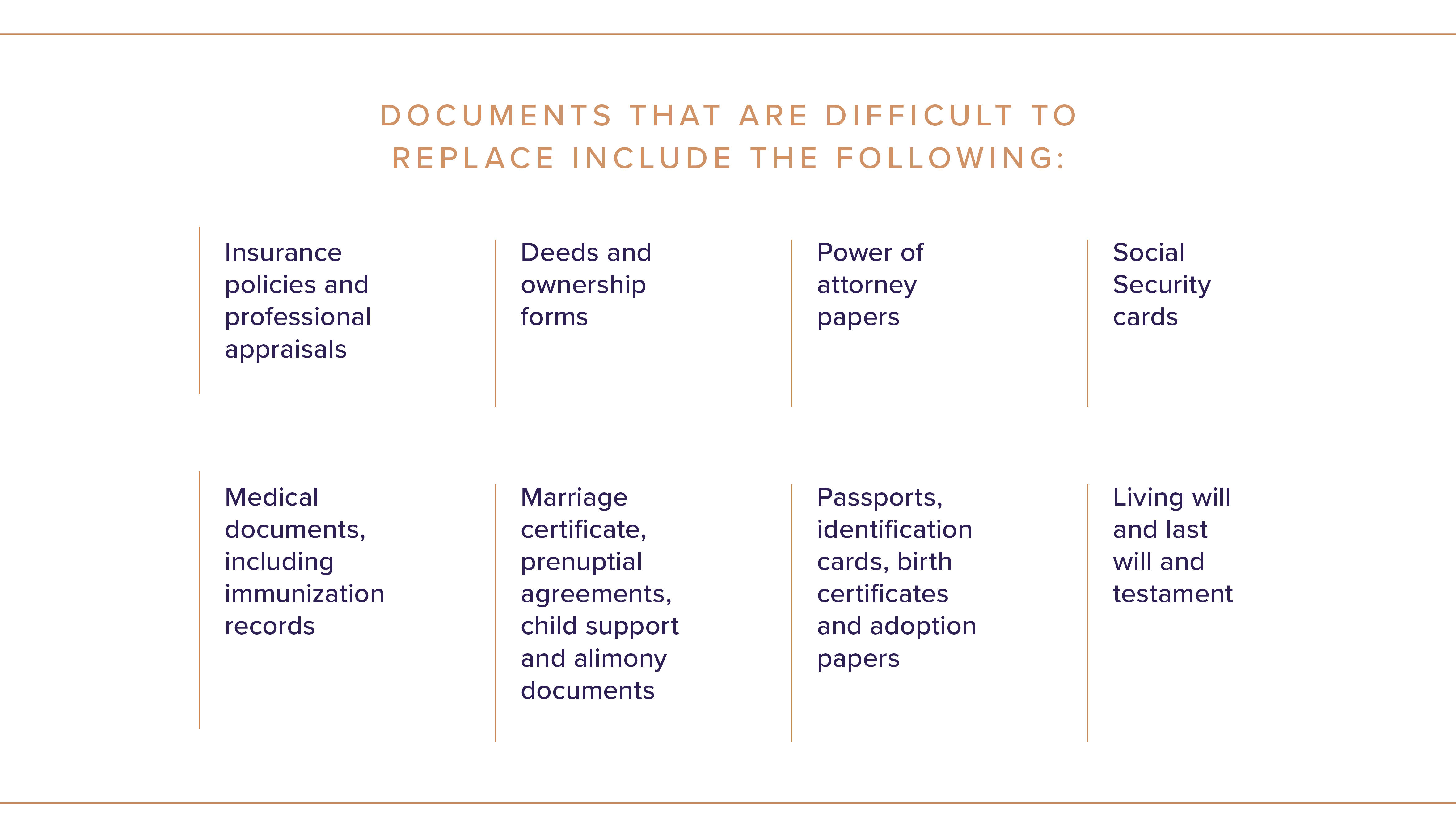

Securing heirlooms and personal documents.

Of course, some personal possessions are irreplaceable, such as precious heirlooms, generational property, or other items of sentimental value. For this reason, it’s important to take every precaution possible to secure these items and documents, such as waterproof and fireproof lock boxes for paper documents. Having a locked safe for precious heirlooms and jewelry is an added peace of mind, as well. For certain items, it may benefit you to store them in a different secure area outside of your retirement home that’s at high risk for natural disasters.

Technology can be helpful in this area, too. Consider using cloud storage to save e-documents or scan other important paperwork.

Don't underestimate your health and well-being.

It’s important to take the risks and environmental factors into consideration when planning for your retirement and new home. This threat level can induce stress and take a toll on a person’s health, physically and/or mentally. For example, moving west where there are wildfires will undoubtedly have air pollutants and smoke, so someone with a medical condition related to respiratory issues, such as asthma, would need to make accommodations to decrease exposure.

Mobility is another factor to consider and becomes increasingly important during retirement years. It’s crucial to choose a home that aids in any mobility issues that may already exist or could worsen with age. Take this into account for not only everyday activities but also in case an emergency should arise.

Consider your peace of mind and physical and mental health as you navigate the environmental risks in your new place of residence. Ensure there is an appropriate setup that will aid you and your significant other when living in this new home, as well as take into consideration friends or family members that may come to visit. These accommodations will certainly ease stress in risky or emergency situations.

Planning for the worst.

When in doubt, plan for the worst. Understand all the risks in the area that you choose to have your retirement home in and have plans in place for these emergency situations. Plans consist of packing a “go bag” in an easily-accessible spot, like a coat closet, that contains toiletries, change of clothes, cash, an extra phone charger, and battery pack, and whatever else you believe you would need. Stay stocked on medical and pantry supplies and essentials. Have a list ready of what to grab before you leave your home in a rush.

Know how to contact family members in case either is impacted in a disaster and keep these contacts up to date. Also schedule regular maintenance on your documentation, such as life insurance policies, estate planning, will, power of attorney, etc.

Enjoying retirement with safety and peace of mind.

Emergency planning should inherently be part of your retirement and wealth strategy. We recommend reflection and honest planning conversations to ensure all your assets are covered. Sanderson is here to help with this and adjust your wealth strategy as your life, and the world around you, change.

Disclosure

© 2022 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, insurance, accounting, or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, investment, insurance, accounting, or tax advice from their own counsel. Sanderson does not receive any fees or commissions for recommending any insurance products. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®