Being named as a trustee should be considered an honor. As the name suggests, the settlor of a trust thinks you have the character, integrity, and acumen to serve in this special role, which involves the oversight and management of assets they have set aside for others. While people often accept the role without hesitation, many do not fully understand the responsibilities and duties they are taking on by doing so. Furthermore, a trustee’s breach of these duties can lead to serious financial consequences.

Much of trust law, including trustee responsibilities, is defined by state laws that are continuously evolving. Additionally, some jurisdictions now allow for the bifurcation and delegation of specific trustee roles and responsibilities. While both of these complications make a detailed assessment of trustee duties impractical, there are general responsibilities and duties that all trustees should be aware of to help ensure long-term success for the trust and mitigation of their fiduciary exposure.

In this article, we’ll explore what each duty entails.

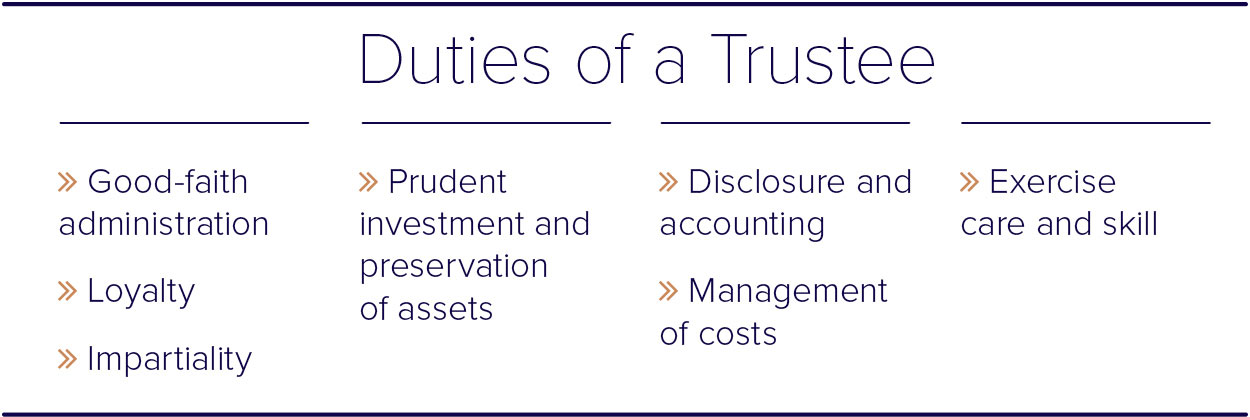

Good-faith administration.

The trust document generally sets forth who the current and remainder beneficiaries (both income and principal) of the trust are and how the trust assets should be used to support them. A trustee has a duty to understand and adhere to the dispositive provisions of the trust, which may involve exercising their discretion on the merits of a distribution. Trust distribution provisions can range from the easy and mundane to intricate and complicated. For more on this topic, refer to our In-Depth Guide of Modern Trust Structures and Distributions.

Good-faith administration also includes making sure other terms and procedures set forth in the trust document are followed, such as how the assets are to be invested, how successor trustees are selected, and how assets are transitioned to remainder beneficiaries.

Loyalty.

A trustee has a duty of loyalty to the current and future beneficiaries of the trust. They must act in the best interest of these people at all times when carrying out their duties, while balancing their other trustee duties. To avoid conflicts of interest, trustees cannot place their own personal or financial interests ahead of the people they are serving, nor should they commingle their own personal assets with those of the trust.

This duty is also closely related to the duty to manage costs, as a trustee cannot unduly further the financial gain of professionals they engage with during the administration of the trust, most certainly in a quid pro quo arrangement. Self-dealing is generally prohibited unless explicitly authorized in the trust agreement.

Impartiality.

A trustee has a duty to balance the settlor’s intentions and the interests of both the current and remainder beneficiaries when making both investment and distribution decisions. The terms of the trust agreement, along with personal understanding of the settlor’s intent, provide important guidance in this regard. When exercising discretion for distributions of income and principal, a trustee needs to ensure the standards set forth in the trust document (i.e., distributions for health, education, maintenance, and support, or HEMS) are adhered to. Should a trustee’s decisions ever be questioned, thorough documentation of the factors going into making these decisions should be maintained.

When the generation of income (i.e., dividends and interest) governs distributions for current beneficiaries versus growth orientation for remainder beneficiaries, investment decisions will often be scrutinized for impartiality. As such, many state statutes indirectly advocate a total-return approach to investing in attempt to maximize trust value for each group of beneficiaries over time (we’ll cover this in more detail in the next section).

The duty of impartiality is the source of much litigation in the area of trusts and estates, particularly when remainder beneficiaries are left with less than they anticipated after the current beneficiaries have made use of the assets. It is important that a trustee understands their obligation to provide for each of these groups of beneficiaries and document decisions that have a significant impact on each.

Prudent investment and preservation of trust assets.

A trustee has a responsibility to manage and invest the assets in a trust to accomplish its short- and long-term objectives. In doing so, they must make sure the appropriate actions are taken to follow investment standards that help mitigate risk, generate stable income and growth, and that help preserve assets during times of instability.

In general, this means trustees (or the investment advisors that they oversee) must follow the standards of the Uniform Prudent Investor Act or Prudent Investor Rules. These standards include practicing Modern Portfolio Theory in the management of investments, which emphasizes diversification and risk control, and focuses on total return investing, avoiding biases toward income generation (i.e., interest and dividends) or capital appreciation/growth. Avoiding concentrated positions, excessive risk, and speculative investments are also central themes in practicing Modern Portfolio Theory.

These investment constraints and standards, or portions of them, can be waived within the trust agreement. This may be done for a variety of reasons, including ensuring the continued ownership of family business interests.

For physical assets such as commodities and real estate, a trustee must take measures to physically secure the assets from theft, misuse, and casualties. The maintenance of appropriate insurance and security measures is paramount in this regard. Additionally, trustees should pay appropriate expenses to make sure these assets do not physically deteriorate over time and maintain their value.

Disclosure and accounting.

A trustee has a duty to make sure all appropriate parties are aware of the activities and administration of the trust so that they can provide oversight and protect their interests. This can be challenging in “silent trust” situations where a grantor/settlor does not want a beneficiary to be aware of the trust for a variety of reasons, including preserving the beneficiary’s self-motivation.

State case law is evolving in this area, but generally, if a beneficiary wants information regarding the trust, the trustee must disclose it to them. For states that authorize silent trusts, designated representatives are entitled to receive information on the trust in lieu of the beneficiaries.

Additionally, a trustee must make sure that records are maintained that can be used to formally account for trust activity throughout its entire term. These accountings are vital to providing assurance to beneficiaries that the trust assets are being managed properly and cost-effectively. They also provide remainder beneficiaries with insight and peace of mind with how the balance of the trust passing down to them was derived. A formal accounting (or the release from one) is often required before a trustee can relinquish their post.

Managing costs.

A trustee has a duty to ensure the costs being incurred in the administration of the trust and investment/preservation of trust assets are reasonable and necessary. Given the complexity of trusts and plethora of trustee responsibilities, it should come as no surprise that substantial costs may be incurred throughout the life of a trust. These may include:

- Income taxes

- Tax services

- Investment advisory fees

- Trustee commission

- Legal expenses

While not precluded from paying these expenses, trustees must take action to ensure they are not excessive given the value derived from them. Additionally, they should ensure they are not breaching their duty of loyalty when selecting the professionals and businesses they are engaging with on behalf of the trust. Trustees can help mitigate their risk in this area by periodically re-evaluating their expenses and seeing if effective alternatives are available.

Depending on the structure of a trust, income taxes can be a significant cost—and trustees are often tasked with making the decision as to who should bear the burden. Again, this is often an area where the trustee needs to balance their understanding of the purpose of the trust with the financial impact income taxes have on all interested parties. It is an area where skilled and knowledgeable trustees can provide tremendous value to wealthy families in terms of overall family tax burdens and even the efficient mitigation of estate taxes.

Exercise skill and care.

Generally, a trustee must exercise the degree of care, skill, and caution that a reasonably prudent person would exercise in managing their own personal property. A trustee’s personal inexperience and deficiencies in certain areas of trust administration do not reduce the expected minimum degree of skill required to execute their duties. Rather, it makes a good case for the need to engage professionals to provide assistance in these areas.

Depending on state law (i.e., directed trust statutes) however, the engagement of professionals may not absolve an individual trustee of all of their responsibility in these areas. Conversely, if a trustee possesses some specialized knowledge or credentials, the degree of skill expected to be exercised by the trustee will be elevated to this superior level. This is particularly true for professional fiduciaries, such as trust companies or banks. They are held to a higher standard than the lay trustee.

Seeking guidance in your role as trustee.

Being appointed as a trustee comes with significant responsibilities and expectations. It is essential that individuals contemplating accepting the role understand the full range of their duties, personal risks, and exposures when serving in a fiduciary capacity before formally accepting the position.

When choosing to move forward as a trustee, an individual should take steps to maintain documentation evidencing fulfillment of their responsibilities and duties throughout their term, and even maintain liability insurance along the way. If you find yourself overwhelmed with the requirements and falling behind in your responsibilities, it is important to consider engaging professionals experienced in the management and administration of trusts to assist you, or perhaps consider stepping down from the position.

Serving in a fiduciary role ourselves, we at Sanderson Wealth Management have experience working closely with our clients who serve as trustees to make sure they are effective in the position. We guide them in fulfilling their responsibilities, hopefully culminating in long-term success for the trust and fulfillment of its objectives.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © March 2020 Sanderson Wealth Management

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®