The Tax Cuts and Jobs Act of 2017 has caused profound changes to the income tax landscape for individuals. One of the biggest disruptions has been the elimination, or limitation, of many of the itemized deductions that people have grown accustomed to in the past, including tax preparation and investment fees as well as state and local taxes. As a trade-off, taxpayers can now potentially utilize higher standard deduction amounts of $12,000 for single filers and $24,000 for married taxpayers.

Married couples paying a modest amount of mortgage interest and who are up against the $10,000 state and local tax limitation may find themselves thousands of dollars away from reaching the new standard deduction amount. For taxpayers whose after-tax healthcare costs are relatively low, this leaves them with only charitable donations to help them reach and exceed the standard deduction threshold. If the threshold isn’t reached, the tax benefit from any donations or other itemized deductions generated in that year are generally lost.

Strategies for tax-efficient giving.

Losing a tax benefit for your heartfelt donations to charity can be difficult to stomach. It has been a mainstay in the tax code for many years and has traditionally been a great incentive for taxpayers to give back to the charitable organizations that mean the most to them.

Thankfully, financial advisors have the tools necessary to address this issue and to help ensure that their clients are giving in a tax-efficient manner and maximizing the benefit they receive from their donations. Relatively simple tax planning strategies such as donation bunching and the use of Qualified Charitable Distributions from qualified retirement accounts can yield tremendous savings.

However, for many of our high-net-worth clients, their philanthropic ambitions, personal cash flows, and desire for recognition can lead to the need for a more sophisticated and flexible charitable planning tool. This is where the donor advised fund (DAF) often fits best.

The basics of donor advised funds.

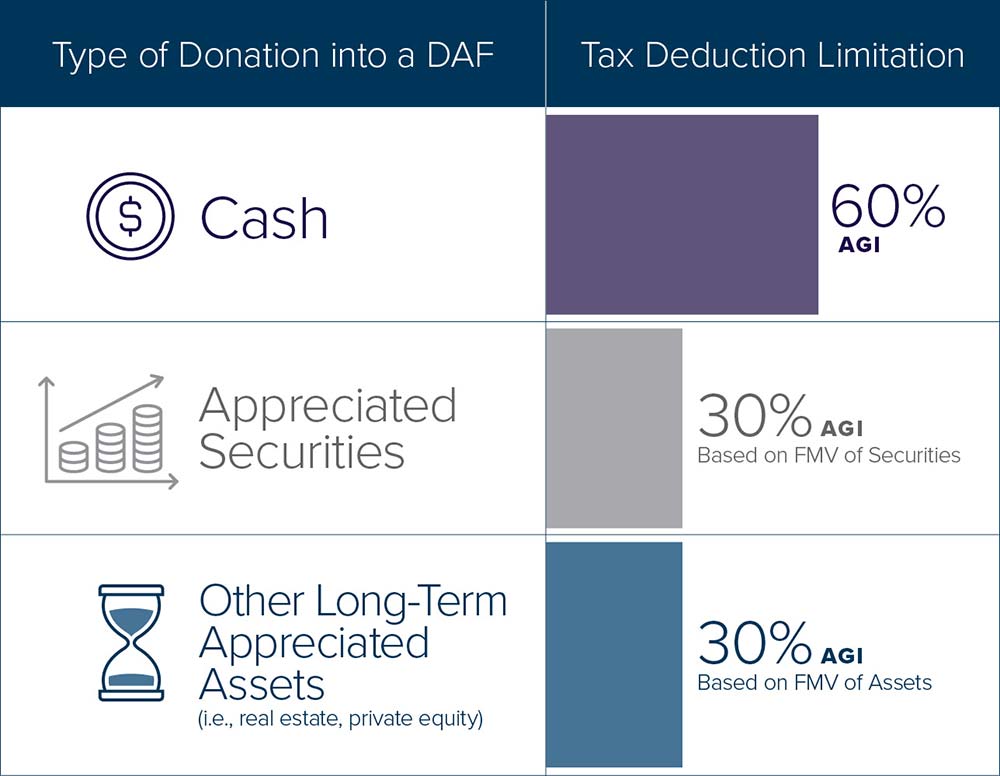

Donor advised funds are segregated accounts that individuals can set up at sponsoring charitable organizations, which essentially serve as an intermediary holding place for their charitable donations. Upon making a contribution to their DAF (perhaps in conjunction with a deduction bunching strategy), the taxpayer receives an itemized charitable donation for income tax purposes. Contributions can be in the form of cash but often it is more tax efficient to contribute appreciated securities or other highly appreciated assets to DAFs, such as real estate, collectibles, and artwork.

How a DAF operates.

The larger, more robust, sponsoring organizations are usually administratively equipped to handle contributions of unique assets such as real estate, artwork/collectibles, and private equity interests, and can often provide guidance on efficiently giving and transferring these types of assets into the DAF.

The contributed assets reside in the original donor’s separate DAF account at the sponsoring organization and are eventually sold and diversified. With prudent investment management, the diversified investments should appreciate and generate income throughout their remaining time in the DAF, income tax free. This tax-free compounding growth enables the donor to amplify the financial impact of their original donation over time. At a time of their choosing, the original donor then “advises” the fund administrators to give a certain amount of the assets in their DAF to a specified qualified charitable organization.

After the donor contributes to the DAF, they technically relinquish all future control over the contributed assets. From then on, the donor can only suggest or request that a subsequent contribution be made to a specific qualified charitable organization. While the sponsoring organization is under no obligation to comply with the donor’s request, they would have a difficult time securing new business if word got out that they were consistently ignoring their donor’s suggestions.

Limitations and restrictions.

Assuming there are no issues with the recipient organization’s charitable status, character, ethics, or integrity, the DAF administrator is typically happy to comply with the original donor’s request. However, there are some general restrictions on the use of DAFs.

Unlike private foundations, DAFs are prohibited from making:

- General grantmaking distributions to non-charitable entities

- Fund available to run charitable programs

- Distributions to individuals

- Distributions directly to international organizations

For many wealthy individuals weighing their philanthropic planning options, these restrictions may a deciding factor in choosing to set up a private foundation instead of a DAF.

Another notable limitation on permissible use of DAF donations is that they cannot be used to fulfill the legally binding pledges of the donor. The IRS addressed this issue in IRS Notice 2017-73, in addition to prohibiting the use of DAFs to secure tickets to charity events for the donor.

While private foundations have a 5% annual distribution requirement, there is no similar requirement for annual distributions from a DAF. However, some fund administrators may try to avoid long periods of inactivity in their DAF accounts by working with their clients to spur giving through their account.

Private foundations are subject to a 1% - 2% excise tax on their income. With a long history of abuse and misuse of private foundations, the excise tax is designed to support the enforcement efforts of the IRS in this area. There is no tax on the income of DAFs. While subtle, the true tax-free growth of DAF assets helps donors accomplish more of their philanthropic goals over time, compared to the use of personal assets.

The advantages of DAFs.

By using the DAF as an intermediary holding place for a charitable donation, the taxpayer can control all of the main constraining variables that impact the tax efficiency of their giving – the amount, the type of asset, and the timing of the contribution.

Perhaps equally as important as tax efficiency are the various qualitative reasons for using DAFs. A DAF enables the original donor to control the pace at which the charity receives their donation, which can be important for donations to small charitable organizations, ones that are relatively new on the scene (whose administrative or financial oversight is still developing), or those whose mission is unique, requiring financial infusions at different times.

Another very important qualitative factor supporting the use of DAFs is the flexibility they provide in terms of recognition. When giving through a DAF, a donor can maintain their anonymity. This can be important if the donor is trying to avoid solicitation for future donations or if they want to give to a cause that, for personal reasons, they would rather not make public. Inversely, by titling your DAF as a namesake foundation (which is permissible) and selecting to make the source of the contribution known, a donor can receive more distinguished recognition, perceived by many individuals to be reserved for the philanthropic efforts of very wealthy families and large charitable organizations.

Should I start a private foundation instead?

While the creation and utilization of a private family foundation can accomplish many of the same goals as a DAF, they also introduce various constraining factors into the equation. For tax purposes, foundations have complicated and costly filing requirements, and are subject to the previously mentioned 1%-2% excise tax. Administratively, there are trustee/board member oversight requirements and meetings, along with accounting, record-keeping, and due diligence requirements, all of which come at a financial cost.

For very wealthy families with philanthropic goals that are substantial in size, scope, and nature (i.e., supporting individuals, scholarships, grantmaking, programs), and who are working to achieve and continue a family legacy into future generations, there may be no substitute for a private foundation. However, a new spectrum of wealthy philanthropists and high-net-worth individuals evaluating between the two options may find themselves leaning towards a DAF because of how the administration and use of DAFs has evolved over the past few years.

In some instances, the case can be made to deploy both as part of an individual’s philanthropic strategy. It is relatively easy to envision a scenario where a family wants to drive a multi-generational philanthropic mission and legacy through their family foundation, but also use a DAF to maximize the income tax efficiency of their donations, to make donations for causes not in alignment with the mission of their family foundation, to avoid recognition for donations for personal reasons, or to avoid solicitation in the future. As the cost of DAFs continues to decrease and as the availability of high-quality DAF sponsoring charitable organizations continues to increase, we will undoubtedly see more philanthropists choosing to deploy a dual-pronged approach to their giving strategy.

A DAF may also be a great place for an individual or family to test the waters of their commitment to their philanthropic efforts as well. While there is no requirement to do so, there is no reason a family cannot treat their DAF like a private foundation by doing things such as having family meetings to evaluate giving options, deploy an informal “board of directors” to monitor and/or advise on the administrative functions or investment strategy of the DAF assets, or partake in the diligence process for evaluating recipient organizations alongside the DAF.

Many of the more robust sponsoring organizations already have a team and process in place to operate and interface with their donors in this way, and somewhat surprisingly encourage this level of involvement from them. For these reasons, a DAF can be an important half-step before choosing to go all in on a private family foundation.

Side-by-side comparison of DAF vs private foundation.

| Donor Advised Fund | Private Foundation | |

| Set up | Account application with sponsoring organization | Establishment of legal entity, registration with state, and application for tax-exempt status with the IRS |

| On-going administration | Responsibility of sponsoring organization | Responsibility of board of directors/trustees. Record keeping, operational, diligence, and tax filing requirements |

|

Donor and family involvement (done due diligence, administrative, and investment oversight) |

Not required and non-binding but can be done informally and effectively | Required by board of directors/trustees |

| Investment management | Recommended but not controlled by donor. May be able to appoint outside investment advisor | Responsibility of board of directors/trustees. Investment management and diligence can be internal or outsourced, but retain overall responsibility |

| Contribution |

Cash, appreciated securities, complex assets (i.e., real estate, artwork, collectibles, private equity) *Subject to excess business holdings rule |

Cash, appreciated securities, complex assets (i.e., real estate, artwork, collectibles, private equity) *Subject to excess business holdings rule |

| Annual donation requirements | None | Generally 5% of FMV |

| Permissible donation recipients |

Only qualified charitable organizations (i.e. IRC 501(c)(3) organizations). Sponsoring organization responsible for diligence requirements |

Grants to qualified charitable organizations, individuals, program purposes. Board of directors/trustees responsible for diligence requirements |

| Fulfillment of donor’s pledges | Not permissible | Not permissible |

| Donation privacy | Can be anonymous | Public record through review of 990-PF (see GuideStar.org) |

| Expenses | Typically % of asset based to cover administrative expenses and investment management fees | Separate fees for accounting and auditing, tax preparation, investment management, legal and payroll expenses |

| Taxes | None | 1%-2% Federal excise tax |

Converting private foundation to DAF.

For those who have already chosen the path of a private foundation and regret doing so because of the administrative burdens and costs, the option exists to collapse it into a DAF. There are legal and tax filing requirements to accomplish this, as well as administrative and operational steps that must be adhered to in doing so.

Experienced advisors and sophisticated DAF sponsoring organizations can help guide their clients through this process. While it may not be the most comfortable experience for a philanthropic individual to go through, possibly invoking feelings of failure and regret, it may be necessary to get them out from underneath the administrative weight of their private foundation. With the weight removed, they will hopefully be re-energized and refocused on making a difference in the world through their efforts and resources.

Summary.

Donor advised funds have come a long way from their early use as primarily income tax planning vehicles. Through changes in tax laws, the efforts of sponsoring organizations and financial advisors, they have evolved into flexible and efficient charitable planning vehicles, designed to meet the needs of a wide range of individuals – from ordinary mass-affluent annual donors to sophisticated philanthropists.

While private family foundations may be the only suitable structure in some cases, more and more families are using DAFs as an initial step into gauging their generational philanthropic efforts, or as a means of complementing their overall giving strategy.

Disclosure

This publication contains general information that is not suitable for everyone. All material presented is compiled from sources believed to be reliable. Accuracy, however, cannot be guaranteed. Further, the information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this publication will come to pass. Past performance may not be indicative of future results. All investments contain risk and may lose value. © October 2019 JSG

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (161)

- Financial Planning (145)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®