The stock market finished 2023 with a bang. The S&P 500 has now logged nine consecutive weeks of gains, a streak not seen since 2004. The extended rally in risk assets came as the economy remained resilient and inflation slowed. The Federal Reserve signaled they are done raising rates and forecasted rate cuts later in 2024.

Markets

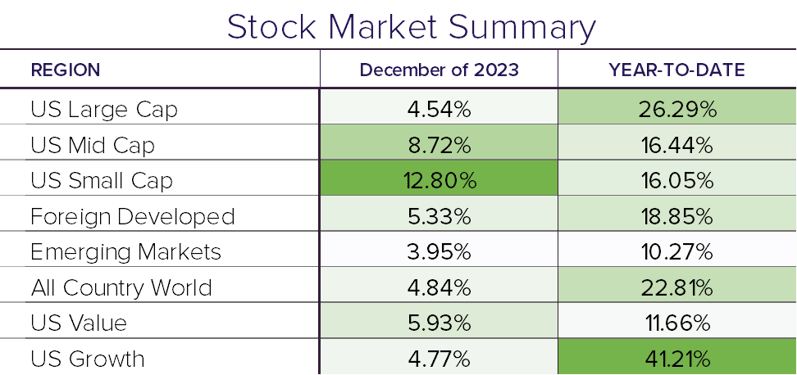

The nine straight weeks of gains has led to a 16% move higher in the S&P 500 since October lows, bringing the 2023 return of the index to 26.3%. 4.5% of that came in December, a small fraction compared to the 12.8% return seen in small cap stocks. Foreign developed and emerging markets also participated in the rally, up 5.3% and 4.0% respectively.

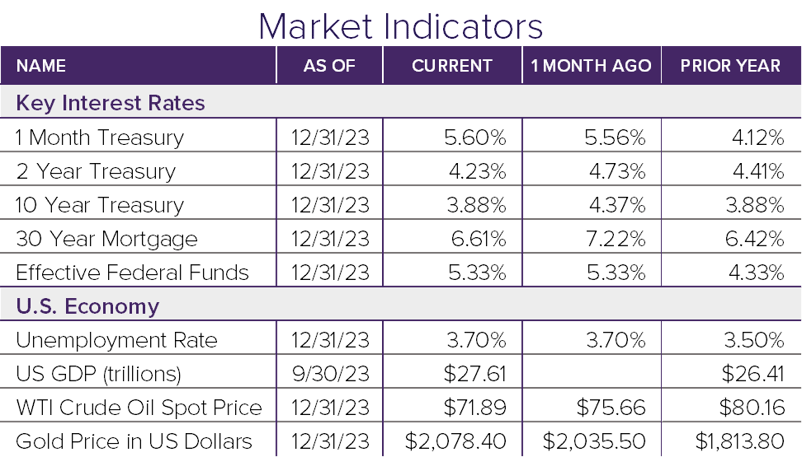

The shift in interest rate expectations also led to a significant bond rally. Interest rates move inversely to prices and since the 10-year treasury topped 5% in October, it has slid to end the year at 3.9%. During that same time, the bond market has popped 9.3% to finish the year up 5.5.%

Looking Back at 2023

Interest rate hikes, persistent inflation, recession fears, wars, and a regional banking crisis were among the many factors endured by the markets in 2023. Despite all of the turmoil, the Magnificent Seven technology stocks drove the S&P 500 within reach of all-time highs.

Looking Ahead

If history is any indication, 2024 could be another positive year, albeit muted. Since 1950, there have been 21 times that the S&P 500 gained more than 20%. Over that period, the following year was positive 76% of the time, with an average return of roughly 10%. However, only once has the following year’s gain been more than the previous.

Disclosure

© 2024 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®