Ho-hum Holiday Finish.

The end of December marks the close of a rough month and year for the markets. Persistent inflation and aggressive rate hikes from central banks pummeled growth and tech stocks. Geopolitical events and volatile economic data also contributed to the unprecedented year across all asset classes. There was no place to hide as the volatility rocked stocks, bonds, currencies, commodities, and cryptocurrency. Of the past 95 years, there have only been five times—including 2022—that US stocks and 10-year treasury bonds were both down concurrently, and 2022 was the worst of them.

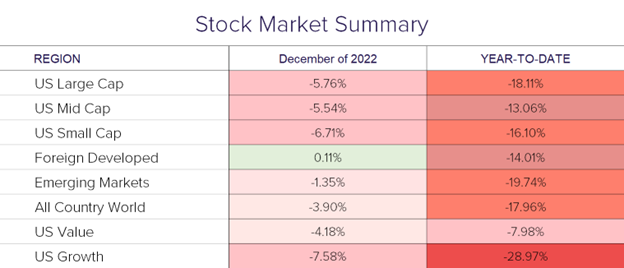

Stock Market

There was no Santa Claus rally to be seen this December as US stocks finished -5.8% lower for the month, and down -18.1% for the year. Growth stocks significantly underperformed value stocks this year as growth was down -29%, compared to value which was down only -8%. Foreign-developed stocks were the lone bright spot, up 0.11% for December, while finishing down -14% on the year. Emerging markets ended the month down -1.4% and -19.7% on the year.

Bonds, Rates, and the Fed

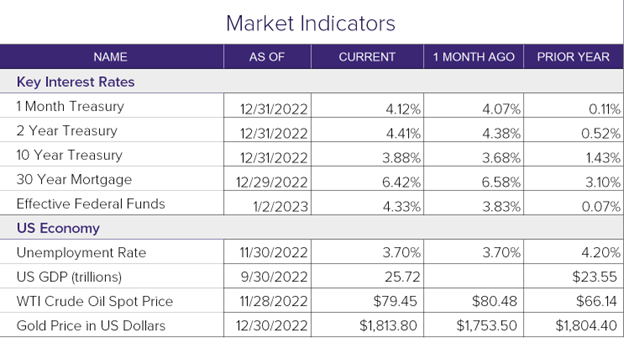

The US bond market didn’t fare much better as it finished down -0.45% for the month and -13% for the year. The 10-year treasury yield finished the year at 3.88%, marking one of the largest 1-year yield advances on record. 2022 also marks the second consecutive negative year in bonds, but the good news is that we have never seen three consecutive down years in the bond market…yet.

In its final meeting of the year, the Federal Reserve raised the fed funds rate an additional 0.50% to the range of 4.25%-4.50%, an adjustment from the four previous 0.75% moves. Jerome Powell made it clear that they are staying in the long fight to get back to price stability.

Outlook

As 2023 kicks off, the lagging economic data will begin rolling in for markets to digest. Concerns about an economic recession may be muted by the hopes for a Fed policy pivot. In any case, volatility will likely continue into the new year as investors eagerly await the data.

Disclosure

© 2023 Sanderson Wealth Management LLC. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. All information discussed herein is current as of the date appearing in this material and is subject to change at any time without notice. Opinions expressed are those of the author, do not necessarily reflect the opinions of Sanderson Wealth Management, and are subject to change without notice. The information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Let’s talk about your future.

Schedule a consultation to learn more about our investment services.

Filter Blog Posts

SUBJECT

- Investment Consulting (160)

- Financial Planning (144)

- Tax Consulting (44)

- Estate & Generational Wealth Planning (15)

- Firm News (11)

- Lessons Earned (11)

- COVID-19: Market Watch (10)

- Community (4)

- Philanthropy (4)

- Business Succession Planning (3)

- Prosper Financial Wellness (3)

- Ukraine: Market Watch (1)

AUTHOR

- Angelo Goodenough

- C. Michael Bader, Esq., MBA, CPA, CIMA®

- Caleb Jennings, MBA, CFP®, CIMA®, AIF®

- Cameron Radziwon, LSSBB

- Debbie Todaro

- Evan Kraft, CFP®, CRPC®

- James Warner, MBA, CPA, CFP®, CIMA®

- Joe Bartelo, CPA

- John Gullo, MBA, CFA, CFP®, CIMA®

- John Sanderson, CPA, CIMA®

- Justin Sanderson, MBA, CFP®, CIMA®

- Karen Nicpon, CPA

- Phil Frattali, CFA

- Regyna Waterhouse

- Sanderson Wealth Management

- Tim Domino, CPA, CFP®

- Tucker Weppner, CFP®